Cotality recently examined the state of the housing market in the Sunshine State of Florida. The state has long been a destination for those looking to flee high taxes and high costs in other states, serving as a landing ground for snowbirds, retirees, hourly workers, and increasingly, younger professionals unable to crack housing markets elsewhere. Cotality reports that between 2021-2023, nearly 2.76 million people flocked to the Sunshine State to transform the southern tip of the U.S. into the third-most populous state in the nation.

However, recent trends in the state may be driving those once flocking to the state elsewhere, as rising home prices, diminishing affordability, and growing pressures on infrastructure have driven many elsewhere.

“The last 25 years have seen home prices, homeowners’ insurance, and property taxes surge in Florida,” said Cotality Chief Economist Selma Hepp. “When you add in the unflagging migration that is straining the state’s public services and inflated costs across the board, the pressure on the quality of life has become so great that it is beginning to tip the balance. Many households are finding it increasingly difficult to stay in the state.”

In a case of history repeating itself, the state of California experienced a population exodus, spurred by the weight of housing costs, insurance, and an equally faltering infrastructure. Cotality’s report investigates how Florida may become a victim of its own success.

Has Growth Pushed Florida to the Edge?

Florida’s fragile housing market, growing population, aging infrastructure, and environmental threats could test the state’s limits—and there are indications that homebuyers may soon be looking elsewhere.

Cotality experts highlight two key warning signs shaping Florida’s future: the link between natural disasters, soaring insurance costs, and declining affordability, and the growing tension between business growth and housing availability. These factors signal that Florida’s appeal as a place to put down roots is already changing.

Migration and Hidden Costs

Florida’s growth is shaped by who is moving and where they are coming from. Cotality’s database, covering 99.9% of U.S. residential properties, pinpoints the states driving this migration and the impact on housing, infrastructure, and the economy.

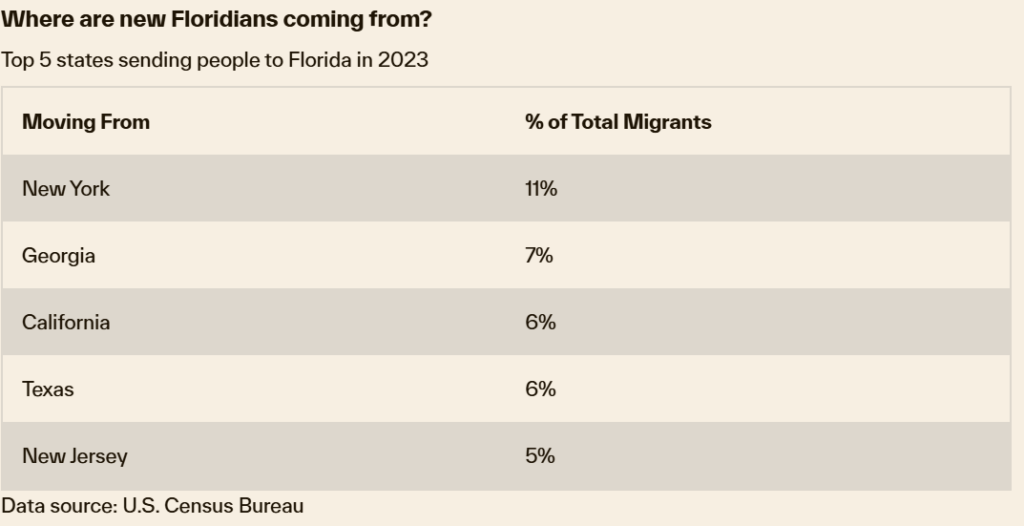

New York has long been a pipeline for Florida’s population growth, but migration patterns are shifting. In 2023, California accounted for 6% of new arrivals, signaling a move away from West Coast costs toward Florida’s economic and political influence. Georgia, Texas, and New Jersey also ranked among the top five states sending new residents.

“Migration to Florida markets resulted in strong demand for housing and some of the highest rates of home price appreciation since the onset of the pandemic,” said Hepp. “Among the largest U.S. metro areas, Miami tops the list with some of the highest cumulative increases in home prices over the last four-year period. Tampa was a close second.”

The New Struggle for Affordability

In October 2024, data from Cotality showed that Florida’s median home price of $393,500 surpassed the national average. In Miami, where prices have soared fastest, the median listing price sits at $629,575—60% higher than the state’s overall figure. Rents, too, have climbed sharply. In August 2024, the median rent price for a single-family home in Miami hit $2,944. Add inflationary concerns and a lack of housing supply to the mix, and Floridians, nearly a third of whom are renters, are beginning to feel the strain. In 2023, nearly one million moved to the Sunshine State seeking to take advantage of the state’s low-taxes.

“The influx of high-income residents to Miami over the last few years has fueled economic growth, real estate development, and infrastructure investments, but it has also driven up housing costs and deepened income gaps, making it harder for long-time residents to afford living in the city,” said Pete Carroll, Cotality’s EVP of Public Policy and Industry Relations. “Recent proposals to eliminate property taxes could further accelerate these trends—potentially attracting even more wealthy newcomers, while raising questions about how essential local services will be funded in an already strained housing market.”

Constructing Florida’s Future

New construction has slipped in the Sunshine State. Cotality examined decades of building activity across the state to establish that permitting activity plummeted by 9.7% in 2022—its first decline since 2009. Activity fell again by 7.2% in 2023 amid labor shortages, rising material costs, and regulatory delays. Recent price pressures from tariffs have added an additional hurdle for developers who are growing hesitant to launch new projects.

In addition to new home construction, the state’s infrastructure requires periodic updates as well to support an influx of population. Each year, Florida reportedly adds the equivalent of Tampa’s population, but the state’s roads, schools, and utilities are struggling to keep pace with an eroding infrastructure.

Natural Disasters and Insurance Concerns

Adding to the equation are hurricanes, having only intensified by changing weather patterns—which remain an ever-present threat. Hurricane Milton’s near miss in Tampa in 2024 exposed just how vulnerable the state actually is.

“While Florida’s metros have topped the list of hottest appreciating housing markets in recent years, the increasing costs of persistent natural disasters and consequent pressure on insurance expenses and rebuilding costs are starting to weigh on home prices in west Florida,” Hepp said. “The Cape Coral region, for example, was one of the few markets last year where home prices declined as a result of these issues.”

In areas impacted by hurricanes, property values often decline due to extensive damage and the need for repairs or reconstruction. Many less-affluent homeowners have policies that do not cover the full reconstruction value of their house or don’t insure costly items such as pools, decks, or fences. Additionally, homeowners using National Flood Insurance Program (NFIP) coverage don’t receive payment for additional living expenses if they must move. The end result is that some cannot afford to rebuild their homes, while others cannot afford both additional living expenses and their current mortgage, which can push them into foreclosure.

In the Florida counties of Hillsborough and Pinellas, which cover the greater Tampa area, approximately 17% of the 1.12 million units in the area are covered by the NFIP policies in force. This does not account for flood insurance that homeowners have with private carriers.

According to Science Insider, last year’s Hurricane Helene caused approximately $250 billion in damages to the southeastern U.S., concentrated in Florida, Georgia, and North Carolina. And less than two weeks later, Hurricane Milton wreaked havoc on Florida causing an additional $50 billion in estimated damages.

The increasing frequency and severity of storms in Florida has pushed up the number of insurance claims in recent years. Couple this with the overall increase in material prices since the pandemic—Cotality data analysis shows that in 2024 concrete was up 7.2% from a year prior, labor cost 3.9% more, and structural steel is 2% more expensive year over year—and it’s fair to wonder if insurers should be concerned about the future of this market.

Billion-dollar hurricane disasters in Florida are now becoming a reality rather than a worst-case scenario. Since the beginning of the decade, 18 storms that have caused in excess of $1 billion in damages.

Cotality projects that over the course of the next 30 years, Monroe, Florida will become the fourth-riskiest place to live in the U.S. for natural disasters due to its extremely high risk of hurricanes. Looking at the state for where flood, wind, and hurricane risk overlap, Miami and Naples are among the top three cities with the greatest number of homes exposed.

“When insurance carriers lose money, they pull out. Right now, we’re seeing historic cancellations throughout California,” Robert Feldman, the co-founder of WOWS Insurance told Cotality. “And what’s really scary is it’s not just California. The western United States is affected by this, and unless we make changes, it’s not viable. Rates are going to continue to rise and it’s just going to be out of control.”

Over the last several years, Farmers Insurance, Bankers Insurance, and Lexington Insurance, a subsidiary of AIG, have all withdrawn from the state.

“A hurricane like Milton was inevitable somewhere along this coast, but the thing we can control is how fast we can restore buildings—and part of that means having appropriate level of insurance coverage,” said Tom Larsen, the AVP of Insurance Product Marketing at Cotality. Larsen adds that modeling for future scenarios can help insurers understand the risk of the properties in their portfolios so that resilience measures can be encouraged to help homes withstand these inevitable storms and reduce overall restoration costs.

Click here for more on Cotality’s examination of the Florida housing marketplace.