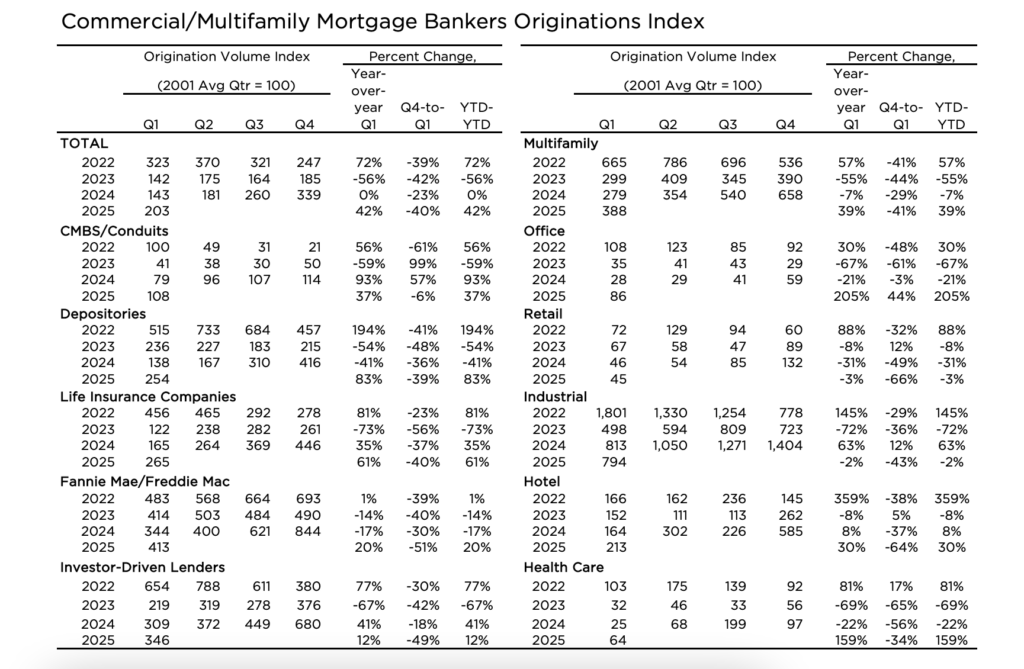

According to the Mortgage Bankers Association‘s (MBA) Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations, originations of commercial and multifamily mortgage loans fell 40% from Q4 of 2024 and increased 42% from Q1 of 2025 compared to the same period last year.

“Commercial and multifamily mortgage originations posted a strong rebound in the first three months of the year, increasing 42% compared to year-ago levels,” said Reggie Booker, MBA’s Associate VP of Commercial Research. “The first quarter of the year is typically the slowest, so this level of activity—particularly the strong gains in office, health care, and multifamily lending—signals renewed momentum and growing confidence in key segments of the market.”

Q1 of 2025 Sees 42% Jump in Originations

Commercial/multifamily loan volumes increased overall due to an increase in originations for office, health care, and multifamily compared to a year ago.

Q1 Key Findings — U.S.

- The dollar volume of office property loans increased by 205%.

- Health care property loans increased by 159%.

- Multifamily property loans increased by 39%.

- Hotel property loans increased by 30%.

- Compared to Q4 of 2024, loan originations for retail properties fell 3%, and those for industrial buildings were down 2%.

“Despite ongoing volatility in interest rates and the broader financial markets, borrowers and lenders are finding opportunities to move new deals forward,” Booker said.

The dollar amount of loans provided to depositories rose by 83% annually among all investor categories. The number of loans to life insurance companies increased by 61%, commercial mortgage-backed securities (CMBS) loans increased by 37%, government-sponsored enterprise (GSE) loans (Fannie Mae and Freddie Mac) increased by 20%, and investor-driven lender loans increased by 12%.

Originations in Q1 of 2025 Much Lower Compared to Q4 of 2024

In comparison to Q4r of 2024, the first quarter originations for retail properties fell by 66% on a quarterly basis. The originations of hotel properties decreased by 64%, those of industrial buildings by 43%, multifamily properties by 41%, and those of health care facilities by 34%. Overall, compared to Q4 of 2024, office property originations rose by approximately 44%.

Between Q4 of 2024 and Q1 of 2025, the dollar volume of loans for GSEs fell by 51%, loans for investor-driven lenders fell by 49%, life insurance company originations fell by 40%, depositories loans fell by 39%, and CMBS loans fell by 6%.

“2024, and particularly the fourth quarter, was a welcome rebound for the industry following a slow pace of origination activity in 2023. The significant, but brief, dip in interest rates in September, followed by a pickup in market sentiment post-election resulted in more business, with origination activity back to 2022 levels,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “The triple-digit percentage increases in the origination indexes certainly reflect this bounce off a low base. With interest rates moving up again to start 2025, we will have to see how origination activity responds through the first quarter. However, MBA still expects more borrowing and lending in 2025.”

To read more, click here.