Flooding is the most common and costly natural disaster in the U.S., yet 96.7% of homes lack flood insurance, according to a report by ValuePenguin. In 2024, the average home sustained nearly $34,000 in flood damage, with the most significant losses linked to Hurricanes Helene and Milton, which devastated parts of Florida, Georgia, Kentucky, North Carolina, South Carolina, Tennessee, and Virginia.

“Climate change continues to drive sea-level increases and make weather more extreme,” said ValuePenguin Insurance Expert and Spokesperson Divya Sangameshwar. “Flood-prone areas around the country are expected to grow by nearly half in just this century.”

Despite the rising threat, flood insurance isn’t mandatory unless a home is in a FEMA-designated Special Flood Hazard Area (SFHA). This leaves many homeowners financially vulnerable. Just one inch of floodwater can cause $25,000 in damage, yet many still choose to go uninsured.

Key Findings From the Report

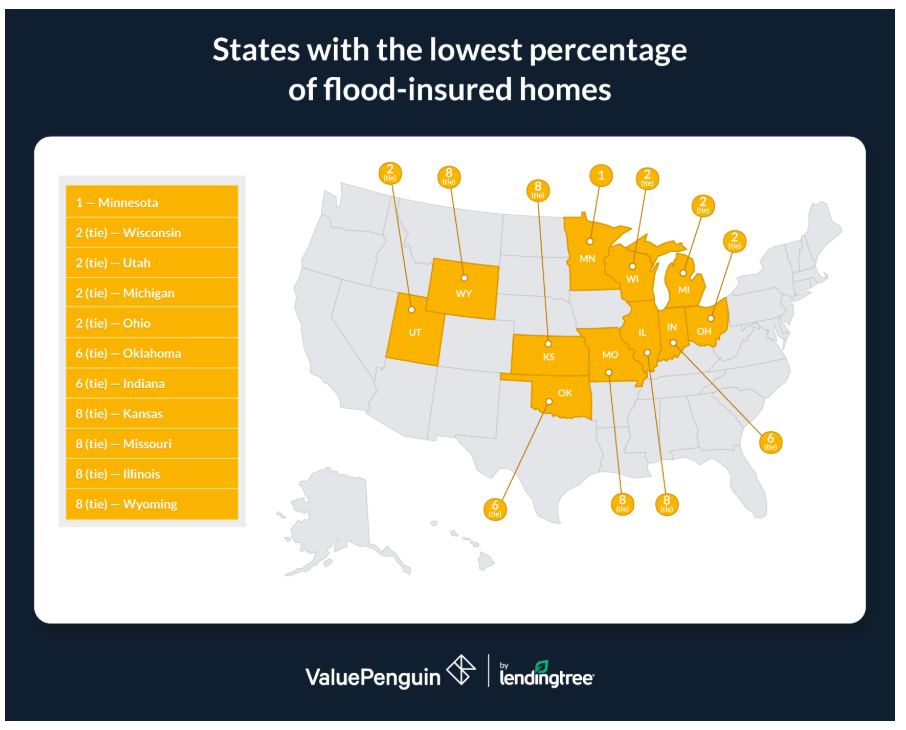

- Only 3.3% of U.S. homes (4.7 million) have flood insurance, and in 26 states, less than 1% of homes are covered. In Minnesota, Wisconsin, Utah, Michigan, and Ohio, coverage rates drop below 0.4%.

- 36 states saw a decline in flood insurance enrollment in 2024, with the biggest drops in Utah (-37.5%), North Dakota (-10.1%), and West Virginia (-87.6%).

- The average flood insurance claim in 2024 was $33,906, with the highest claims in Florida ($38,970) and North Carolina ($23,757).

- 6% of reported flood losses occurred outside SFHAs, proving that flooding isn’t just a coastal problem. The District of Columbia (85.6%), Utah (81.3%), and Wyoming (61.6%) had the highest share of non-SFHA flood losses.

Sangameshwar warns that low flood risk doesn’t mean no risk, and homeowners’ and renters’ insurance do not cover flooding. As climate-driven disasters intensify, the lack of coverage could leave millions financially devastated.

Click here for more information on ValuePenguin’s study on flood insurance policies.