The highest mortgage rates in this century are wearing down American homeowners and prospective homebuyers, according to a new report from TheStreet.

With ongoing government changes and looming economic uncertainty, the housing market is stagnant, with 30-year fixed mortgages at 6.77% as of June 26. There are no buyers, no sellers, and behind new development, a crucial economic indicator.

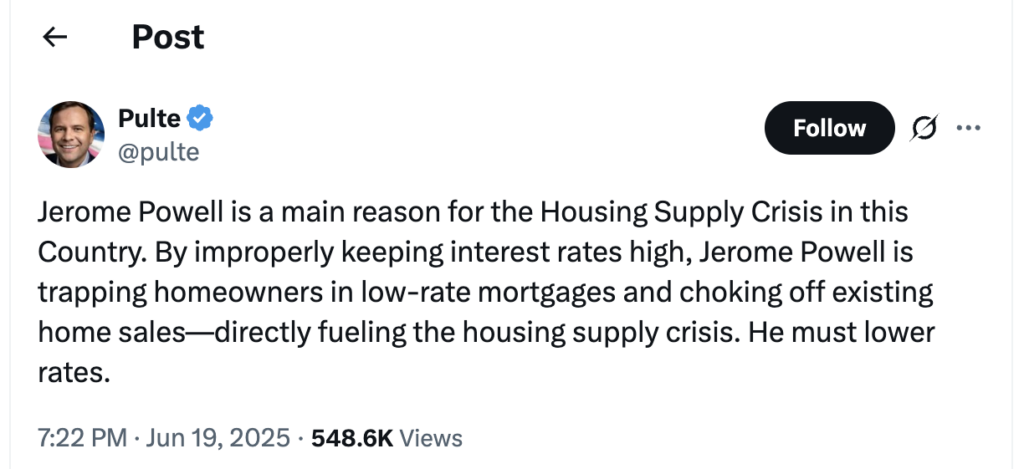

Following in the footsteps of his employer, President Donald Trump, U.S. Housing FHFA Director William J. Pulte places the full burden on Federal Reserve Chairman Jerome Powell.

This week, Pulte intensified his criticism of Powell, first demanding his resignation and then personally scolding him on June 27.

In an interview with CNBC on June 27, Pulte stated that mortgage rates would decrease if interest rates did. Pulte remarked that Powell “can hallucinate about what tariffs can do,” but that he is incorrect.

“Jerome Powell is a main reason for the Housing Supply Crisis in this Country,” Pulte wrote in a a post on X. “By improperly keeping interest rates high, Jerome Powell is trapping homeowners in low-rate mortgages and choking off existing home sales—directly fueling the housing supply crisis. He must lower rates.”

According to Pulte, the housing crisis is harming all sizes of construction enterprises. He noted that publicly traded builders are not exempt.

“For this reason, we need the ‘Fake High Priest of the Fed’ to lower rates,” Pulte said. “The American people are sick and tired.”

At a June 27 press conference in the White House Briefing Room, President Trump reiterated his disapproval of high interest rates and described Powell as “just not a very smart person.” The Fed will meet again on July 29–30.

First-Time Buyers “Get the Short End of the Stick”

Due to supply limitations that have pushed up property prices, the current U.S. housing market is particularly harsh for first-time homebuyers who can hardly afford down payments.

A new home’s median price increased from $310,000 in 2020 to over $407,000 in April. Additionally, according to Bankrate, the average mortgage payment doubled to $2,207 in 2024, making it difficult for first-time homebuyers to keep up.

Privately-owned housing starts in May were at a seasonally adjusted rate of 1,256,000. This is 9.8% below the revised April estimate. The Northeast, South, and Midwest saw declines, while the West saw an increase.

In order to keep the recession-free economy and its GDP thriving, the Fed’s twin purpose is to prudently oversee monetary policy in order to keep unemployment low and inflation at around 2%. The balance is delicate.

The Federal Funds Rate, which banks charge one another overnight to borrow money, is set by the Federal Open Meeting Committee. The funds rate remained between 4.25% and 4.50% at the June meeting. In December 2024, the funding rate was last lowered. However, the cost of borrowing money for businesses, investors, and consumers is correlated with the funds rate.

The yield on the 10-year Treasury note is heavily influenced by the Fed Funds Rate, and mortgage rates are normally 2% to 3% higher than the 10-year yield. Consequently, 30-year mortgage rates increased from 2.7% in early 2021 to almost 6.8%. Between 2020 and 2024, the average mortgage payment also doubled to $2,207.

Fed Chair Powell Chimes In

Given that unemployment is at an all-time low and that the economy is still predicted to grow by 3% this quarter despite some concerning indicators.

“The effects on inflation could be short-lived—reflecting a one-time shift in the price level. It is also possible that the inflationary effects could instead be more persistent,” said Powell after holding rates steady on June 18. “Avoiding that outcome will depend on the size of the tariff effects, on how long it takes for them to pass through fully into prices, and, ultimately, on keeping longer-term inflation expectations well anchored.”

Powell stated at the June Fed meeting that although the post-pandemic economy was robust and stable, a “wait-and-see” approach to maintaining rates was necessary due to the possibility of tariff inflation on the costs of the country’s supply chain.

Last week, he reiterated those claims to panels in the House and the Senate, adding that the anticipated inflation brought on by the tariffs will probably cause an uptick in June and July economic indices. The deadline for President Trump’s planned tariffs is July 9.

The next likely rate decrease was predicted by the Fed and market observers to occur during the central bank’s September FOMC meeting.