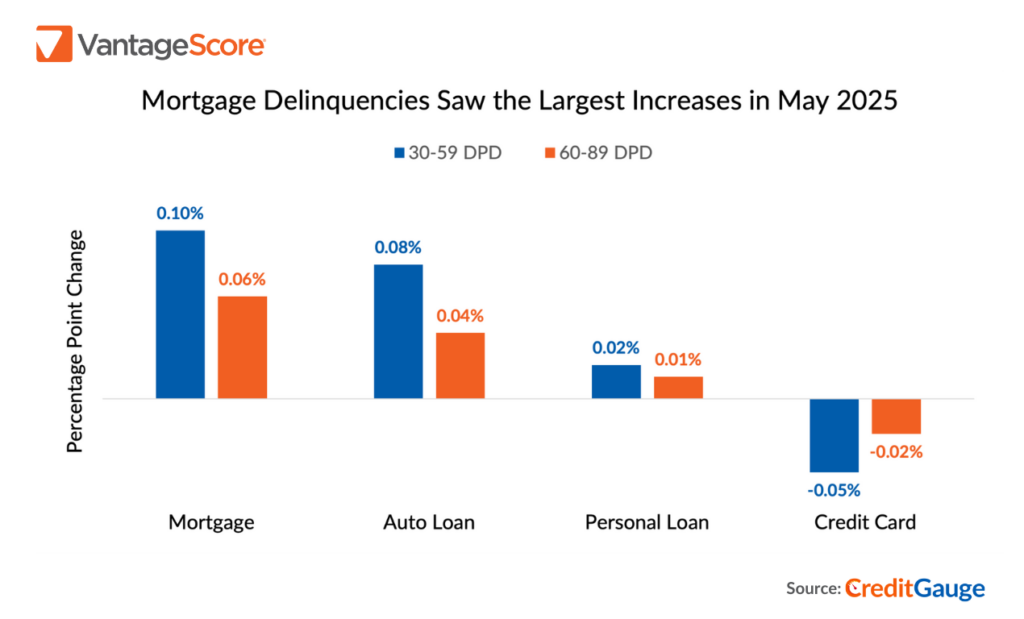

According to VantageScore’s new CreditGauge platform, mortgage loans in May were the primary cause of an increase in early- and mid-stage delinquencies in all credit categories. The 30-59 Days Past Due (DPD) payment category experienced the most year-over-year rise in home loans.

In May, mortgage delinquencies increased from 0.92% in the previous month to 1.03%, suggesting that the U.S. housing industry may be showing early warning signals of financial strain on borrowers.

“The rise in early and mid-stage delinquencies this month indicates potential financial strain among some consumers,” said Susan Fahy, EVP and Chief Digital Officer at VantageScore. “While consumer behavior generally remains positive, particularly among younger borrowers, mortgages may be an area to watch for increasing credit stress, particularly for traditionally less-risky segments with credit scores above VantageScore 660.”

Consumer Credit: Key Highlights — National

A surprise increase in delinquencies seen in mortgage loans: Mortgage payments are usually given priority by consumers above other credit payments. However, the 30-59 Days Past Due (DPD) payment category experienced the biggest year-over-year increase in May for home loans. In May, mortgage delinquencies increased to 1.03% from 0.92% the previous month.

Across the majority of credit tiers, early-stage delinquencies increase most: In May 2025, credit delinquencies in the VantageScore Nearprime, Prime, and Superprime segments in the 30-59 Days Past Due (DPD) category increased year over year. Even historically lower-risk borrowers may be starting to experience short-term financial hardship, as evidenced by modestly increasing delinquency percentages in other VantageScore credit classes, even though Subprime late payments decreased little year over year.

New highs for average credit balances: May saw the average credit balance reach $106,000, up $249 (+0.24%) from April. This was the sixth consecutive month that the total reached a five-year high. Balances increased by $1,479 (+1.4%) from May 2024 to the current year. The product line with the biggest increase, climbing 2.8% year over year, was mortgage balances.

To watch the latest commentary from Jeff Richardson, Susan Fahy, and Atif Mirza as they share the latest insights into U.S. consumer credit health. click here.