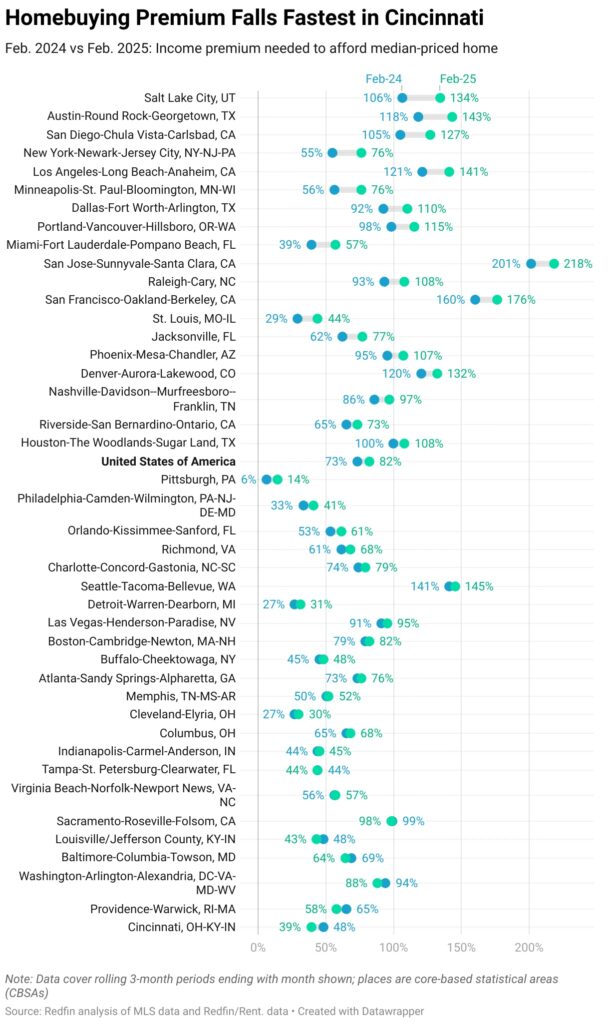

The median-priced property for sale requires an annual income of $116,633, which is 81.8% higher than the $64,160 required to rent a typical apartment, according to new Redfin report.

The average U.S. property for sale last year required a salary of $110,808, which is 73.1% higher than the average rental income of $64,000. To afford the average property for sale two years ago, they had to make $101,341, which was 54.5% higher than the average rental income of $65,600.

Additionally, in 2021, they had to make $63,925 in order to afford the average home for sale, which was only 17.3% more than the average rental income of $54,520. A home is deemed affordable by Redfin if the monthly housing payment for a buyer who takes out a mortgage does not exceed thirty percent of their income.

“It has become increasingly challenging for American renters to make the shift to homeownership thanks to the triple whammy of rising home prices, high mortgage rates and a shortage of houses for sale,” said Redfin Senior Economist Elijah de la Campa. “The gap between what someone must earn to buy versus rent may shrink in the coming months, but only because rents are expected to rise as the number of new apartments hitting the market tapers off due to a construction slowdown.”

The difference between the income required to buy a home and an apartment is widening since the cost of purchasing a home is increasing more quickly than the cost of renting one. In February, the median home-sale price increased 4.5% year-over-year to $423,892, and it has been expanding at a similar rate for several months. In addition, the average 30-year fixed mortgage rate is currently around 6.5%, which is more than twice as low as it was before the epidemic. The average household in the United States makes an estimated $86,382, which is around $30,000 less than what is needed to buy a conventional home.

In February, the median asking rent increased by just 0.2% year-over-year to $1,604. Renters now have more options thanks to the flood of newly constructed apartments brought about by the current construction boom, which has caused rents to level off below their record high. As a result, landlords have found it more difficult to raise rents. Due in part to the mortgage-rate lock-in impact, supply is more limited in the for-sale market, which is causing bidding wars and higher price hikes.

The income required to finance a home was only roughly 17% greater than the income required to afford an apartment in 2020 and 2021 because rents were soaring and mortgage rates were at all-time lows.

Overall, the difference between the income required to buy a home and an apartment is widening since the cost of purchasing a home is increasing more quickly than the cost of renting one. In February, the median home-sale price increased 4.5% year over year to $423,892, and it has been expanding at a similar rate for several months. In addition, the average 30-year fixed mortgage rate is currently around 6.5%, which is more than twice as low as it was before the epidemic. The average household in the United States makes an estimated $86,382, which is around $30,000 less than what is needed to buy a conventional home.

In February, the median asking rent increased by just 0.2% year over year to $1,604. Renters now have more options thanks to the flood of newly constructed apartments brought about by the current construction boom, which has caused rents to level off below their record high. As a result, landlords have found it more difficult to raise rents. Due in part to the mortgage-rate lock-in impact, supply is more limited in the for-sale market, which is causing bidding wars and higher price hikes.

The income required to finance a home was only roughly 17% greater than the income required to afford an apartment in 2020 and 2021 because rents were soaring and mortgage rates were at all-time lows.

To read more, click here.