For many Americans, buying a home remains a major financial challenge. Home prices are near record highs, and mortgage rates have more than doubled since their pandemic lows, making affordability a top concern for aspiring homeowners.

According to Bankrate’s 2025 Home Affordability Report, based on multiple surveys of over 2,000 U.S. adults, the biggest obstacles to homeownership include saving for a downpayment and closing costs, rising living expenses, and high home prices.

Saving for a Downpayment Is a Major Hurdle

More than four in five aspiring homeowners (81%) say the cost of a downpayment and closing costs is a significant obstacle. Over half (52%) call it a “very significant” challenge, while 29% say it’s “somewhat significant.”

For some, the idea of homeownership feels out of reach entirely. One in five (20%) aspiring homeowners believe they will never be able to save enough for a downpayment. Others expect it to take years:

- 12% say they’ll need 10 or more years

- 9% expect it to take seven to 10 years

- Only 4% believe they will have enough saved within a year

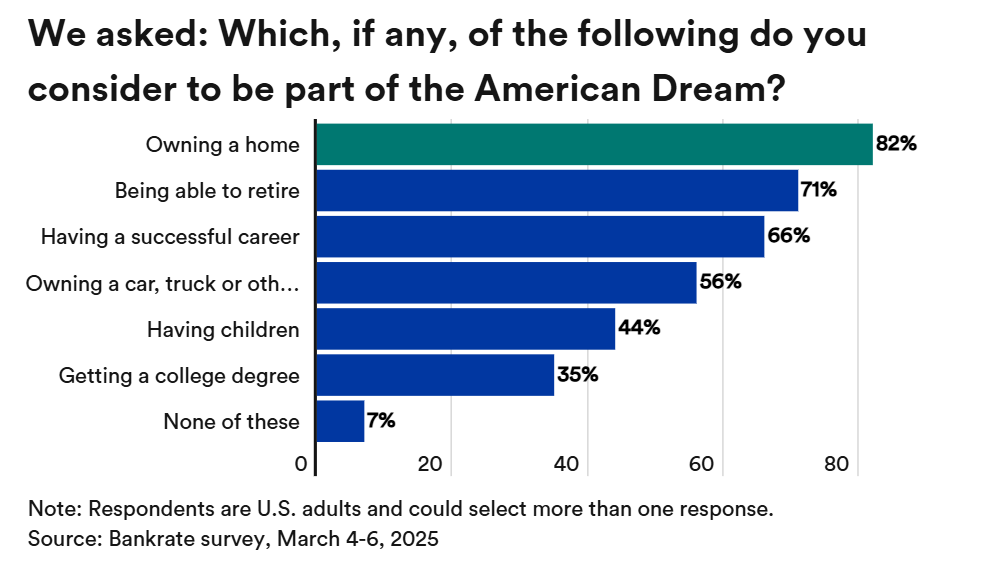

Many Americans Still See Homeownership as the American Dream

Despite affordability concerns, 78% of U.S. adults believe that owning a home is part of the American Dream. Among generations, older Americans feel the strongest about homeownership:

- 88% of baby boomers and 83% of Gen Xers say homeownership is a key life goal

- Only 68% of Gen Zers feel the same, prioritizing career success instead

However, housing costs are preventing many from achieving this dream. Among those who want to buy but have not:

- 56% say they do not have enough income

- 47% say home prices are too high

- 42% say they cannot afford the down payment and closing costs

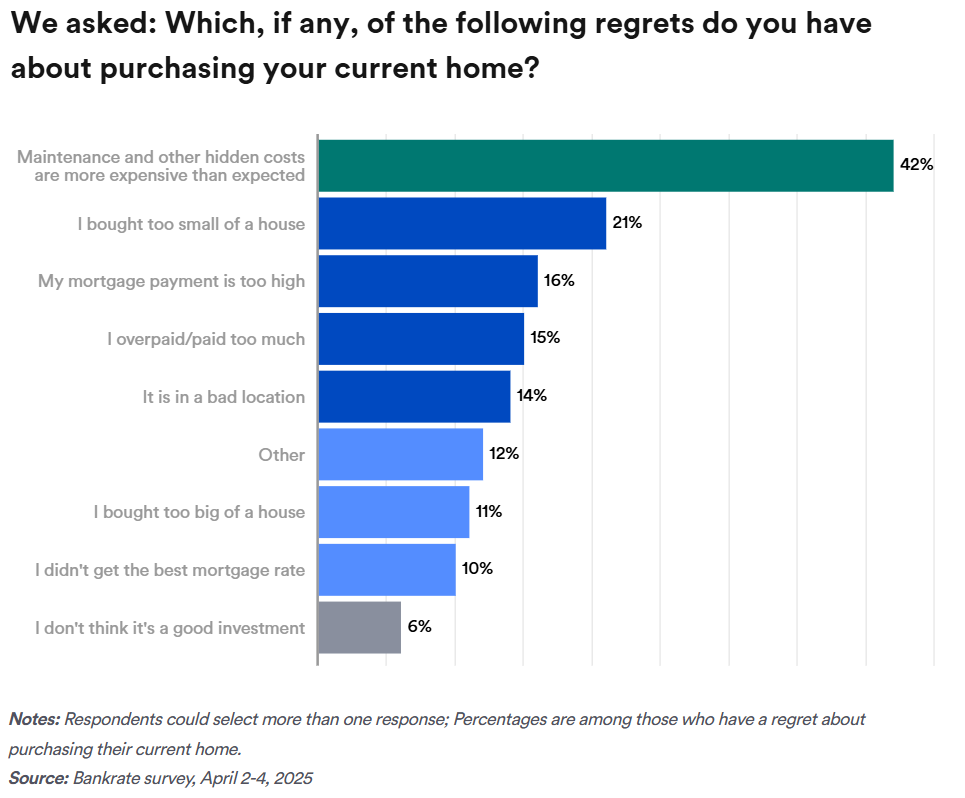

Surprises and Regrets of Homeownership

For those who do buy a home, the financial strain does not end at closing. 40% of homeowners regret underestimating maintenance and hidden costs. Other regrets include:

- 18% bought a home that was too small

- 15% regret their home’s location

- 14% feel they overpaid

- 13% say their mortgage payments are too high

Despite these regrets, 69% of homeowners say they would still buy their current home if given the choice again. Younger homeowners tend to be the most satisfied with their purchases, with 77% of Gen Zers and 76% of millennials saying they would buy again.

Would-Be Buyers Are Willing to Make Sacrifices for Affordability

With housing costs so high, 69% of Americans say they would be willing to make sacrifices to afford a home, as:

- 44% would downsize their living space

- 34% would buy a fixer-upper

- 34% would move out of state

However, 31% of Americans say they are unwilling to make any sacrifices to find affordable housing, particularly older generations like Gen Xers (33%) and baby boomers (40%).

Looking Forward

Homeownership remains a major goal for many Americans, but affordability challenges are making it increasingly difficult. High home prices, elevated mortgage rates, and the struggle to save for a downpayment remain just three of the biggest barriers.

For those determined to buy, there are options available, such as state and local downpayment assistance programs, first-time homebuyer grants, and alternative loan options. While patience may be necessary, smart financial planning can help aspiring homeowners navigate today’s challenging market.

Click here for more on Bankrate’s affordability report.