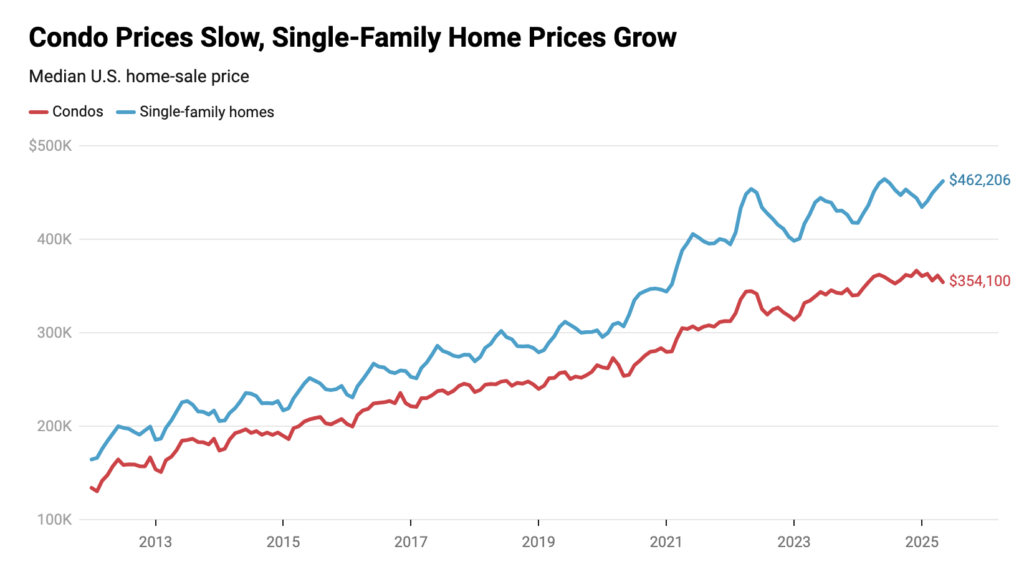

In May, the median condo sale price in the U.S. dropped 2.2% year-over-year (YoY) to $354,100, the second-largest decline since 2012—according to a recent Redfin report. Condo prices only had a greater year-over-year fall in April 2023 (-2.9%), and that was mostly due to the fact that prices peaked around a year earlier (this was true for all property categories).

Because there are currently over 80% more condo sellers than buyers in the market, condo prices are declining. Due to rising insurance and HOA dues, as well as certain homeowners’ organizations imposing high special assessments, many condo owners are attempting to sell their units. For the same reasons, many homebuyers are reluctant to buy a condo.

“It’s a slow housing market across the board, but condos have been hit particularly hard,” said Aditi Jain, a Redfin Premier real estate agent in the Boston area. “A lot of condo associations don’t allow buyers with FHA loans, which is limiting sales. Two of my clients who want to buy a condo have had to back out of a purchase because they couldn’t get financing.”

Condo Prices See Sharpest Decline in Two Years

Although not as quickly as the condo market, the U.S. single-family home market is cooling. In May, the median transaction price of single-family homes increased 0.5% YoY to $462,206. And although it’s the smallest growth in almost two years, growth is still happening.

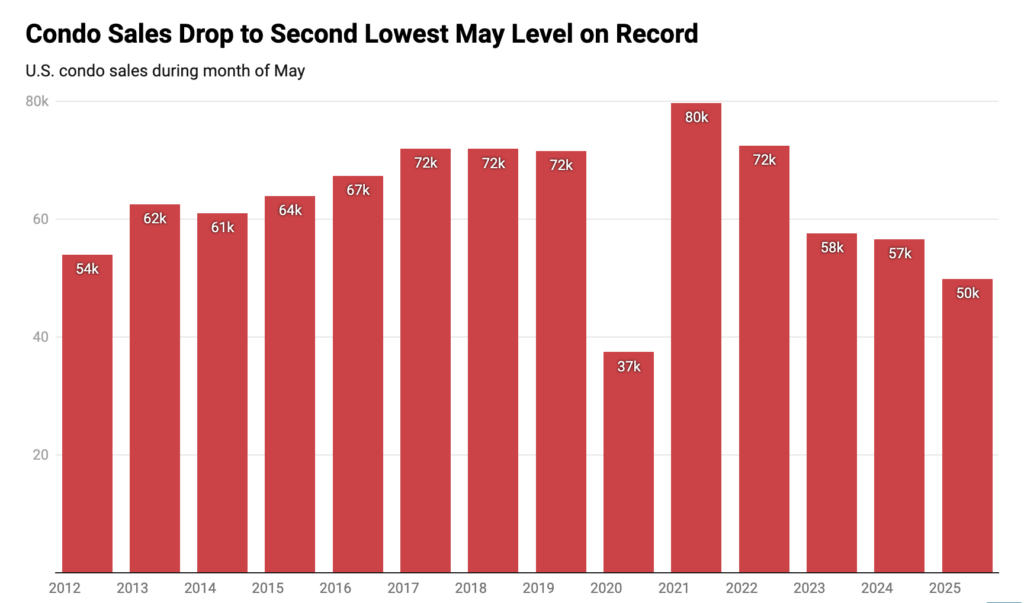

In May, condo sales decreased 11.9% YoY. That is more than three times the reduction in single-family home sales (-3.7%), and it is the biggest decline since June 2024. Both kinds of real estate sales dropped to their lowest May level since 2020. This indicates that condo sales in May were at their second-lowest level ever.

In many regions of the nation, condos—once thought of as the inexpensive path to homeownership—are now seen as an increasingly dangerous investment. They consequently take longer to sell than they used to. The average condo that went under contract in May took 46 days, which was seven days longer than the previous year and the longest for any May since 2015. In contrast, the average single-family home went under contract in 38 days, which is six days longer than it was a year ago and the longest for any May since 2020.

Listings are accumulating as a result of units remaining unsold. Last month, the number of active listings for U.S. condos reached its greatest level in ten years, and the number of single-family homes for sale reached its highest level since 2019. Condo purchasers may be able to locate sellers who are prepared to make concessions and/or sell for less than their asking price in numerous locations as a result of declining prices and lingering listings.

Florida & Texas Markets Moderate as Inventory Climbs

The housing markets in Florida and Texas have slowed recently as a result of an increase in supply brought on by the global homebuilding boom. The condo slump has been made worse by rising insurance and HOA dues. Natural catastrophes and stricter construction codes have played a significant role in Florida. The market for condos has decreased as a result of numerous HOAs raising dues and imposing high special assessments in order to comply with the new regulations.

The biggest decrease among the metros in the analysis was seen in Deltona, FL, where the median condo sale price fell 32.2% YoY in May. Next came Crestview, FL (-32%); Houston (-23%); Oakland, CA (-20.3%); and Tampa, FL (-19%).

Of the 10 metros with the largest price declines, seven are in Florida and two are in Texas.

Condo sales showed a similar pattern. Condo sales fell fastest in:

- Dallas (-33.3%)

- Palm Bay, FL (-32.8%)

- Phoenix (-32.7%)

- Port St. Lucie, FL (-31.5%)

- Orlando, FL (-31%)

In May, condo prices in New Brunswick, NJ, increased 14.9% YoY, the biggest increase among the metro areas Redfin examined.

Montgomery County, PA (14.1%), Pittsburgh (14.1%), San Francisco (8.8%), and Ocean City, NJ (8.2%), followed. A supply shortage is still plaguing many eastern markets, which could be driving up costs.

The popular Indianapolis metro has the best-performing condo sales, increasing 27.3% over the previous year. Next in line were Portland, ME (19.2%), Charleston, SC (11.5%), Montgomery County (10.8%), and Ocean City (8.4%).

Note: Redfin analyzed the 66 U.S. metropolitan areas that had sufficient data and at least 100 condo sales in both May 2025 and May 2024.