Not all homeowners in the U.S. are equally at danger from the increasing frequency and severity of weather-related natural disasters. Black and Hispanic homeowners are disproportionately at danger from significant climate hazards including wind, wildfire, and excessive heat, according to a recent Zillow report.

An analysis of First Street data on Zillow for-sale listings shows that Hispanic homeowners are more likely than white homeowners to possess homes at significant danger of wildfire. Extreme wind is more likely to pose a serious risk to Black homeowners. Because these regions typically have fewer financial options, the racial wealth gap may be a contributing factor.

Key Highlights — U.S.

- Compared to White homeowners, Hispanic homeowners are more likely to own homes that are at high danger of wildfire.

- Extreme wind is more likely to affect Black households.

- Communities of color are disproportionately affected by growing homeownership costs in high-risk areas.

- The racial wealth gap may grow as a result of these growing expenses, which may restrict homeowners of color’s ability to accumulate wealth.

“The disproportionate burden of climate risk on homeowners of color threatens to deepen financial inequality,” said Kara Ng, Senior Economist at Zillow. “Climate risk is driving up homeownership costs due to rising insurance premiums and potential repair or rebuilding expenses after disasters. These added financial pressures can make it harder for families to build and maintain wealth through homeownership.”

Flood Risk is “Fairly Balanced” Across U.S. Racial Groups

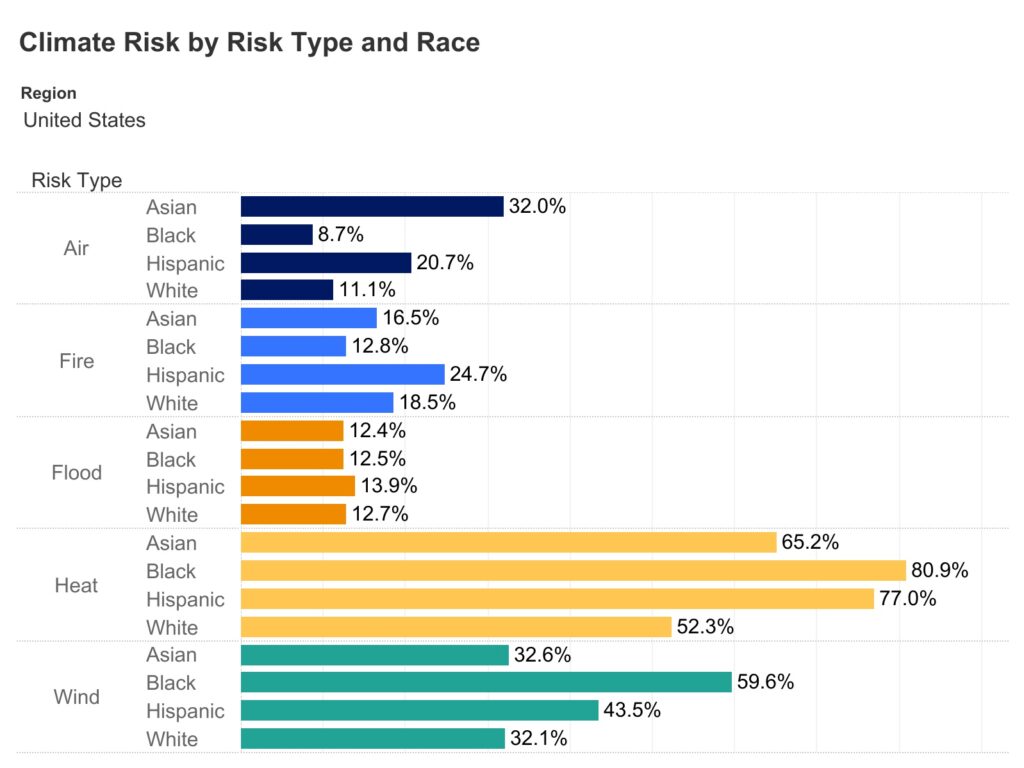

Between an estimated 12% and 14% of White, Black, Hispanic, and Asian American households own homes that are at high risk of flooding.

Local statistics, however, may present a different picture. Some 95% of Asian American homeowners, 92% of Black homeowners, and 86% of Hispanic homeowners in the New Orleans metro area are at significant danger of flooding. In New Orleans, only 76% of White homeowners are at the same danger.

The contrary is frequently true in Florida, where a higher percentage of white homeowners live in major flood-prone areas like Miami, Tampa, and Jacksonville. Due to the unfortunate racial income gap, White homebuyers are more likely than Black or Hispanic buyers to be able to afford these usually more expensive residences.

Extreme heat and poor air quality are two further ways that climate risk impacts dwellings’ livability in addition to physical risks. Minority groups are also disproportionately affected by these conditions: Compared to 52% of homes owned by White people, roughly 81% of homes owned by Black people and some 77% of homes owned by Hispanic people are at significant risk from heat. Poor air quality is a disproportionate problem for Asian American households. Major air-quality concern is present in 32% of Asian American households’ dwellings, which is almost three times higher than the proportion for White households (11%).

Zillow’s research clarifies how long-standing housing disparities are being exacerbated by climate risk. Homeowners in high-risk areas face increasing expenditures due to higher insurance premiums, a higher likelihood of repairs, and higher energy bills as natural catastrophes become more frequent and intense. Opportunities to accumulate wealth may be restricted by the unequal distribution of these costs.

While looking through Zillow listings, homebuyers can examine climate risk information. With risk scores and interactive maps, the search map and for-sale ads provide information on five major risks: flood, wildfire, wind, heat, and air quality. This data makes it easier for homebuyers and sellers to assess long-term aspects of homeownership, like costs, safety, and resiliency.

| Climate Risk Type | White Homeowners: Share of Homes at Major Risk | Black Homeowners: Share of Homes at Major Risk | Hispanic Homeowners: Share of Homes at Major Risk | Asian American Homeowners: Share of Homes at Major Risk |

| Extreme heat | 52 % | 81 % | 77 % | 65 % |

| Extreme wind | 32 % | 60 % | 43 % | 33 % |

| Wildfire | 18 % | 13 % | 25 % | 16 % |

| Flood | 13 % | 13 % | 14 % | 12 % |

| Air quality | 11 % | 9 % | 21 % | 32 % |

Consumers Face Financial Stress as Climate Risk Adds to Challenges

By increasing expenses, decreasing housing supply, and making it more difficult to obtain insurance, the growing impact of climate threats is exacerbating the housing affordability issue. This puts additional pressure on the housing market by straining budgets for both first-time and existing homeowners and preventing many from moving.

This study shows that historically underprivileged ethnic groups are disproportionately affected by climate risk, which could worsen racial wealth and income disparities.

In addition to being more vulnerable to the effects of climate change, minority groups are also less likely to obtain homeowners insurance, which can aid in their recovery in the event of a disaster. One in 13 American homes do not have insurance, and individuals of color are the most likely to do so: some 22% of Native American homeowners, 14% of Hispanic homeowners, and 11% of Black homeowners do not have insurance, according to the Consumer Federation of America. In comparison, only 5% of Asian American and Pacific Islander homes and 6% of White homeowners do not have insurance.

Rising premiums raise the likelihood of mortgage delinquency for homeowners who do carry insurance. Black and Hispanic communities are likely to be more financially impacted by the increased cost of insurance given the current financial gaps. After being affected by the disaster, communities of color had a 31-point drop in credit scores, while majority-White communities saw a 4-point reduction, according to the Urban Institute.

A 2025 Zillow analysis found that homes with extreme risk of fire and flood are less likely to sell, or even go pending, and those that do sell are more likely to sell for less than the original list price, making racial groups that face higher climate risk more vulnerable to loss of wealth from home equity. This is another effect that can affect owners of homes facing climate risk: they are less likely to realize the full potential of their home equity when they sell.

Overall, and unfortunately, homeowners of color continue to be more vulnerable to significant climate dangers and the associated escalating expenses.

To read more, click here.