Homebuyers facing today’s near-7% mortgage rates can still unlock major savings if they take the time to shop around. According to a LendingTree report analyzing more than 80,000 mortgage requests in early 2025, borrowers can save an average of $80,024 over the life of a 30-year fixed-rate mortgage by choosing the best offer available.

That translates to $222 in monthly savings, or $2,667 annually. It is a jump from last year’s average savings of $76,410—$3,614 less than what borrowers could save now.

“Shopping around between different lenders is important for homebuyers,” said Hannah Jones, Senior Economic Research Analyst at Realtor.com. “A recent analysis found that shopping around can save homebuyers as much as 86 basis points on their mortgage loan.”

LendingTree’s analysis included users who received two or more offers for 30-year, fixed-rate loans between Jan. 1 and April 30, 2025. By comparing the lowest and highest APRs offered in each state, they estimated monthly and long-term savings based on the average mortgage amount requested in each location.

Nationwide, the average APR spread is 0.99 basis points, with variations depending on the state. Minnesota had the largest gap at 1.15 basis points, while New York and Louisiana had the narrowest at 0.73 points.

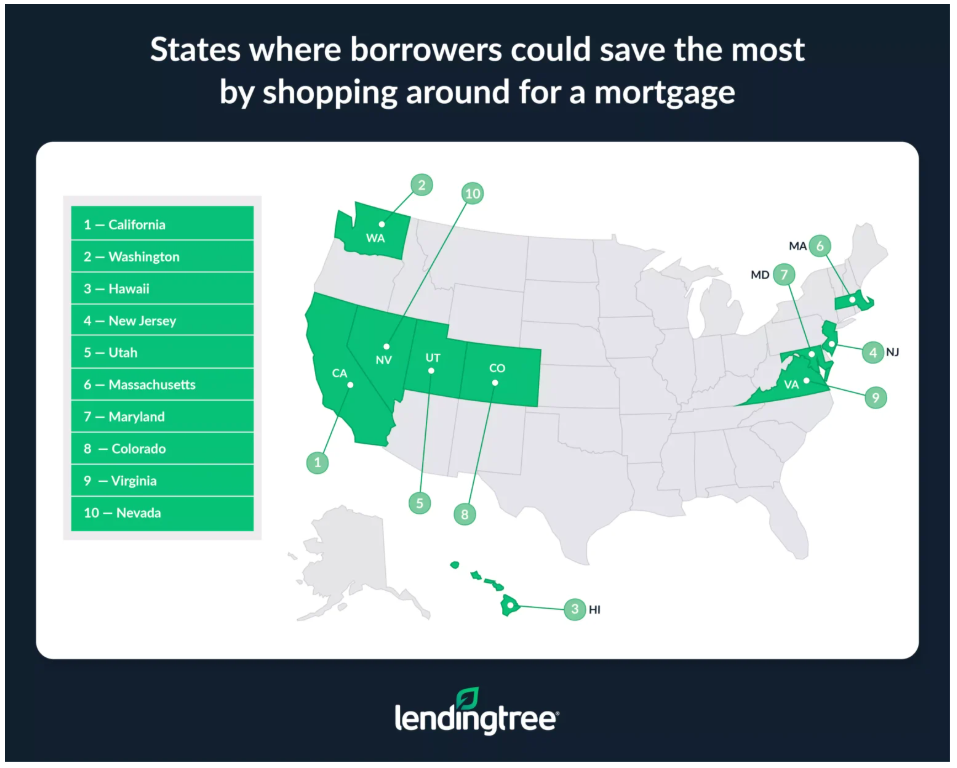

Borrowers in California, Washington, and Hawaii stand to save the most due to higher average mortgage requests:

- California: $510,776 average mortgage or $118,393 in lifetime savings

- Washington: $437,948 or $109,012 in lifetime savings

- Hawaii: $506,980 or $105,473 in lifetime savings

In seven states, potential long-term savings exceed $100,000 when securing the best mortgage rate.

Different lenders can offer different rates due to factors like borrower attributes, debt-to-income ratio, operating costs, local competition, and risk models. “These are just a few reasons why rate quotes could differ,” Jones explained.

Even with high mortgage rates and a national median home price of $440,000, securing the right loan can significantly affect total costs. Listings are also spending more time on the market—a median of 51 days, according to Realtor.com’s May Housing Market Trends Report—offering buyers more time to compare offers.

Ultimately, fixed-rate mortgages continue to offer budget certainty. “Borrowers know that they will pay the same rate across the entire lifetime of the loan,” said Jones, which can help with budgeting in the long run.

Click here for more on LendingTree’s study on mortgage savings.