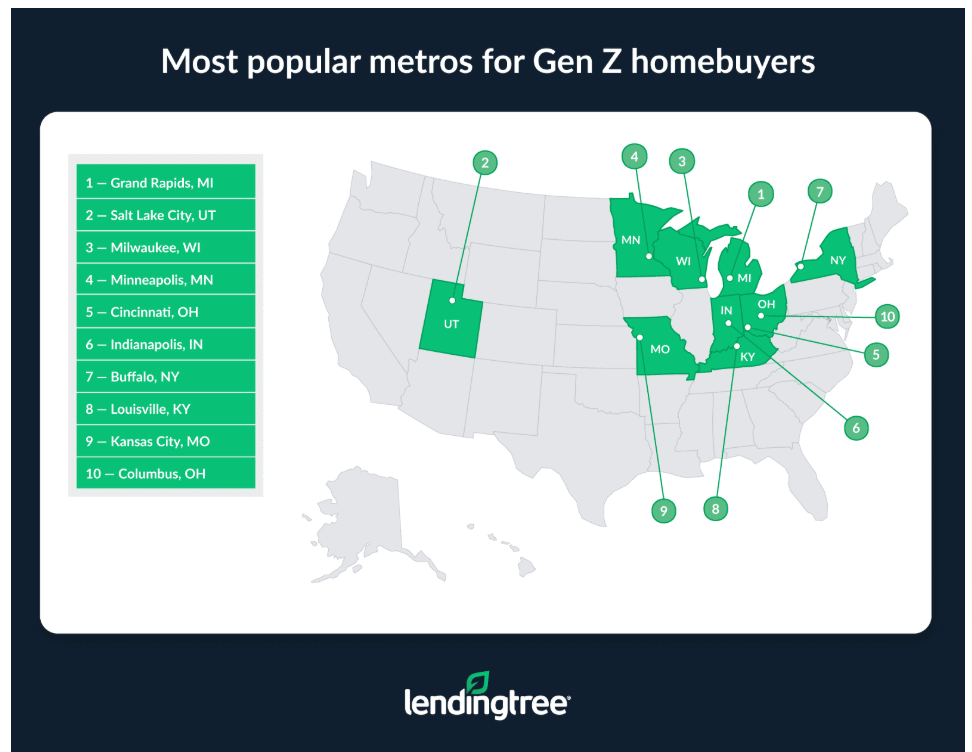

A new LendingTree study analyzing mortgage applications in the nation’s 50 largest metro areas has found that Gen Z homebuyers—defined in the analysis as those ages 18 to 27—are most active in the Midwest. In 2024, Grand Rapids, Michigan topped the list with 31.45% of mortgage requests coming from Gen Z applicants.

Following closely behind Grand Rapids were Salt Lake City, Utah (24.79%); and Milwaukee, Wisconsin (24.33%). Other metros in the top 10 included Minneapolis, Cincinnati, Indianapolis, Buffalo, Louisville, Kansas City, and Columbus—highlighting a consistent trend of affordability-focused migration among younger buyers.

“Grand Rapids and Milwaukee are relatively average cost-of-living areas where homeownership may not be out of the question for younger people,” said Matt Schulz, LendingTree’s Chief Consumer Finance Analyst. He also noted that Salt Lake City’s “thriving tech scene and booming economy” have contributed to higher-paying job opportunities for younger workers.

LendingTree’s findings align with previous Redfin analyses, which ranked several Midwest metros—such as Detroit, Cleveland, and Dayton—as some of the most affordable housing markets in the country.

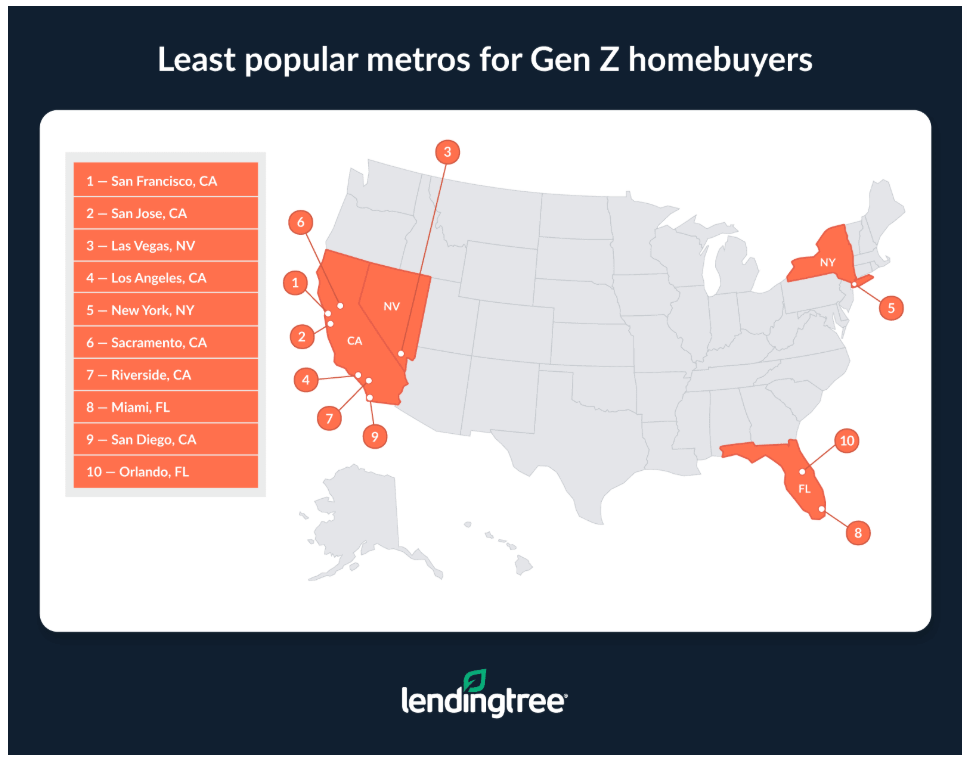

Conversely, metro areas with the lowest share of Gen Z mortgage applicants were primarily in California and other high-cost regions. San Francisco ranked last, with just 9.68% of mortgage requests from Gen Z buyers. Other low-ranking cities included San Jose (11.31%), Las Vegas (12.07%), Los Angeles (13.17%), and New York City (13.54%).

This generational affordability gap is compounded by skyrocketing housing costs. According to recent Realtor.com data, buyers now need to earn $47,000 more annually than they did six years ago just to afford a home at the median U.S. listing price. In cities like San Jose, the required income exceeds $370,000 per year.

“The cost of buying a house is just so high that many young people see it as a pipe dream,” Schulz said.

Click here for a full list of metro areas ranked by the share of Gen Z mortgage applications analyzed by LendingTree.com.