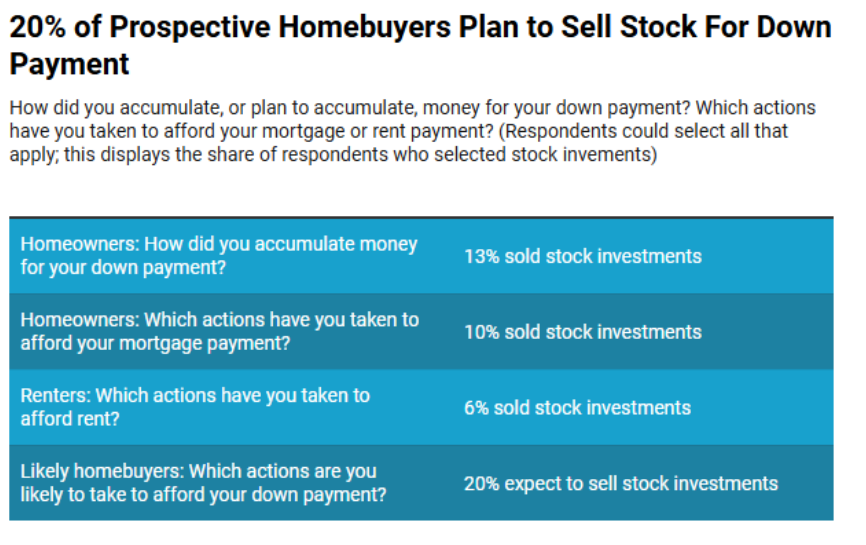

A new survey from Redfin has found that 20% (one in five) prospective homebuyers plan to sell stocks to help fund their next downpayment.

When it comes to those who own homes, roughly one in eight (13%) homeowners report selling stocks to help fund their downpayment. One in 10 (10%) homeowners have sold stocks to help afford their mortgage payments. Renters are less likely to use stock investments for their housing payments: Just 6% of renters have sold stock to afford rent.

“Some prospective buyers are pulling back because they’re worried about volatility in the stock market,” said Heather Mahmood-Corley, a Redfin Premier Agent in Phoenix. “In my area, this is mostly a concern for buyers in their 50s and older. Many of them are retreating from the housing market because a lot of the money they’d use to pay for housing is sitting in their stock portfolios, and they just don’t know what’s going to happen.”

Redfin-commissioned a survey conducted by Ipsos in September 2024, fielded to 1,802 U.S. residents aged 18-65.

Stocks in the Spotlight

Stock investments remain top of mind because President Trump’s sweeping new tariff policy has sent a ripple effect through the U.S. economy, with financial markets on wild up-and-down swings. Most homeowners hold some of their wealth in stocks, and so do many renters. Nearly seven in 10 (68.8%) U.S. homeowners had stock holdings as of 2022, as did 36.9% of renters.

Chen Zhao, Redfin’s Head of Economic Research, said as stocks continue to drop, homebuying demand will fall as well, most directly because it takes money out of prospective buyers’ pockets. A sizable portion of buyers plan to use stocks to fund their down payment, and now they may not have enough money in their portfolio. Volatility in the stock market also pushes down homebuying demand in other ways.

“Big drops in the stock market not only cut into funds earmarked for down payments and other housing costs, they shake consumer confidence and make people feel poorer in general. And this comes at a time when people are bracing for the price they pay for all kinds of things to rise as tariffs go into effect,” Zhao said. “But there are some possible silver linings for the housing market. One, a volatile stock market can encourage people to invest their money in real estate instead of stocks because some may view a home as a safer investment. Two, stocks declining can push mortgage rates down.”

Mortgage rates fell to a six-month low in April, as Freddie Mac’s latest Primary Mortgage Market Survey (PMMS) shows that the 30-year fixed-rate mortgage (FRM) hit an average of 6.64%, giving homebuyers a brief window of relief. In turn, mortgage applications increased a significant 20% week-over-week, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 4, 2025.

Joel Kan, MBA’s VP and Deputy Chief Economist, said, “Both homebuyers and refinance borrowers were quick to take advantage of this dip in rates, driving the purchase index 24% higher than a year ago to the strongest pace since January 2024. Refinance applications rose by 35% to the highest level in six months, as borrowers with larger loan sizes tend to be more sensitive to rate changes. The average refinance loan size jumped to its second highest in the survey at $399,600.”

Methods of Cracking Into the Housing Space

Selling stocks is a less prevalent way of paying for housing than other methods—but it’s more common for homeowners than for renters.

For house hunters looking to purchase a home soon, selling stock investments is the number-three way they’re putting together funds for a down payment, out of 13 possible choices. Nearly half (48%) of likely homebuyers plan to save directly from paychecks for their down payment, 29% are working a second job, and 20% plan to sell stocks. For the sake of comparison, some of the less prevalent methods of saving for a down payment are selling another home (16%) and using an inheritance (11%).

For renters, selling stocks is near the bottom of the list of methods people use to pay for housing. Of 13 possible choices, only two were less commonly cited than selling stock, which clocked in at 6%: using an inheritance (5%) and selling cryptocurrency investments (5%). The most common ways to pay rent are using regular income (45%) and working a second job (20%).