Buying a home is a major life milestone, but for many first-time homebuyers, the experience is more stressful and costly than expected. A new survey by Guardian Service of 1,005 homeowners reveals that a significant portion of new buyers face buyer’s remorse and regret key parts of their decision-making process—often driven by financial missteps, emotional pressure, and lack of preparation.

According to the findings, 31% of first-time homebuyers reported buyer’s remorse, with 9% stating they shouldn’t have bought their home at all. The regret was even more pronounced among those who bought within the past two years—44% of that group felt regret. Younger generations felt it most: 35% of Gen Z and millennial buyers experienced remorse.

Rushed decisions were a common source of regret. In fact, 38% of first-time buyers said they felt pressured to decide quickly, and those who did were nearly three times more likely to experience buyer’s remorse. The emotional weight of homebuying played a major role: buyers who felt overwhelmed (34%), stressed (28%), or nervous (25%) were the most likely to regret financial decisions driven by those emotions.

Unexpected costs were another major source of regret, with 66% of first-time homeowners reporting facing unexpected home issues after buying, with an average cost of $5,356. Cosmetic or minor repairs were most common, but many faced more serious problems. Notably, 17% skipped a home inspection altogether, and buyers earning under $50,000 annually were the most likely to do so (23%).

Income levels also influenced regret. First-time buyers earning under $50,000 were 50% more likely to regret their purchase than those earning over $100,000. Financial knowledge was another factor—more than 1 in 4 buyers said their financial understanding was inadequate at the time of purchase, and those who lacked knowledge had a 42% remorse rate.

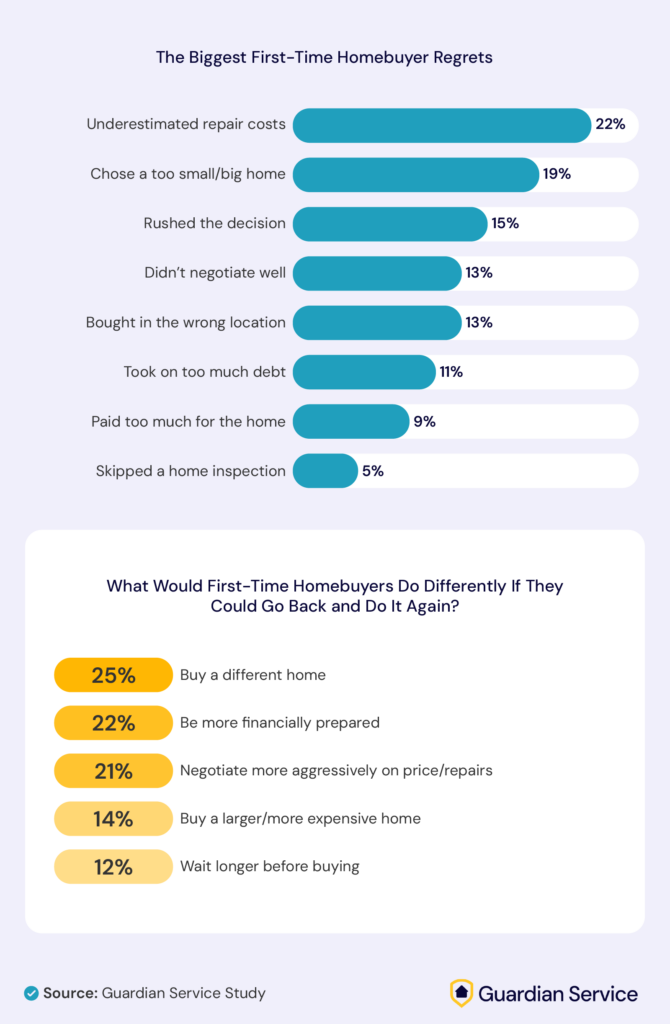

The top regrets included underestimating repair costs (22%), choosing the wrong home size (19%), and rushing into the purchase (15%). Gen Z and millennial buyers were more likely to say they didn’t negotiate well (15%) or overpaid (11%).

Looking back, many first-time buyers would approach things differently. Specifically, 25% said they would choose a different home, 22% would be more financially prepared, and 21% would negotiate more aggressively. Gen X buyers were most likely to want a different home (29%).

For many, the decision to buy was fueled by the desire to stop renting, with 63% stating this was their main motivation. Social and peer pressure also played a role, especially among younger buyers. When asked how they viewed their home, 65% saw it as a personal space, 7% as a financial investment, and 28% as both.

Budgeting proved difficult for many. While 50% spent what they originally planned, 45% paid more than expected. For ongoing homeownership costs, 56% budgeted accurately, while 41% underestimated.

The report highlights that first-time homeownership often comes with unforeseen challenges. But by learning from these common regrets—from rushing decisions to underestimating costs—future buyers can better prepare and make more confident, informed choices.

Click here for more on Guardian Service’s report on first-time homebuyers.