A new study from LendingTree reveals that 13.6% of U.S. homes—roughly 11.3 million—are uninsured, leaving millions of homeowners financially vulnerable in the event of a disaster. The analysis, based on U.S. Census Bureau data, highlights the growing affordability crisis as home insurance premiums continue to surge. Between 2020 and 2023, home insurance costs jumped 33%, averaging $2,530 annually, forcing many homeowners to weigh the financial risk of going without coverage.

Insurance is typically required for homes with a mortgage, but for those who own their homes outright, rising costs have made skipping coverage a necessity for some. “Insurance has become more expensive and harder to get in recent years. This is putting people just one disaster away from losing the physical and financial security their home provides,” said Rob Bhatt, a home insurance expert at LendingTree.

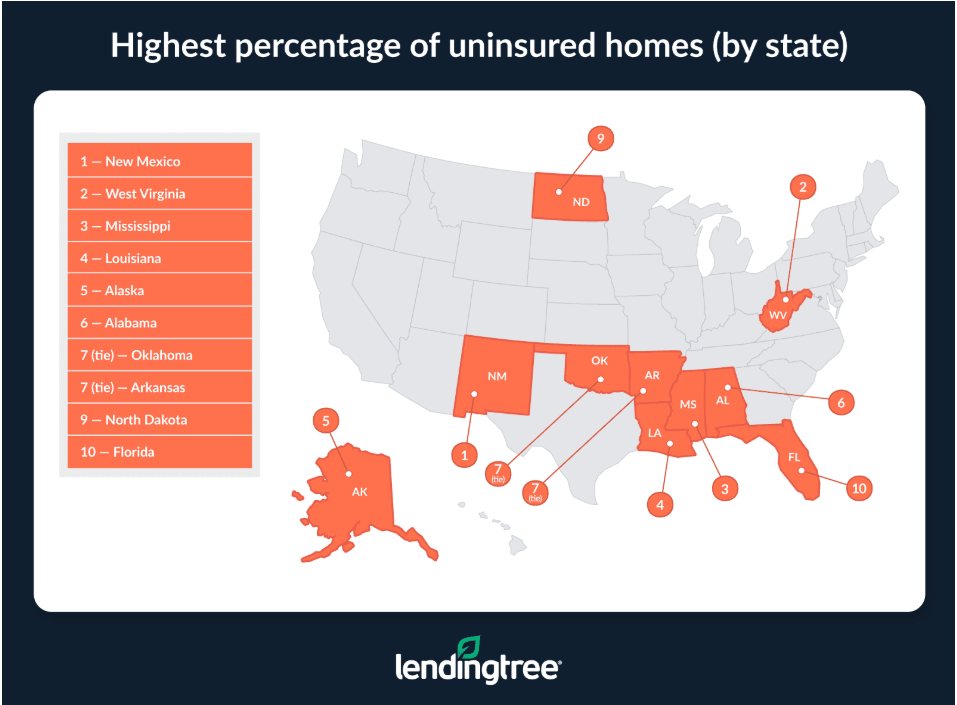

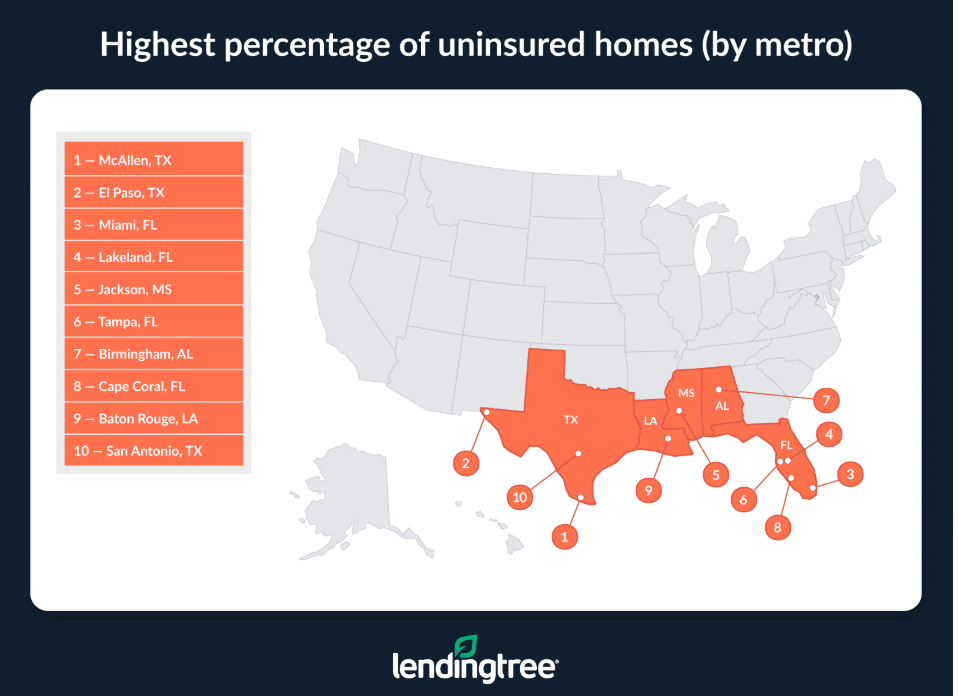

Certain states and metro areas have particularly high uninsured rates. New Mexico has the highest share of uninsured homes at 23.3%, followed by West Virginia and Mississippi. In major cities, McAllen, Texas tops the list with 43.3% of homes uninsured, followed by El Paso, Texas (23%) and Miami, Florida (21%)—despite Miami’s high hurricane risk.

Even in some of the most disaster-prone areas, many homeowners remain uninsured. In Florida, 18% of homes lack coverage, with Miami-Dade County (23.5%), Broward County (22.7%), and Lee County (17.9%) ranking among the worst. Florida is already one of the most expensive states for home insurance, and one in five homeowners there pays at least $4,000 per year—the highest share in the country.

The skyrocketing cost of insurance is adding another financial burden to homeownership, potentially deterring buyers.

“Markets with high insurance premiums, such as Florida, could see buyer demand dwindle as buyers and homeowners look elsewhere rather than take on either the expense of home insurance or the risk of being uninsured,” said Senior Economic Research Analyst Hannah Jones.

Some homeowners are opting to forgo insurance altogether, trading lower monthly costs for significant financial risk.

“Though this strategy translates to a more affordable payment, uninsured homeowners are exposed should tragedy strike,” Jones warns.

With insurance costs rising and climate-related disasters increasing, the affordability crisis is leaving millions of homeowners vulnerable. While avoiding insurance may seem like a way to save money, it could mean devastating losses for those hit by an unexpected catastrophe.

Click here for more on LendingTree’s analysis of uninsured homes across the U.S.