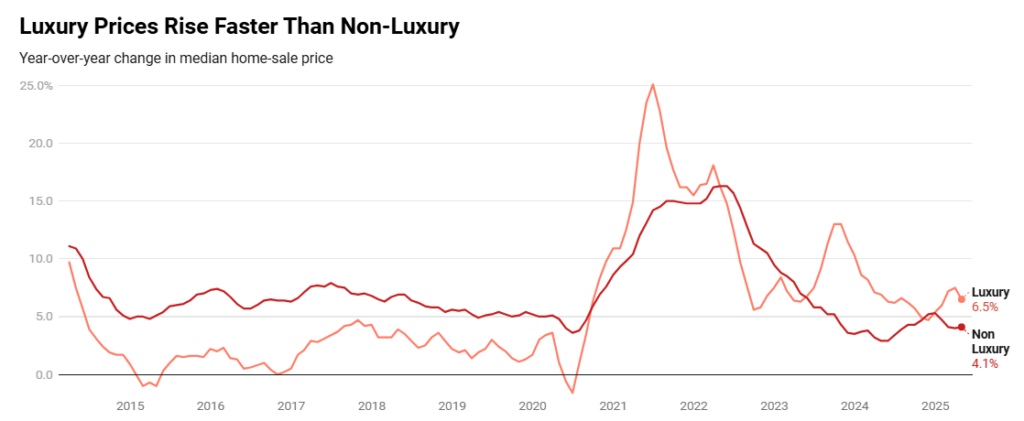

Redfin reports that the typical U.S. luxury home sold for a near-record $1,348,065 in April, up 6.5% year-over-year, as pending sales dropped to the lowest level in over a decade amid economic uncertainty. Non-luxury home prices grew 4.1% to a record high median of $374,598 in April 2025.

Redfin defines luxury homes as those estimated to be in the top 5% of their respective metro area based on prices of homes sold over a rolling 12-month period, and non-luxury homes as those estimated to be in the 35th-65th percentile.

“Many luxury buyers are adopting a wait-and-see approach because of volatility across financial markets and shifting tariff policies,” said Redfin Senior Economist Sheharyar Bokhari. “These high-end buyers often sell stock to help with downpayments, but many pressed pause on their home search when the stock market tumbled in April. As a result, what is usually a fiercely competitive space is cooling.”

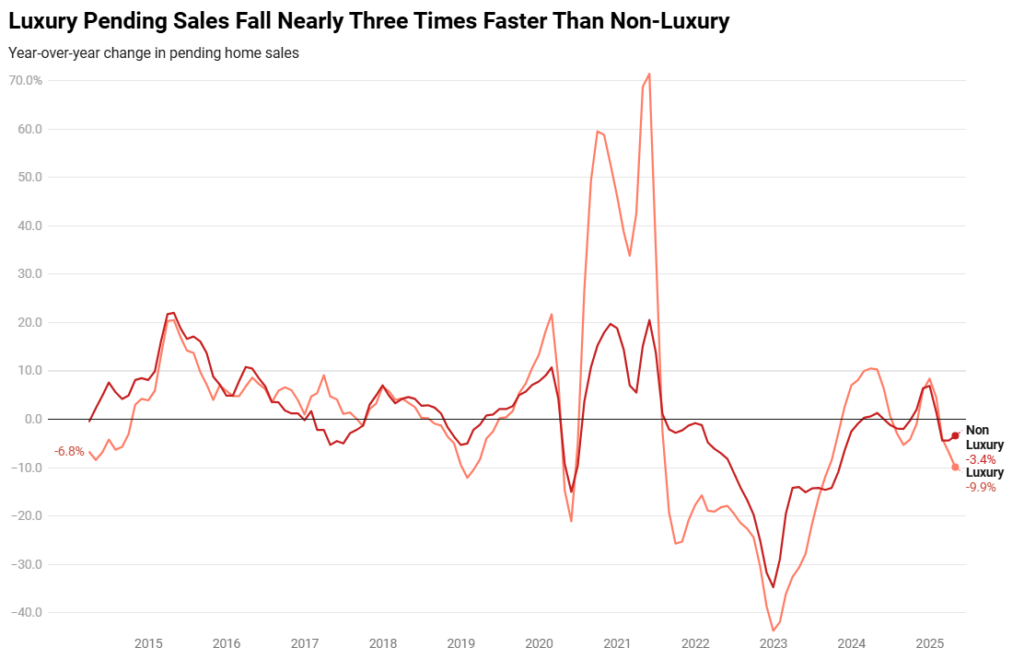

Pending Luxury Sales Drop Nearly 10%

An analysis of April 2025’s pending luxury home sales saw a 9.9% dip year-over-year, the largest annual decline since August 2023 and the lowest level for any April since 2014. Pending sales of non-luxury homes fell 3.4% to hit the lowest April number since 2014. Closed—or finalized—sales fell for both categories in April, with luxury home sales down 6.5%, and non-luxury sales down 4.3%.

“Buyers looking at homes from $1.2 million up are almost non-existent right now,” said Meme Loggins, a Redfin Premier Agent in Portland, Oregon, where luxury sales are down more than 5% year-over-year. “Even in nice areas, high-end homes are selling really, really slow. If I have a buyer who finds the perfect house and is ready to make an offer, they tend to sleep on it for a little, and then they come back to me and say ‘nope, I think we’ll wait and see if the price comes down.’”

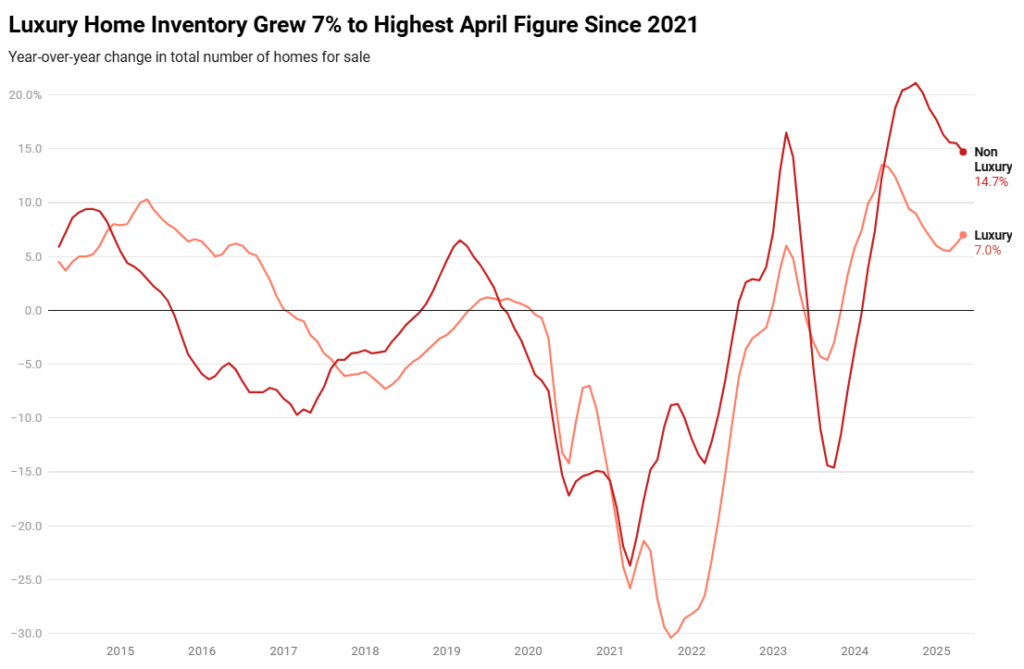

Luxury Home Inventory Soars

With sales impacted, the number of luxury homes on the market grew 7% last month to the highest level for April since 2021. The number of non-luxury homes for sale grew more than twice as fast (14.7%) to reach the highest April level since 2020. The number of new listings of luxury homes increased 7.3%, growing at more than three times the speed of non-luxury homes (2.3%).

The typical luxury home sold in 52 days in April, virtually unchanged from 51 days a year ago. More than one in four (25.3%) luxury homes went under contract within a week in April, a slight 0.4 ppt increase from a year ago. The share that went under contract within two weeks also increased slightly year-over-year, rising to 36.4% from 35.7%.

“Even though luxury sales are down overall, the most desirable homes are still being snapped up relatively quickly,” said Bokhari. “That’s because many wealthy buyers have the means to weather economic uncertainty and make large purchases without overextending themselves.”

In comparison, non-luxury home sales took considerably longer than a year ago, with the median days on market increasing to 45 from 39. The share that went under contract within a week fell 3.5 ppts to 26.1%, while the share going under contract within two weeks fell 4.1 ppts to 38.5%.

April 2025 Metro-Level Luxury Highlights

- Prices: The median sale price of luxury homes rose the most in West Palm Beach, Florida (25.8% increase to $4,132,048); Miami, Florida (22% increase to $4,367,401); and San Jose, California (20.8% increase to $5,508,743). It fell in just two metros: San Francisco, California (-2.2% to $6,092,801); and Sacramento, California (-1.1% to $1,659,264)—while Kansas City was flat.

- Sales: Luxury home sales increased most in San Francisco, California (18.3%); Los Angeles, California (18.3%); and Indianapolis, Indiana (13.2%). Luxury home sales decreased most in Jacksonville, Florida (-27.6%); Fort Lauderdale, Florida (-26.7%); and Detroit, Michigan (-25.6%).

- Active listings: The total number of luxury homes for sale increased most in San Antonio, Texas (21%); Fort Worth, Texas (20.7%); and Las Vegas, Nevada (20.6%). Total inventory fell the most in Philadelphia, Pennsylvania (-18.2%); Chicago, Illinois (-16.4%); and Pittsburgh, Pennsylvania (-14.1%).

- New listings: New listings of luxury homes increased most in Indianapolis, Indiana (28.7%); San Antonio, Texas (28%); and Sacramento, California (22.3%). New listings fell in 14 metros, with the biggest declines reported in Warren, Michigan (-17.7%); San Jose, California (-14.9%); and Jacksonville, Florida (-12.3%).

- Speed of sales: Luxury homes sold the quickest in Seattle with a median of five days, ahead of San Jose, California (10 days), and then Oakland, California and Detroit, Michigan (11 days). Luxury homes sold slowest in Miami, Florida (125 days); Fort Lauderdale, Florida (112 days); and Nashville, Tennessee (97 days).

Click here for more on Redfin’s report on the nation’s luxury home sales in April 2025.