With economic changes looming, new data found that investors are taking up more of the homebuying pie in the U.S. housing market. According to Realtor.com‘s lnvestor Report, investor selling hit a record high as market dynamics shifted in 2024, even while investor purchases increased.

Investors bought 13.0% of properties nationwide in 2024, a modest rise from 2023 but still less than the 13.3% peak from 2022. A decline in overall home sales contributed to this increase, suggesting that investors are becoming more prevalent in a smaller market.

Investors made up 10.8% of sellers in 2024, the largest percentage ever recorded, up from 10.1% in 2023. The lowest margin between investor purchasing and selling since 2019 was the outcome of this change, indicating a smaller net effect of investor demand on total supply.

“Investor trends signal a transition,” said Danielle Hale, Chief Economist at Realtor.com. “Nationwide, investors picked up more homes on net in 2024, as smaller investors were a growing majority of investor buyers. But with investor selling at a new high, the market saw the smallest net investor buying activity in five years, lessening one of the notable headwinds for entry-level buyers who often compete with investors.”

Investor Activity Differs Significantly by Region

Regional differences in investor activity were notable. The largest shares of investor buyers were in Missouri (21.2%), Oklahoma (18.7%), and Kansas (18.4%), while the largest shares of investor sellers were in Oklahoma (16.7%), Georgia (15.9%), and Missouri (16.7%).

California, Minnesota, and Oregon had the highest net-positive influence on supply (more sellers than buyers), while Hawaii, Montana, and Washington, D.C., had the largest net-negative impact (more buyers than sellers).

Top 10 States with the Highest Share of Investor Buyers

| U.S. State | Investor Buyers (2024 Share) | YoY |

| Missouri | 21.2% | 0.3% |

| Oklahoma | 18.7% | 0.2% |

| Kansas | 18.4% | 1% |

| Utah | 18% | 0.3% |

| Georgia | 17.3% | 1.2% |

| Montana | 17.2% | -0.1% |

| Mississippi | 16.7% | -1.1% |

| Wyoming | 16.3% | 0.9% |

| Indiana | 16.1% | 0.6% |

| Alabama | 15.9% | 0.8% |

Mississippi, Nevada, and South Dakota saw the biggest increases in investor selling, while Delaware, Ohio, and Washington, D.C., saw the biggest increases in investor buying share when compared to 2023.

The cities with the largest investor buyer shares among the 150 largest U.S. metro areas were Springfield, MO; Memphis, TN; and Wichita, KS. In terms of investor seller share, Memphis, TN; Oklahoma City; and Springfield, MO; were in the front.

Investors contributed the most supply in Sacramento, CA; Minneapolis; and Portland, OR; while they most dramatically increased demand in Miami, Pittsburgh, and New York.

Although for different reasons, investors in Miami, Pittsburgh, and New York City experienced the largest negative proportional impact in 2024. Miami saw a decline in investor buyer, investor seller, and total transactions in 2024, indicating that the overall slowing market is the cause of the net-negative impact of investors in Miami.

Pittsburgh’s robust housing market is demonstrated by the growth in investor buyer, investor seller, and total transactions. Perhaps as a result of high housing costs, which might damage traditional buyers while opening doors for investors, the total amount of transactions in New York City decreased but investor, seller, and buyer activity increased. In these markets, investors generally purchased more homes than they sold, which reduced the number of available properties for traditional buyers.

Top 10 Metros with the Highest Share of Negative Investor Impact

| Metro | 2024 Net Investor Impact |

| Miami-Fort Lauderdale-West Palm Beach, FL | -5.7% |

| Pittsburgh | -5.1% |

| New York-Newark-Jersey City, NY-NJ | -4.4% |

| St. Louis, MO-IL | -4.3% |

| Hartford-West Hartford-East Hartford, CT | -3.9% |

| Kansas City, MO-KS | -3.7% |

| Austin-Round Rock-San Marcos, TX | -3.6% |

| Tampa-St. Petersburg-Clearwater, FL | -3.5% |

| Birmingham, AL | -3.4% |

| Cleveland | -3.3% |

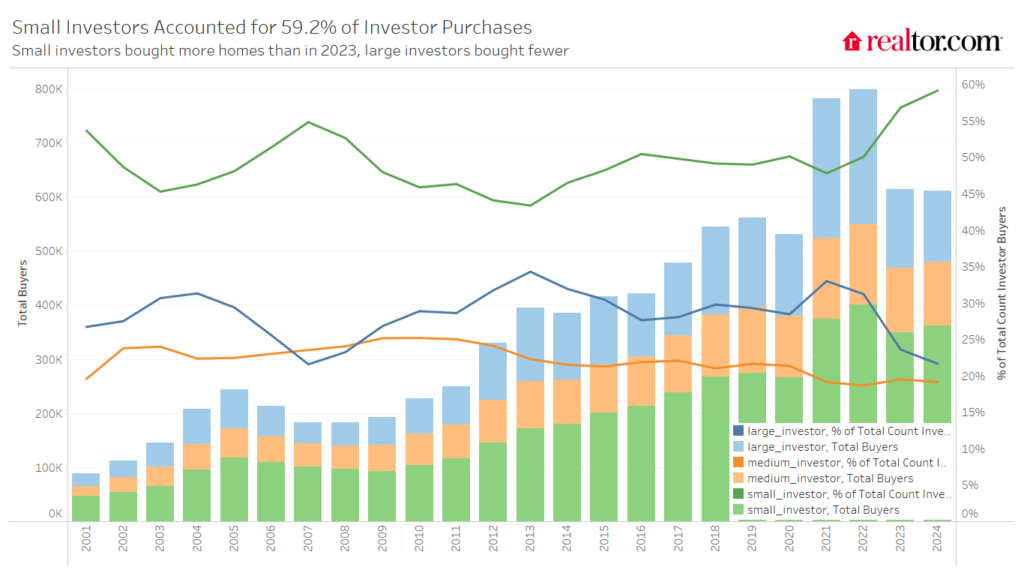

The rising dominance of small investors was a noteworthy feature in the 2024 data. Some 59.2% of investor purchases were made by small investors, which are defined as entities that have bought fewer than ten residences. This is the greatest percentage in the history of the data. Large investor activity, which includes companies that have bought 50 or more properties, on the other hand, decreased to 21.7% of acquisitions, the lowest level since 2007. In 2024, small investors bought 361,900 homes, up 3.7% from the previous year, while large investors bought 132,500 homes, the fewest since 2018.

In 2024, investors were more likely to use debt, even while all-cash sales increased in the broader housing market. While still accounting for roughly twice the cash proportion of all home purchases, all-cash investor sales dropped to their lowest level since 2008. From its peak of 65.6% in 2023 to 62.0% in 2024, the cash purchase share for small investors fell to its lowest level since 2008. In 2024, the major investor cash-buy share dropped to its lowest level since 2015, from 73.2% in 2023 to an estimated 68.9%.

Montana, Oklahoma, Utah, Delaware, Idaho, and Wyoming have had the most increases in investor purchases as compared to pre-pandemic (2019). The epidemic caused a population boom in many West region markets, alerting investors to the possibility of profiting from rising home demand.

In the same states, however, investor buyer and seller activity is still on the go. Investor activity is highly concentrated in some areas, as evidenced by the similarity between the top states for investor sales and the top states for investor buyers. In 2024, the states with the most percentage of investor sales were Oklahoma, Missouri, Georgia, Nevada, and Utah.

Top 10 States with the Highest Share of Investor Purchase Growth

| Average Share of Investor Buyers | |||

| U.S. State | 2019 | 2024 | vs. 2019 |

| Montana | 10.9% | 17.2% | 6.3% |

| Oklahoma | 13% | 18.7% | 5.7% |

| Utah | 12.6% | 18% | 5.4% |

| Delaware | 9% | 14.3% | 5.3% |

| Wyoming | 11.4% | 16.3% | 4.9% |

| Idaho | 8.9% | 13.8% | 4.9% |

| Kansas | 13.6% | 18.4% | 4.8% |

| Ohio | 10.2% | 14.7% | 4.5% |

| Alabama | 11.8% | 15.9% | 4.1% |

| Massachusetts | 4% | 8.1% | 4.1% |

It’s fascinating to examine the net effect of investor activity, which is calculated by dividing the total number of transactions in a state in 2024 by the number of properties sold by investors minus the number they bought. This is because states that are popular for investor buys are also popular for sellers. Investor activity had the biggest detrimental effect on housing supply in the following markets:

- Hawaii

- Montana

- Washington, DC

- Missouri

- Wyoming

On the other hand, certain markets experienced a net increase in investor activity. In other words, by selling, investors contributed a net amount to the home supply. Investors had the biggest positive impact in California, Minnesota, Oregon, and Nevada, where they sold more properties than they purchased.

As a percentage of home purchases, investor purchasing activity is generally still increasing. While overall home sales declined 5.4% in the first two months of the year, investors bought 0.9% fewer properties than they did in the same period last year. Thus, from 14.3% in the first two months of 2024 to 15% thus far in 2025, the investor buying share increased.

As investors sold 6.2% fewer properties than they did a year earlier, investor selling activity decreased from 12% of sales to 11.9%. Buyer activity is still being constrained by persistently high mortgage rates and housing prices, which may indicate that investors’ proportion of purchasers will continue to rise.

Trends in investor activity are somewhat at risk due to widespread economic uncertainty. In general, though, investors are expected to keep making investments in places with high housing demand and reasonably priced properties. Although national rents are still declining, a decline in building may result in a future rental inventory shortage, which would present an opportunity for investors to take advantage of surplus demand for rental properties.

To read more, click here.