A new report revealed that U.S. Financial Technology, LLC (U.S. Fin Tech) was established by Fannie Mae and Freddie Mac (the Enterprises) to replace Common Securitization Solutions (CSS), their jointly owned heritage business. The name U.S. Fin Tech more accurately captures its vital role in offering businesses cutting-edge, creative technology and business solutions.

CSS, currently officially known as U.S. Financial Technology LLC, is a Delaware-based business that is governed by the Federal Housing Finance Agency (FHFA) and co-owned by Freddie Mac and Fannie Mae.

“We are excited to have a name that demonstrates that we are leading the United States and the world in financial services technology,” said Tony Renzi, CEO of U.S. Fin Tech.

Renzi was named CEO of CSS in 2019 and is still in charge of the renamed business.

U.S. Fin Tech Provides MBS Securitization Services for Mortgage Giants

In addition to positioning U.S. Fin Tech for future opportunities to add value and provide industry-leading capabilities for its current and potential clients, this transition reinforces the company’s goal to assist U.S. Housing by guaranteeing liquidity, safety, and soundness in the market.

“We created U.S. Fin Tech to demonstrate the incredible ingenuity of American technology under President Trump’s leadership,” said Director William J. Pulte, U.S. Federal Housing FHFA and Chairman of Fannie Mae and Freddie Mac.

Trump is interested in taking the businesses public and may “sell a small piece” in the process, according to Pulte, who was appointed to lead the agency that oversees Fannie and Freddie.

With its cloud-based platform offering “unrivaled layered security architecture and traceability capabilities,” CSS, a geographically distributed, a totally virtual firm since 2020, claims to offer “business continuity with full disaster recovery and zero data loss within 4 hours.”

CSS “meets the challenges of the market, such as data management, processing, and speed of execution, to bridge the gap between the secondary mortgage market and investors,” the company said.

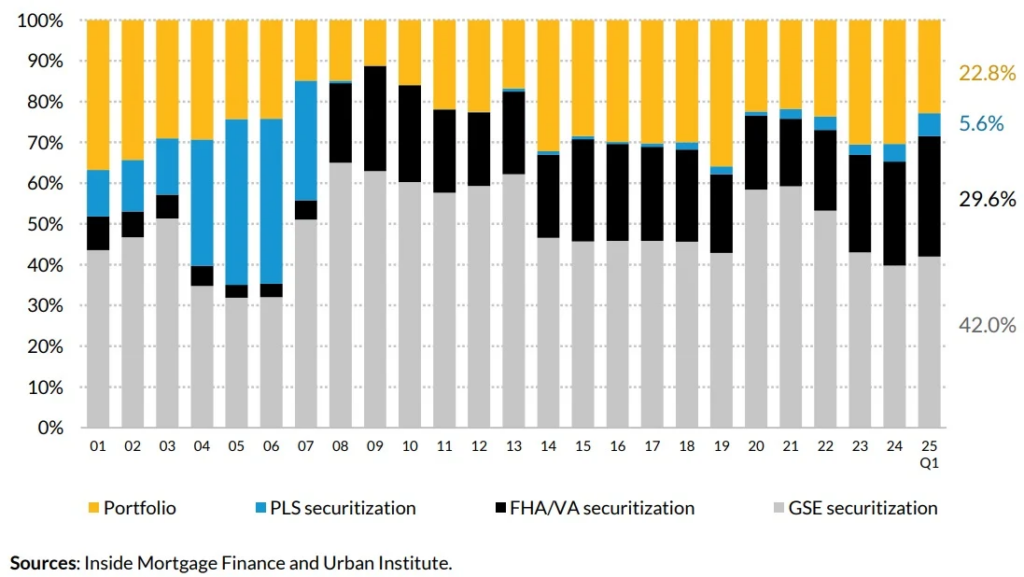

According to data provided by Inside Mortgage Finance and the Urban Institute, some 42% of the $355 billion in mortgages created in Q1of 2025 were packaged up into MBS for sale to investors by the government-sponsored enterprises, or GSEs, Fannie and Freddie.

Ginnie Mae-backed FHA and VA loan securitizations accounted for nearly 30% of Q1 2025 originations, while lenders that retained them in their portfolios made up 23%. Despite being up 24% from the previous year to $20 billion, securitizations of private-label securities (PLS) that did not have the support of Fannie Mae, Freddie Mac, or Ginnie Mae accounted for less than 6% of first-lien mortgage originations in the first quarter of 2025.

When lenders utilized PLS securitizations to finance subprime mortgages at the turn of the century, they flourished. However, with the Great Recession and the housing meltdown of 2007–2009, they disappeared for nearly ten years. The Trump administration is looking into ways to restructure Fannie and Freddie, which were placed in government conservatorship in 2008 as their losses grew.

“We created U.S. Fin Tech to demonstrate the incredible ingenuity of American technology under President Trump’s leadership,” Pulte said in a statement.

Pulte gave the mortgage behemoths instructions on Wednesday to think about letting borrowers count cryptocurrency as an asset without having to exchange their holdings for US dollars.

To read more, click here.