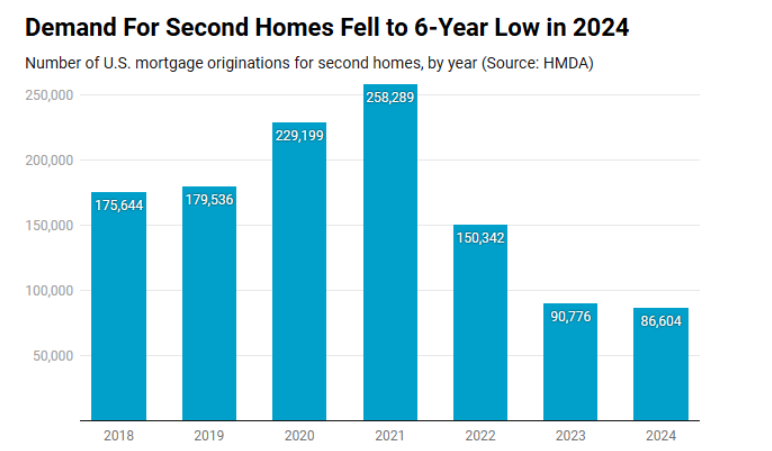

Redfin reports that U.S. homebuyers took out 86,604 mortgages for second homes in 2024, the lowest level dating back to 2018 and down 5% year-over-year. Redfin analyzed Home Mortgage Disclosure Act (HMDA) data covering the purchase of second homes, primary homes, and investment properties from 2018 to 2024. The term “vacation home” is used interchangeably with “second home” in Redfin’s report.

As mortgages for second homes fell to a six-year low in 2024, the rate of decline slowed substantially from the two years prior. In 2022, second-home mortgages fell 42% year over year, and in 2023, they fell 40%. The big declines in 2022 and 2023 were due largely to the vacation-home boom in 2020 and 2021, which was driven by affluent Americans taking advantage of low mortgage rates and remote work to decamp to vacation destinations. Second-home mortgages made up just 2.6% of all mortgages in 2024—the lowest share on record—down from 2.8% the year before, and a peak of 5% in 2020.

Demand for all home types was slow in 2024 because it was the second-least affordable year for homebuying on record, due to high home prices and mortgage rates. But demand for second homes fell more than demand for primary homes; mortgages for primary homes fell 1.4% year-over-year, less than half the decline in mortgages for second homes.

Reasons Behind the Decline

With affordability a continued concern among homebuyers, Redfin broke down several reasons behind the drop in interest in second homes nationwide, concluding:

- Second homes are more expensive: The median value for second homes nationwide was $495,000 in 2024, compared to $385,000 for primary homes. Plus, loan fees for second homes increased in 2022, raising the total cost of buying one.

- Second homes aren’t a must-have commodity: Inflation drove up the price of nearly everything in 2024, prompting many to cut back on unnecessary expenses. As housing costs skyrocketed, many backed off second homes altogether.

- A slowdown in the rental market: Purchasing a second home to rent out became less appealing than in the past, as asking rents held steady, and the short-term rental market cooled from peak levels.

- In-office work: Many workers had less time to spend in a vacation home than they did during the pandemic because employers have asked workers to return to the office post-pandemic.

“Most people aren’t buying vacation homes at all because mortgage rates and insurance costs–especially for waterfront homes and condos–have skyrocketed. Plus, people know they’re unlikely to earn much revenue from listing on Airbnb now that occupancy rates are down,” said Lindsay Garcia, a Redfin Premier Agent in Fort Lauderdale, Florida. “While some wealthy cash buyers are still purchasing second homes, they are much more likely to make a low-ball offer or request concessions than they used to be.”

Regional Trends Vary

In Miami, Florida, second-home mortgage originations dropped 32.2% year-over-year in 2024, more than any other major U.S. metro, followed by four other Florida metros:

- Orlando (-28.4%)

- Fort Lauderdale (-28%)

- West Palm Beach (-23.7%)

- Tampa (-20.9%)

Housing costs in the Sunshine State are soaring, partly due to increasing insurance, HOA and property-tax costs. Additionally, the increasing frequency and intensity of natural disasters is turning some people off from the state. And both of those things together are making some would-be second-home buyers avoid the Sunshine State as they feel the market is a risky one to buy into.

Flooding is the most common and costly natural disaster in the U.S., yet 96.7% of homes lack flood insurance, according to a recent report by ValuePenguin. In 2024, the average home sustained nearly $34,000 in flood damage, with the most significant losses linked to Hurricanes Helene and Milton, which devastated parts of Florida.

Cotality recently examined the state of the housing market in Florida, historically a destination for those looking to flee high taxes and high costs in other states, and a landing ground for snowbirds, retirees, hourly workers, and increasingly, younger professionals unable to crack housing markets elsewhere. Cotality reports that between 2021-2023, nearly 2.76 million people flocked to the Sunshine State to transform the southern tip of the U.S. into the third-most populous state in the nation. However, recent trends in the state may be driving those once flocking to the state elsewhere, as rising home prices, diminishing affordability, and growing pressures on infrastructure have driven many elsewhere.

While vacation-home mortgages are declining in Florida, they are still more common in the West Palm Beach area than anywhere else where second-home mortgages made up 5.6% of all mortgages in 2024, the highest share of the metros in Redfin’s analysis, followed by:

- New Brunswick, New Jersey (4.2%)

- Riverside (Palm Springs), California (3.5%)

Outside of the Sunshine State, mortgages for second homes fell year-over-year in 30 of the 50 most populous U.S. metros, stayed flat in two, and rose in the others. They increased the most in Detroit (up 26% year-over-year), San Francisco (17%), and San Jose, California (15.9%). But note that second-home mortgages still made up a very small portion of all mortgages in those metros … less than 1% in Detroit and San Jose, and 1.7% in San Francisco.

Targeting Second Home Demographics

In terms of exactly who was buying vacation homes in 2024, Redfin found the following in its analysis:

- High earners: Nearly nine in 10 (86.4%) second-home mortgages issued in 2024 went to high-income buyers. Less than one in 10 (7.5%) went to middle-income buyers, and 2.7% went to low-income buyers. The median household income for the high-income category is $280,000, and it is $96,000 for middle-income and $64,000 for low-income. All of those income groups took out fewer second-home mortgages in 2024 than the year before.

- Gen Xers: 30.2% of second-home mortgages went to 55–64-year-olds in 2024, and another 28.4% went to 45–54-year-olds. Next came 35–44-year-olds, who made up 20% of vacation-home mortgage originations, followed by 35–44-year-olds (20%) and 65–74-year-olds (12.5%). But while Gen Xers took out the lion’s share of vacation-home mortgages, they took out fewer than they did the year before.

- Baby boomers: The only generation that took out more vacation-home mortgages in 2024 than the year before (up 4.5% for 65–74-year-olds; up 8.6% for 74+).

- White people: Four in five (79.7%) second-home mortgages went to white homebuyers in 2024, dramatically outpacing the share for Asian (6.4%), Hispanic (6%), and Black (2.6%) homebuyers. All races in Redfin’s analysis took out fewer second-home mortgages in 2024 than the year before.

Click here to access Redfin’s full analysis of second homebuyers in 2024.