Top remodeling projects for homeowner satisfaction and cost recovery continue to vary as individuals remodel their homes for diverse reasons, according to the National Association of Realtors (NAR) and National Association of the Remodeling Industry’s 2025 Remodeling Impact Report.

The report assesses the reasons homeowners undertake remodeling projects, the outcomes of these projects and the increased happiness experienced in the home once a project is completed.

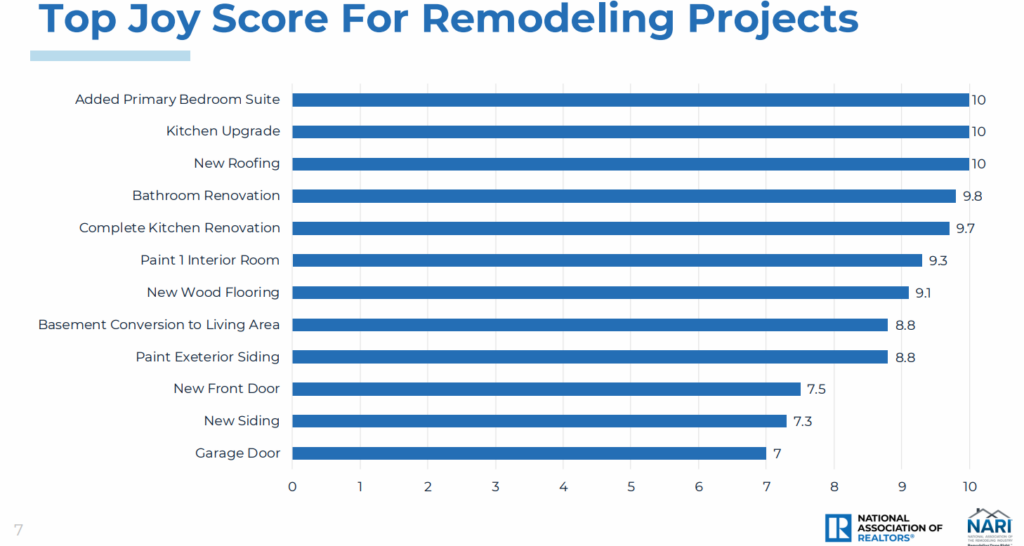

According to the report, Americans spent an estimated $603 billion on home remodeling projects in 2024, and the remodeling projects that received the highest Joy Scores–a ranking from 1 to 10 based on the happiness homeowners reported upon completion–include:

- The addition of a primary bedroom suite (10)

- Kitchen upgrades (10)

- New roofing (10)

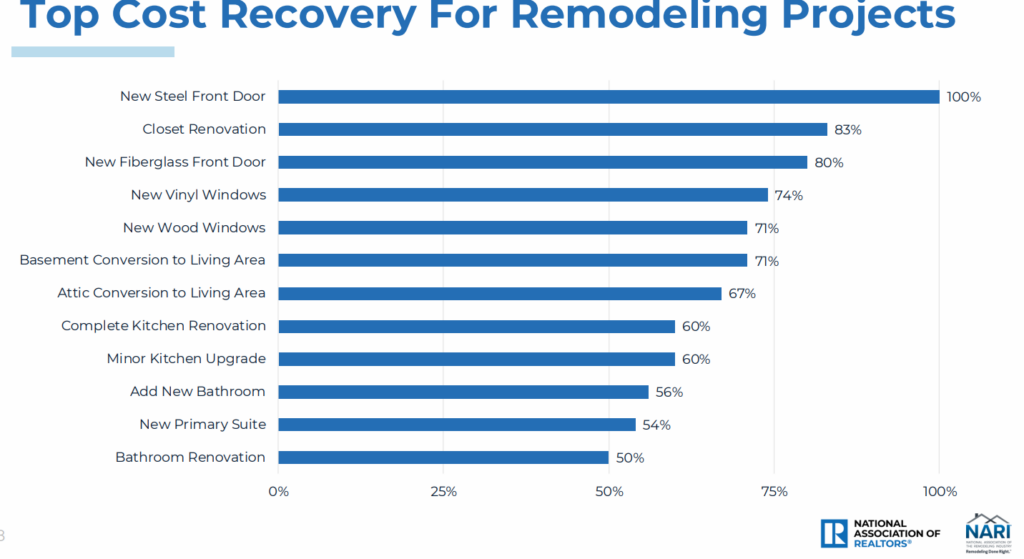

In contrast, the remodeling projects with the highest cost recovery–as estimated by members of National Association of the Remodeling Industry (NARI)–include:

- A new steel front door (100%)

- Closet renovation (83%)

- New fiberglass front door (80%)

“Homeowners undertake remodeling projects for numerous reasons, but what remains intriguing is the disparity between the joy experienced post-remodel and the actual cost recovery,” said Jessica Lautz, NAR Deputy Chief Economist and VP of Research. “While homeowners take pride in seeing their personal tastes and design choices come to life, Realtors may recommend different strategies to enhance the property’s resale value.”

The top remodeling projects that Realtors recommend sellers complete before listing their homes include:

- Painting the entire home (50%)

- Painting a single interior room (41%)

- Installing new roofing (37%)

Additionally, the projects for which Realtors have observed the highest increase in demand include:

- Kitchen upgrades (48%)

- New roofing (43%)

- Bathroom renovations (35%)

When consumers remodel their homes, the primary reasons include:

- Upgrading worn-out surfaces, finishes and materials (27%)

- Improving energy efficiency (19%)

- Desiring general change (18%)

- Preparing to sell within the next two years (18%)

“This report demonstrates that demand for remodeling remains robust, with 42% of NARI members experiencing an increase in contracting projects, and 57% observing larger project scopes over the past two years,” says NARI President Jason Hensler. “Homeowners are discovering significant value and joy in these investments–from smaller upgrades, such as front doors and windows, to major renovations like kitchens and primary suites.”

While housing affordability and rising mortgage rates have been considered potential motivators for home remodeling, most consumers (89%) reported that housing affordability was not a deciding factor in their decisions to remodel. However, for a smaller segment of consumers (9%), housing affordability did serve as a motivating factor for undertaking remodeling projects. To finance their remodeling projects, consumers primarily relied on home equity loans or lines of credit (54%), savings (29%), and credit cards (10%).

“Interestingly, despite the lock-in effect–where low-interest-rate mortgages discourage homeowners from moving–housing affordability isn’t a significant reason why consumers choose to remodel their homes,” added Lautz. “Instead, the substantial housing equity that homeowners have built up over time enables them to invest in transforming their homes while they remain in place.”

Homeowners report that the most important outcomes from remodeling projects are:

- Improved functionality and livability (28%)

- Durable and long-lasting results, materials, and appliances (23%)

- Enhanced beauty and aesthetics (23%)

Following their remodeling projects, 64% of homeowners expressed a greater desire to be in their homes, while 46% reported increased enjoyment of their living spaces. If cost were not a factor, 92% of consumers indicated they would choose to remodel additional areas of their homes.

Click here for more on the National Association of Realtors (NAR) and National Association of the Remodeling Industry’s 2025 Remodeling Impact Report.