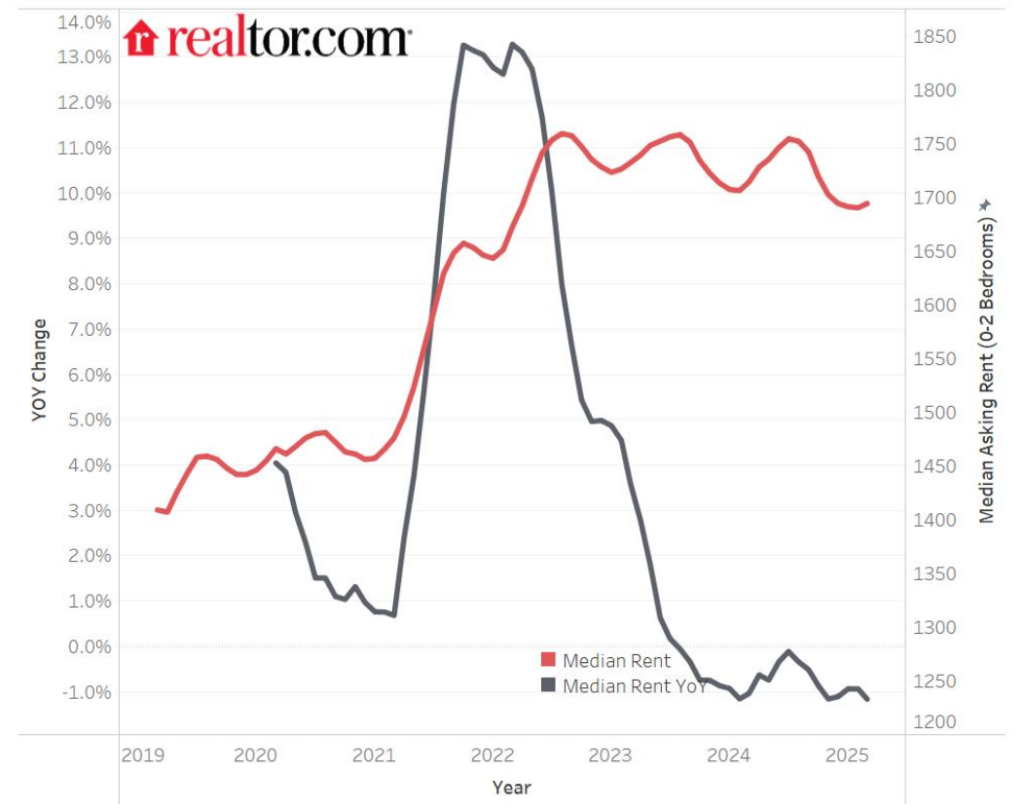

For the 20th consecutive month rents declined in March 2025, and the median asking price for rent in the 50 largest metros is now $65 lower than the 2022 peak, standing at $1,694, according to Realtor.com’s March Rent Report. While rents have been declining for nearly two years due in large part to new multifamily inventory, new tariffs could have impacts on metros where multifamily permitting activity is growing the fastest, jeopardizing rent declines.

“While the median asking rent is down $65 monthly or over $700 annually, in nearly every major U.S. metro rents are still considerably higher than 2019,” said Joel Berner, Senior Economist at Realtor.com. “We have seen declines in rents largely due to robust multi-family building and permitting adding more rental options in many metros. This tailwind is currently under threat as developers grapple with the short-term and long-term impacts of new and evolving tariffs on building materials. For renters in cities with declining rents, it might be a good time to lock in a good rate for the next year or beyond.”

Rents Remain Considerably Higher Than Before the Pandemic

This March marked the fifth anniversary of the onset of the global Covid-19 pandemic, and rents across the U.S. largely remain above pre-pandemic pricing. San Francisco remains the only market where the median asking rent is still below . The median rent has risen 20.2%, from $1,409 in March 2019 to $1,694 in March 2025. During this period, Pittsburgh (47.9%) led the Northeast in rental growth, while Tampa, Florida (45.7%) saw the fastest increases in the South. In the Midwest, Indianapolis (34%) emerged as the fastest growth market, and in the West, Sacramento, California (30.6%) experienced the highest rent hikes.

Markets With the Fastest-Growing Multifamily Permits

The recently announced tariffs on imported building materials such as steel and aluminum could potentially impact the multifamily housing supply by driving up construction costs. These rising expenses may discourage, delay or halt building and added costs could be passed to renters, pushing rental prices higher.

Markets that experienced rapid growth in permitted multifamily homes are expected to see the biggest impacts as developers and builders may postpone or even cancel new projects.

Markets such as Milwaukee, Oklahoma City and Memphis, Tenn., which saw the fastest growth in permitted multifamily homes, are expected to be hit the hardest by the 25% tariffs on steel and aluminum due to anticipated higher construction costs.

“Even markets with declining permitting activity could see impacts as rising construction costs could further dampen new development plans, restricting supply and continuing to exert upward pressure on rental prices,” said Berner.

For the study, Realtor.com examined rental data as of March 2025 for studio, one-bedroom, or two-bedroom units advertised as for-rent on Realtor.com. Rental units include apartments as well as private rentals (condos, townhomes, single-family homes).

Click here for more on Realtor.com’s March rental analysis.