A new study from MortgageResearch.com reveals a sobering reality for the Class of 2025: the average college graduate won’t be able to afford a home until April 2034—nearly a full decade after graduation.

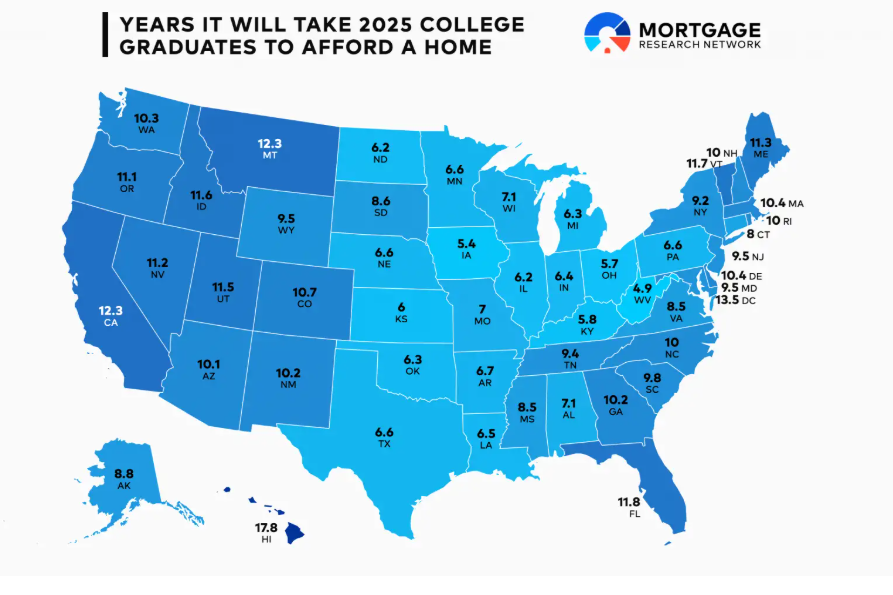

The analysis estimates how long it would take new graduates in each state to save for a 10% down payment, factoring in starting salaries, average home prices, and student loan payments. While the national average timeline is just under 10 years, the study shows wide state-by-state disparities.

In West Virginia, where average home prices are low and grads earn modest salaries, the average timeline is 4.9 years, with homeownership possible by April 2030. In Hawaii, where the typical down payment surpasses $98,000, homeownership could be delayed until February 2043—nearly 18 years after graduation.

“These numbers highlight how geography influences the path to homeownership for first-time buyers,” said Tim Lucas, Lead Analyst at MortgageResearch.com. “Where you land your first job and choose to live can be just as important as your degree.”

The study assumes graduates earn an average of $64,598 annually and contribute 13.8% of gross income toward student loans and a future down payment—nearly three times the national savings rate. After paying a typical $410 monthly student loan, graduates are left with $333 per month for down payment savings.

Without student debt, the average graduate could buy a home by August 2029. But with debt, the timeline is pushed to April 2034—a delay of four years and eight months.

Even in more affordable states, student loans erode buying power. In Mississippi, where homes average $180,641, the average graduate earns only $52,266, leaving just $177 per month after student loan payments. That puts the homeownership date at October 2033.

In Washington, D.C., graduates earn the highest starting salaries at $79,235, but face steep home prices and large loan balances. As a result, their expected home purchase is delayed until October 2038.

Despite the long wait, the study points to zero-down loans, low-down-payment programs, seller concessions, and graduation gifts as ways for new buyers to accelerate their timeline.

“The housing market is the toughest it’s been for first-time buyers since the 1980s,” Lucas added. “But if new graduates continue their learning about the housing market and available programs, they can close the gap faster.”

Click here for more on MortgageResearch.com’s analysis of graduates and homeownership.