In a housing market notoriously known for low inventory, homeowners in seemingly stable markets are facing unexpected challenges: diminishing property values, and difficulties selling their homes. Not because of location, but because of insurance availability, and cost.

Cotality’s 2025 Hurricane Risk Report examines the growing financial and social costs of increasing hurricane risk, with special attention to areas of the U.S. that are not as prepared to weather the storms. The 2025 hurricane season is set to begin June 1, 2025, and run through November 30, 2025.

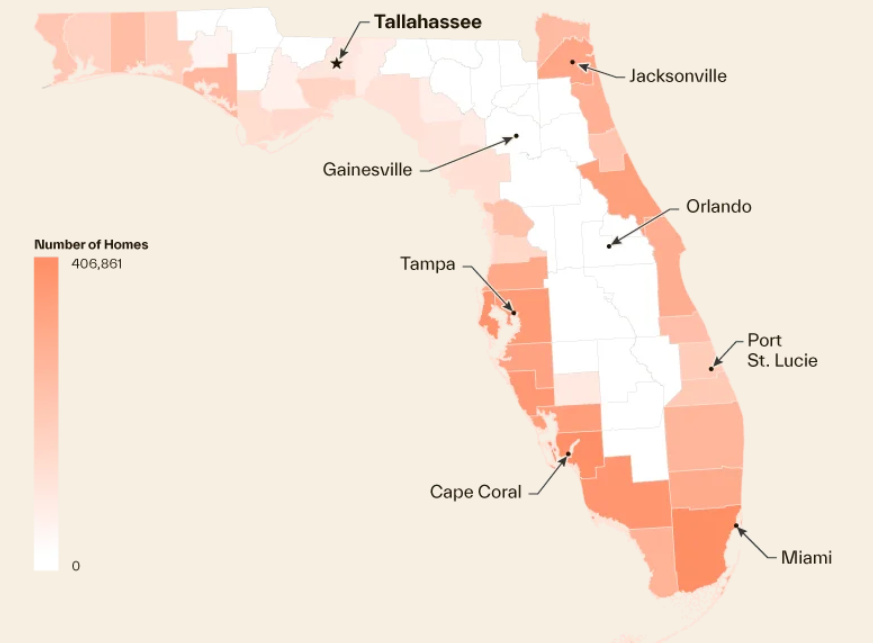

Nationally, Cotality identified more than 33.1 million residential properties, from Texas to Maine, with a combined reconstruction cost value (RCV) of $11.7 trillion at moderate or greater risk of sustaining damage from hurricane-force winds. Focusing on storm surge flood risk, Cotality has identified more than 6.4 million residential properties with a combined RCV of $2.2 trillion at moderate or greater risk of sustaining damage from storm surge flooding.

“Our data shows that the coastline is evolving, with the impacts of hurricanes extending not only further—both in cost and distance—but also on a more consistent basis,” said Maiclaire Bolton-Smith, VP of Insurance Product Marketing at Cotality. “This is being reflected in insurance pricing, which in some cases can actually price people out of what had previously been thought of as less-risky markets.”

While each hurricane season is different, on average, two hurricanes make direct landfall each year, demonstrating that the risk is not just real, but is impacting how long homes stay on the market.

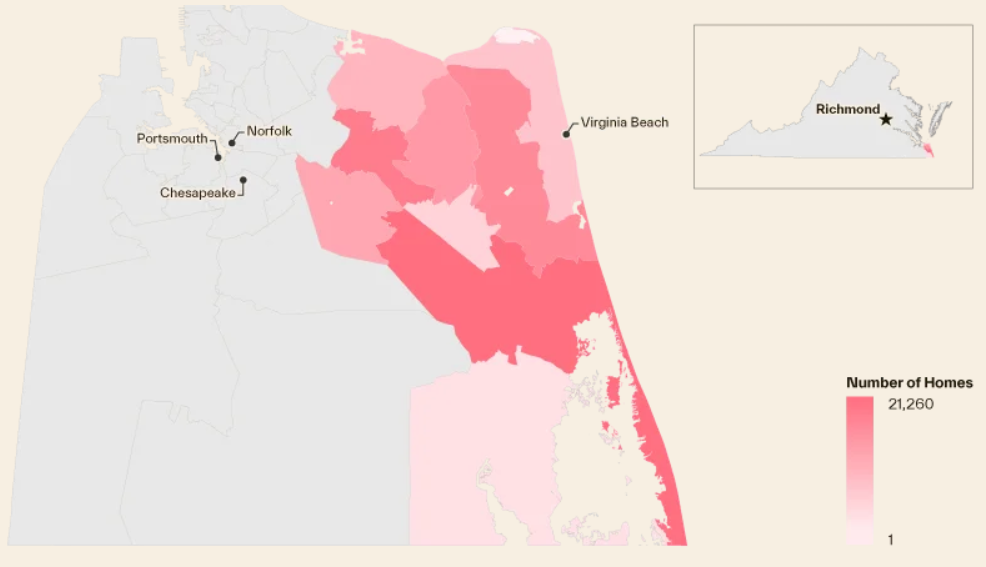

Cotality’s report Illustrates, for example, that more than 656,000 homes in Charleston, South Carolina; Wilmington, North Carolina; and Virginia Beach, Virginia are at risk of storm surge flooding if a hurricane makes direct landfall. Additionally, Cotality data shows homes in Virginia Beach, Virginia remained on the market 32% longer in 2025 than in early 2024, while homes in Wilmington, North Carolina remained on the market 19% longer during the same time period.

Communities from Port Isabel, Texas to Bar Harbor, Maine are faced with flood and wind risk that threaten both home values and security. With hurricane risk intensifying and coverage retreating, the question is not if other communities will feel the effects … it is a matter of where and when.

According to the National Hurricane Center, there were five $1 billion hurricane events in 2024, with an estimated $124 billion in damage, making it the third costliest hurricane season in the past quarter century, behind the $339.2 billion year of 2017, which produced Hurricanes Harvey, Irma, and Maria, and the $264.7 billion year of 2005, when Hurricane Katrina made landfall in the U.S.

In remarks at a recent House Rules Committee hearing, Rep. Jared Moskowitz of Florida was concerned that the Federal Emergency Management Agency (FEMA) may not be ready if disaster strikes. Rep. Moskowitz said budget cuts by the Department of Government Efficiency (DOGE) have made FEMA inefficient, and these cuts may risk sending hurricane-prone states into bankruptcy if they are denied federal aid when a storm strikes.

“Remember that ‘DOGE?’ Remember the ‘E’ at the end of DOGE? The word ‘efficiency?,’” Rep. Moskowitz asked at the House Rules Committee hearing. “Nothing at FEMA has been made more efficient. In fact, I would tell you that the secretary of Homeland Security has turned FEMA into the Newark Airport, OK? It is going to fail this summer.”

In March, Rep. Moskowitz introduced the FEMA Independence Act, a bipartisan bill with Rep. Byron Donalds of Florida to restore FEMA’s status as an independent, Cabinet-level agency reporting directly to the President. The bill would also require that FEMA’s Senate-confirmed leader have “a demonstrated ability in and knowledge of emergency management and homeland security” across the public and private sectors. Under the bill, FEMA would still carry out all responsibilities given to it prior to the enactment of the FEMA Independence Act, including under the Stafford Act.

“FEMA can’t be eliminated. Period! But we can save it by reforming it. These commonsense proposals—my FEMA Independence Act and my new legislation to expand FEMA’s block grant programs—will cut red tape, make disaster recovery more efficient, and help FEMA better deliver for the American people,” said Rep. Moskowitz. “I look forward to working with my colleagues to advance these reforms and ensure FEMA and the critical assistance it provides are there when our communities need it.”

Before entering Congress, Rep. Moskowitz served as Florida’s Director of Emergency Management from 2019-2021, where he oversaw disaster response and recovery for the DeSantis Administration for major events like the COVID-19 pandemic and the Category 5 Hurricane Michael.

“While the challenges facing coastal real estate markets are serious, they are not insurmountable. Insurance premiums, lending decisions, property values, and real estate trends are all influenced by risk, but that also means they can be managed with the right information,” Bolton-Smith said. “Insurability remains a challenge, but as technology continues to advance modeling capabilities, there is reason to be optimistic.”

The report also examines the impact of migration patterns on the Florida markets, leveraging past hurricanes to demonstrate the need to assess risk properly and invest in resilience measures.

Click here for more on Cotality’s 2025 Hurricane Risk Report.