According to statistics from the April 2025 Builder Application Survey (BAS) of the Mortgage Bankers Association (MBA), mortgage applications for the purchase of new homes rose 5.3% over the previous year while the number of applications rose by 2% from March 2025. Typical seasonal patterns have not been adjusted for in this update.

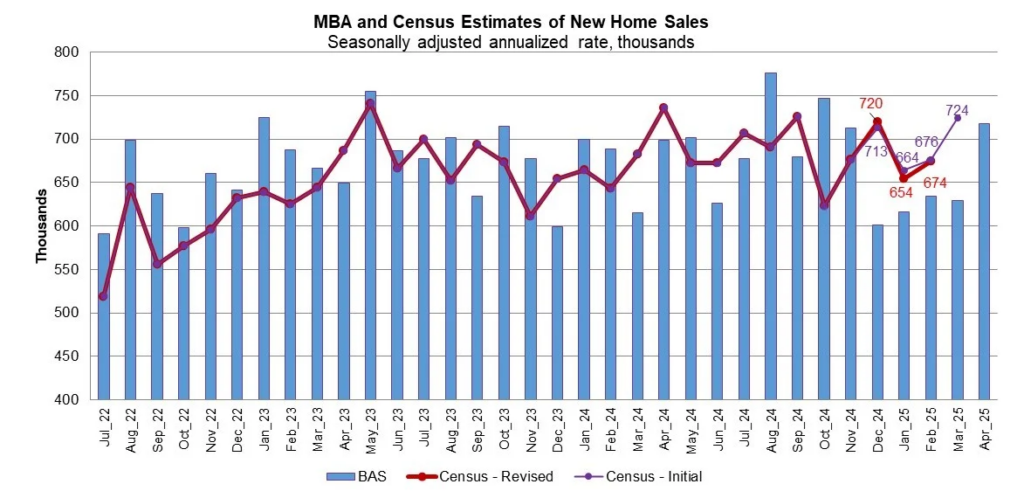

According to MBA, the number of new single-family home sales in April 2025 was 718,000 units, a seasonally adjusted yearly rate that has been a leading indication of the U.S. Census Bureau‘s New Residential Sales report for years. The BAS’s mortgage application data, along with assumptions about market coverage and other variables, are used to calculate the new home sales estimate.

This follows data from March 2025 that indicated mortgage applications for new home purchases rose 5.5% over the previous year. The number of applications rose 14% from February 2025, although typical seasonal patterns were not adjusted for in this update.

Compared to the rate of 634,000 units in February, the seasonally adjusted estimate for March represented a 0.8% decline. According to MBA’s unadjusted estimates, the number of new home sales in March 2025 was 61,000, up 7% from February’s 57,000 sales.

“Despite the ongoing economic uncertainty and mortgage rate volatility, April was a strong month for new home purchase activity, with applications posting an annual gain for the second straight month,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The applications index reached its highest level in the survey’s history dating back to 2012.”

U.S. Highlights — Builder Application Survey (BAS) Data

- In comparison to the pace of 629,000 units in March, the seasonally adjusted estimate for April represents a 14.1% rise.

- According to MBA, the number of new home sales in April 2025 was 65,000, up 6.6% from 61,000 in March on an unadjusted basis.

- Conventional loans accounted for 46.4 percent of loan applications by product type, followed by FHA loans (39.2%), RHS/USDA loans (0.9%), and VA loans (13.5%).

- In March and April, the average loan size for new residences was $381,921 and $376,992, respectively.

“Additionally, MBA’s estimate of new home sales also increased over the month to a 718,000 seasonally adjusted annualized pace, its strongest pace since October 2024,” Kan said. “As the unsold inventory of new homes continues to grow in many parts of the country, reduced buyer competition and pricing pressures supported more buying activity over the month.”

To read more, click here.