In a new study on property taxes by Joel Berner, Senior Economist with Realtor.com, the median U.S. tax bill in 2024 was $3,500, up 2.8% from 2023’s totals. As tax growth varies state-by-state, in some states, tax burdens are outpacing home price growth and others where property taxes are falling even as homes appreciate in value.

The study by Berner estimates that more than 40% of properties nationwide could save $100 or more by disputing their assessment value, with a median savings of over $500.

Home Values Dictating Tax Growth

Property taxes, levied by counties, municipalities, and some state governments, provide funding for essential public services including schools, healthcare, and transportation infrastructure.

According to Realtor.com’s data, from 2023-2024, the median property in the U.S. saw its tax bill grow by 2.8% and 73.6% of properties had tax increases year-to-year. The median tax burden in 2024 was $3,500, up from $3,349—due primarily to home price appreciation, with assessed values having increased by 2% over the same period, and 59.5% of properties nationwide had their assessment value go up. Interestingly, 23.4% of properties saw their tax bill go up from 2023 to 2024 without their assessment value increasing, suggesting a tax rate hike independent of home valuation.

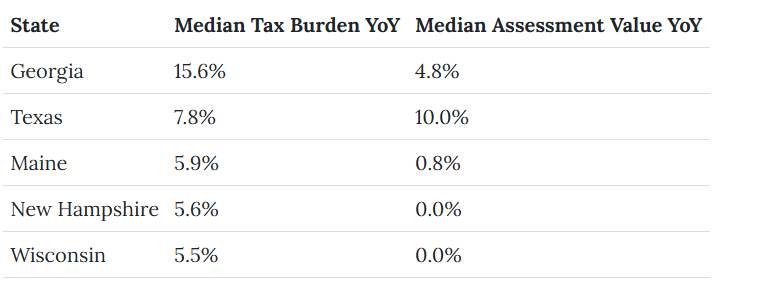

The following five states saw the largest percentage increase in property taxes from 2023 to 2024:

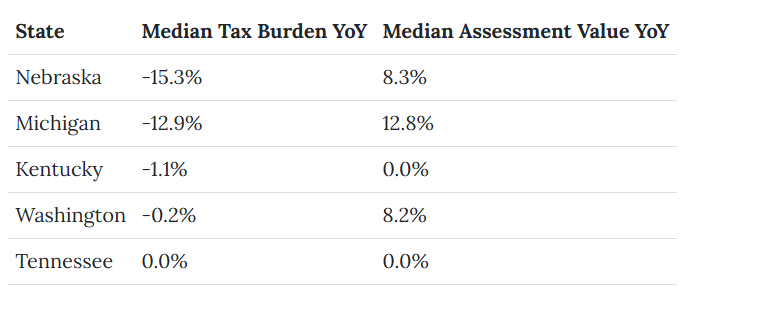

Tax burdens have grown at a faster pace than assessment value, with Georgia, Maine, New Hampshire, and Wisconsin experiencing tax rate hikes. Texas saw tax burdens grow at a slower rate than assessment values, signaling a cut in the effective tax rate. On the other hand, these five states saw decreases or no change to their median tax burden from 2023 to 2024.

Nebraska and Michigan have seen growth in home values at the same time that property taxes fell significantly, meaning that effective tax rates there sharply decreased. The same is true for Washington, while Tennessee and Kentucky held steady year-over-year.

And as properties become more valuable, their tax obligations increase, and in some places, local governments are bumping up effective tax rates. In others, assessment values are out of line with the true market values of homes, which presents homeowners with an opportunity to save.

Nearly 41% of properties could benefit from lowering their assessed value to their market value times their county’s average assessed-to-market value ratio, keeping each property’s effective tax rate the same. This large subset of the housing stock could see significant savings. The median property identified by this methodology could save over $539 per year, a 15.4% reduction of the median property tax bill of $3,500 in 2024.

The following five states include the highest share of properties that could benefit from property tax protesting:

Realtor.com reports Texas, California, and Illinois are three states that are relatively high in taxes, so even a slight change to assessment values could lead to significant tax savings.

For the analysis, tax records from 2023 and 2024 are collected from properties only where both years are available. Data is derived from the Realtor.com tax assessment database. Year-over-year changes are calculated at the property level and aggregated by state from there. Potential savings from property tax protesting are calculated by comparing the actual tax bill for a property for the most recent tax year against the product of that property’s effective tax rate (actual tax bill divided by actual assessment value) and the property’s hypothetical assessment value (market value multiplied by the average assessment-to-market value ratio for the property’s county). Market values are the median of the most recent valuations from several valuation vendors.

Click here for more on Realtor.com’s study of property tax trends.