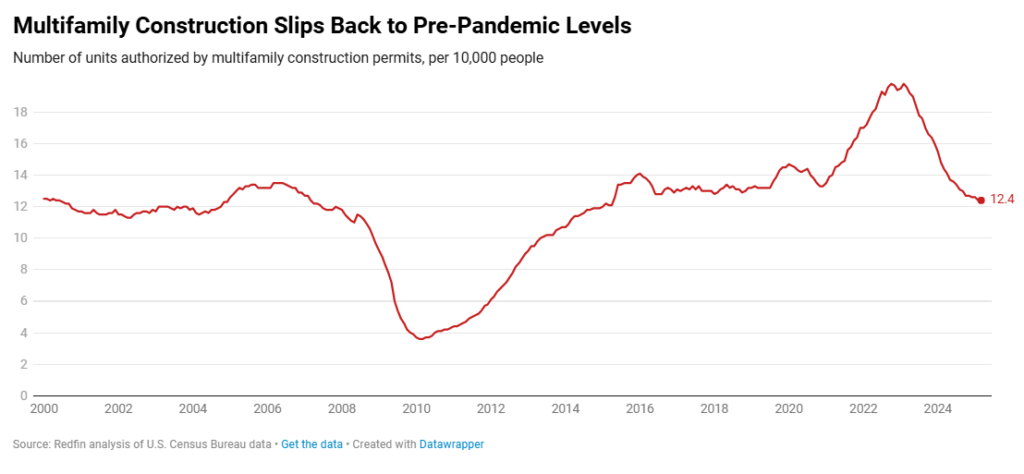

According to a new Redfin analysis of U.S. Census Bureau data, developers obtained permits to build 12.4 multifamily housing units for every 10,000 people in the U.S. over the past year. That total is down 27.1% from 17 units per 10,000 people during the pandemic building boom, and down 5.5% from 13.1 units in the years leading up to the pandemic.

For the study, Redfin analyzed Census Bureau data covering building permits for multifamily units in buildings with five or more units.

The ability to work remotely during the pandemic allowed millions of Americans to relocate, resulting in an upward drive in rental demand. As a response, builders ramped up construction in response—primarily in areas like Austin, Texas and Tampa, Florida—leading to a record number of new apartments being completed in 2024. Today, rents are flattening and borrowing costs are high, making building less attractive.

“New apartments are being rented out at the slowest speed on record, and builders are pumping the brakes because elevated interest rates are making many projects prohibitively expensive,” said Redfin Senior Economist Sheharyar Bokhari. “At some point in the next year, the slowdown in building will mean that renters have fewer options—potentially leading to an increase in rents.”

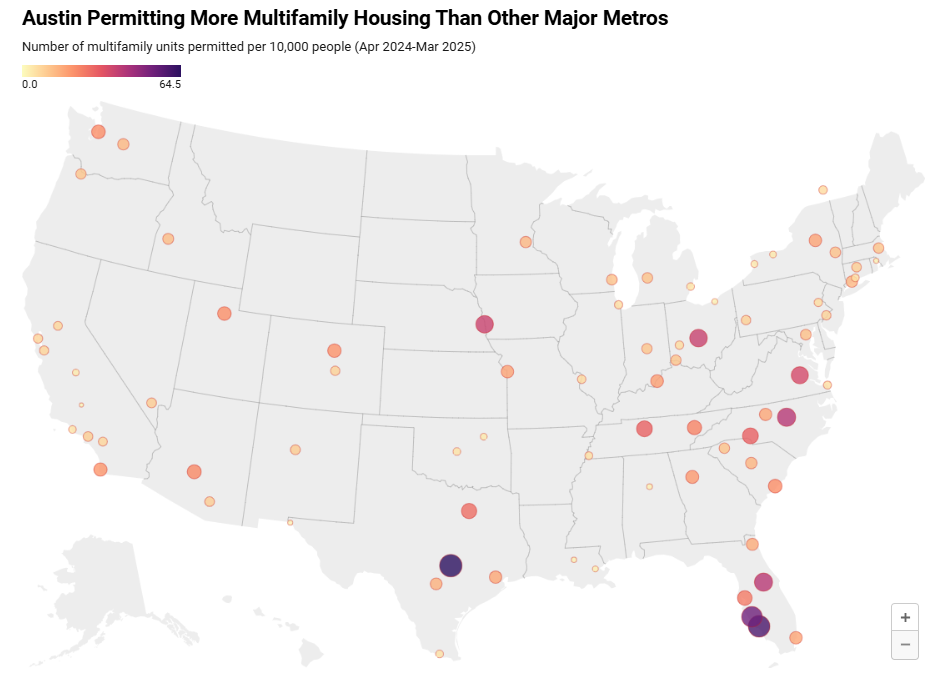

Despite the fall in rents, developers are still targeting Austin for growth. The Texas metro granted permits to build 64.5 multifamily units for every 10,000 people over the past year—the highest level among the 78 U.S. metros with populations of at least 750,000. Austin was followed by four more Sun Belt metros:

- Cape Coral, Florida (59.6)

- North Port, Florida (53.3)

- Raleigh, North Carolina (41.1)

- Orlando, Florida (40.7)

Conversely, Stockton, California recorded no new permits in the past year—the lowest of the metros analyzed, followed by:

- Bakersfield, California (0.8 units per 10,000 people)

- El Paso, Texas (1.6 per 10,000 people)

- Providence, Rhode Island (1.6 per 10,000 people)

- Baton Rouge, Louisiana (1.9 per 10,000 people)

Nearly two thirds (63%) of the metros analyzed posted a decline in multifamily construction since the pandemic. Stockton, California experienced the biggest drop, with permits per 10,000 people falling to zero from 5.7—a decline of 100%. Stickton was followed by:

- Colorado Springs, Colorado (-82% to 8.6 units per 10,000 people over the past year from 47.7 during the pandemic)

- Boise City, Idaho (-64% to 12.6 from 35.2)

- Minneapolis, Minnesota (-62% to 13.6 from 35.6)

- Jacksonville, Florida (-61% to 15.9 from 40.9)

Oklahoma City, Oklahoma led the list of metros posting the largest increase, growing 193% from 1.7 units permitted per 10,000 people during the pandemic to 5.1 over the past year (still below the national average of 12.4 units permitted per 10,000 people, something the next four cities also have in common). OKC was followed by these metros posting the highest permit growth:

- Pittsburgh (+184% to 8.8 units per 10,000 people in over the past year, from 3.1 during the pandemic)

- Hartford, Connecticut (+102% to 9.4 from 4.6)

- Baton Rouge, Louisiana (+90% to 1.9 from 1.0)

- Milwaukee, Wisconsin (+88% to 11.8 from 6.3)

Click here for more on Redfin’s analysis of U.S. rental data.