There are two parts to any purchase: the educational aspect and the financial aspect. When buying a home, you’d hope that everyone—especially first-time homebuyers—has done their homework and comes in with a firm grasp of the process and its jargon. Yet a recent study from JW Surety Bonds showed some large knowledge gaps that challenge homeowners and could turn their American dream into a nightmare (or at least some sleepless nights).

Key Takeaways

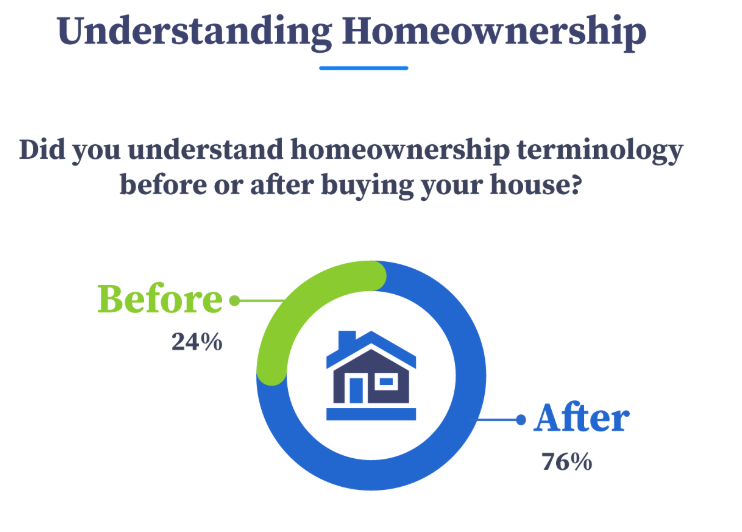

- 76% of homeowners lacked homeownership literacy until after buying their home.

- One in three homeowners doesn’t know their mortgage interest rate.

- 22% of homeowners are unsure of their monthly mortgage payment.

- More than one in four homeowners (27%) were surprised by unexpected fees during the homebuying process.

- One in five prospective homebuyers have delayed purchasing a home due to confusion around financial literacy.

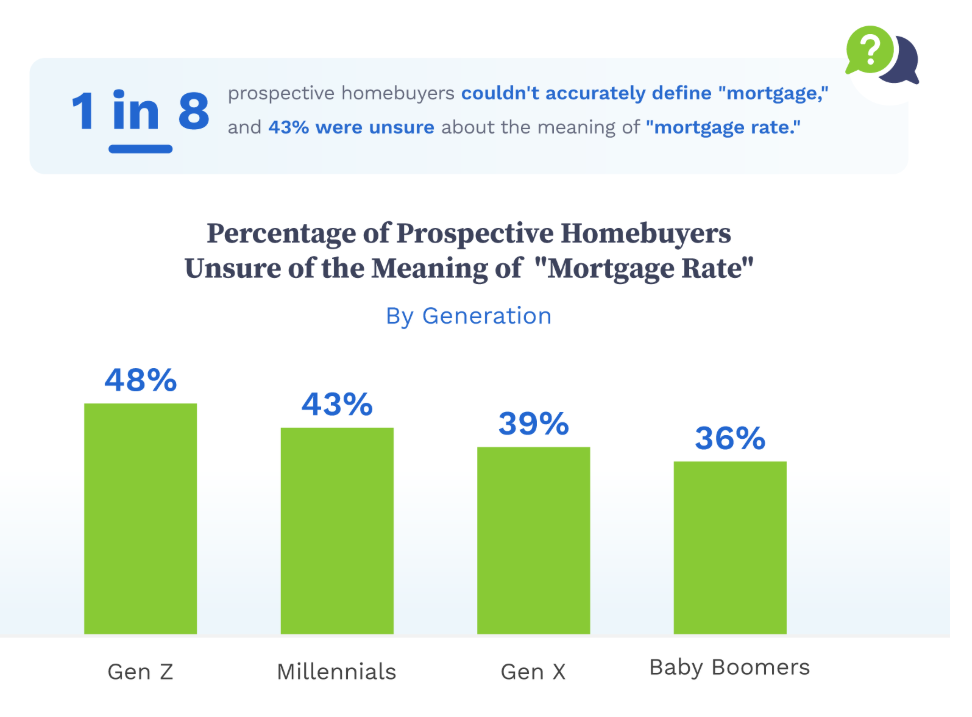

- One in eight prospective homebuyers cannot accurately define “mortgage,” and 43% are unsure about the meaning of “mortgage rate.”

- One in four Generation Z renters get their homebuying knowledge from TikTok.

Homeownership Challenges

JW Surety Bonds found significant knowledge gaps among homeowners, including the unexpected challenges and financial surprises many discovered after purchasing their homes.

It’s a challenging time to buy a home in the current U.S. housing market. Sixty percent of the homeowners surveyed reported they wouldn’t be able to afford their home at today’s market prices. Worse, most homeowners signed on the line without fully understanding of what that would entail: 76% lacked homeownership literacy until after buying their home, with Millennials being the most likely (80%) to have had this knowledge gap.

Homeownership literacy includes things like ongoing costs beyond the mortgage (e.g., property taxes, homeowners insurance, maintenance), different mortgage types, and the responsibilities that come with property ownership, such as routine maintenance and potential HOA obligations.

Many didn’t score well on the financial literacy of homeownership, either: 27% were surprised by unexpected fees during the homebuying process, 33% said they didn’t know their current mortgage interest rate, and 22% were unsure of their monthly mortgage payment.

Worse, 40% of homeowners were not using an escrow account to pay their property taxes, which could expose them to large annual tax bills, and 36% didn’t have an emergency fund for unexpected home repairs.

How Financially Prepared Are Buyers?

The financial aspects of home buying have presented significant hurdles for many prospective homeowners. Only 33% said they’ve budgeted for all the homebuying costs needed, while 69% fear they’ll be priced out of the market due to rising home costs. And 61% of potential buyers said they’re adopting a “wait-and-see” approach, holding off until interest rates drop.

Basic terminology is also an obstacle for many prospective homebuyers: one in eight couldn’t define “mortgage,” a knowledge gap most pronounced among younger generations (18% of Gen Z prospective homebuyers couldn’t define the term). And 43% of all prospective buyers couldn’t define “mortgage rate.” This lack of knowledge led to one in five prospective homebuyers delaying their home purchase.

Renters’ Path to Homeownership

What do renters feel they need to achieve before buying their first house? Over two-thirds (67%) of Gen Z said they had to achieve a certain salary level, and another 65% said they must have saved for a down payment. A quarter of Gen Z renters said they got their homebuying knowledge from TikTok.

Conversely, most Millennial renters (75%) placed the highest importance on saving for a down payment, while another 54% said they needed to reach a separate savings goal. Gen X renters showed similar priorities to Millennials, with 70% focused on saving for a down payment. Their secondary focus (51%) was on improving their credit score.

JW Surety Bonds surveyed 1,003 homeowners, prospective homebuyers, and renters in October 2024 to explore their homeownership literacy: 40% were homeowners, 30% were homebuyers, and 30% were renters. Their generational breakdown was: Gen Z (11%), Millennials (51%), Gen X (30%), Baby boomers (8%).

Click here to read more on JW Surety Bonds’ study.