The Q1 2025 U.S. Home Flipping Report from ATTOM reveals that although home flipping is still a common strategy across the country, investor returns differ greatly by region. Here’s a closer look at flipping activity nationwide in all states with adequate data, plus the District of Columbia, from busy metro areas to rural hotspots.

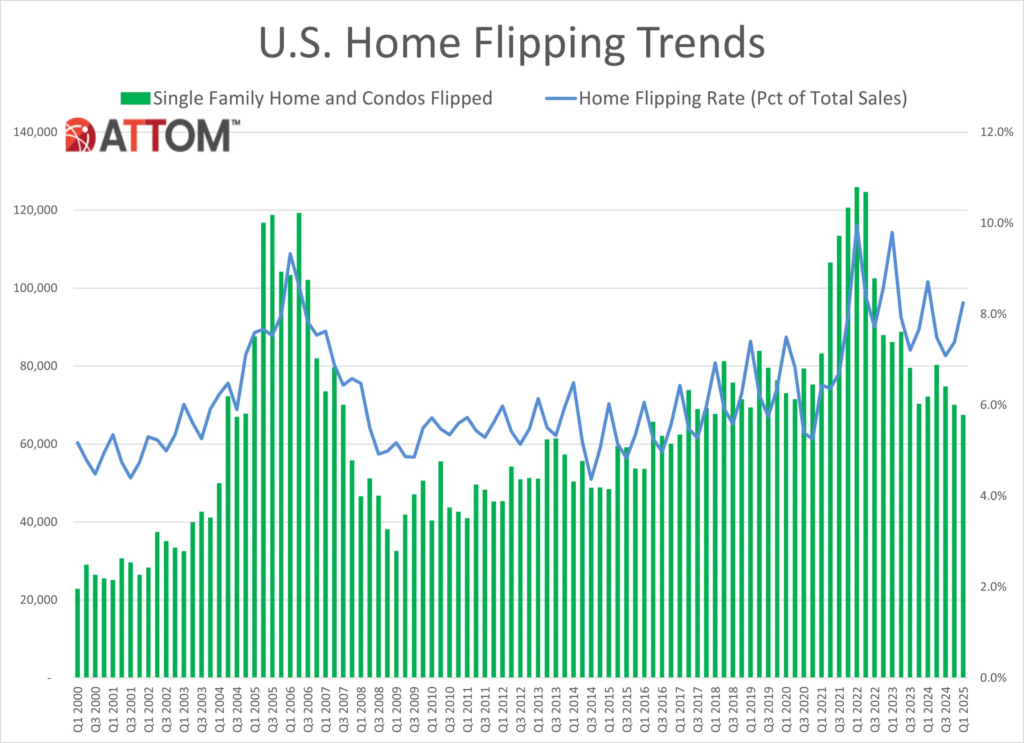

According to the first quarter 2025 U.S. Home Flipping Report released today by ATTOM, a leading curator of land, property data, and real estate analytics, 67,394 single-family homes and condominiums were flipped in the first quarter of 2025, making up 8.3 percent of all home sales from January through March.

As a percentage of total sales, the proportion of flipped properties increased from 7.4% to 8.3% in the previous quarter. However, compared to the same period last year, when flips made up 8.7% of total sales, it was little lower.

Home Flips Vary Across U.S.

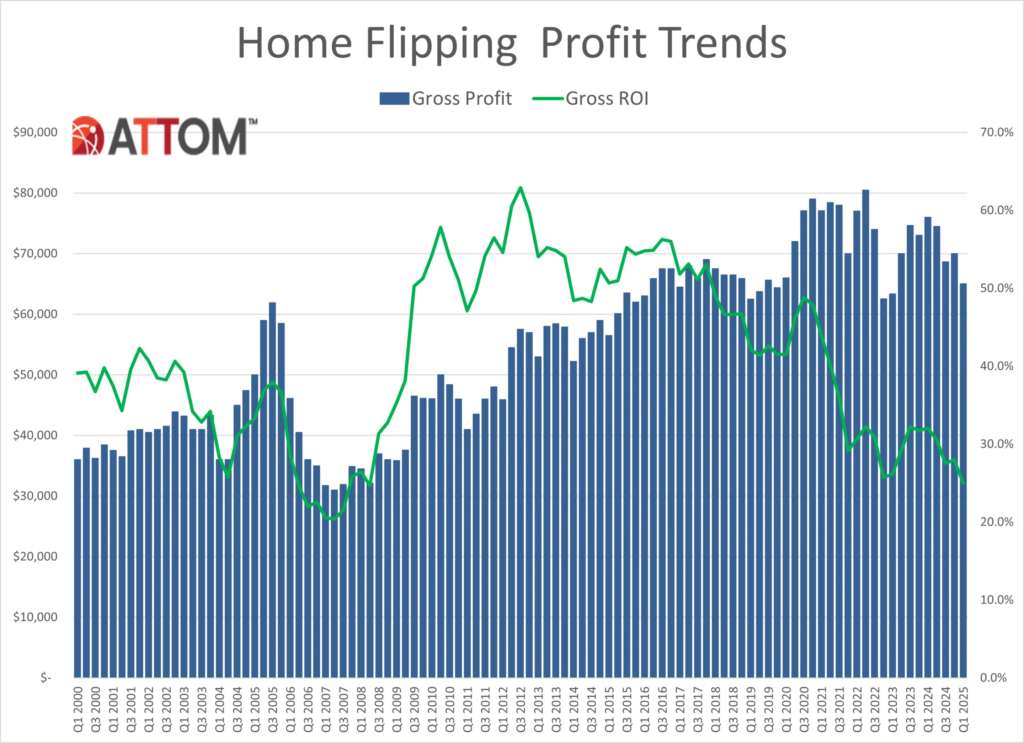

Home flippers also seem to be impacted by the downturn in purchasing. The first three months of the year saw 67,394 home and condo flips nationally, the fewest in a quarter since 2018. Additionally, returns have been declining; in Q1 of 2025, the average flipped property generated a 25% return on investment (before expenses). This maintained a slow slide from the recent peak of 48.8 in the fall of 2020 and was lower than the 28% recorded in the preceding quarter.

“The competitive home market means high prices, which is good for short-term investors on the selling end,” said Rob Barber, CEO at ATTOM. “But that dynamic is also making it harder to find under-priced homes to buy up and it’s ultimately squeezing profit margins for the industry.”

Of the 173 metropolitan statistical regions with enough data to analyze, 76.3% (132) saw a quarter-over-quarter increase in home flips as a percentage of total sales. However, in two thirds (115) of the metro regions, the share was lower than it was at the same time last year. Metro areas that experienced at least 50 home flips in Q1 of 2025 with a population of 200,000 or more were considered.

Among the metro areas analyzed, home flippers accounted for the biggest share of sales in:

- Macon, GA (flips compromised 21% of all home sales)

- Warner-Robins, GA (20.6%)

- Atlanta, GA (15.9%)

- Memphis, TN (14.7%)

- Akron, Ohio (13.3%)

“It’s tricky to balance at times when the market looks like it could take a downturn,” Barber said. “Investors don’t want to buy a property when prices are high and then see them drop before they’re ready to sell.”

Birmingham, AL (12.8%), Kansas City, MO (11.6%), and Salt Lake City (11.1%) were the metro regions with populations over one million that had the highest percentage of flips, outside from Atlanta and Memphis, TN.

Of those biggest metro areas, the smallest proportion of flips were in:

- Honolulu (4.7%)

- New Orleans (4.9%)

- Seattle, WA (5.5%)

- Pittsburgh (5.9%)

- Portland, OR (6.1%)

In Q1 of 2025, a property that was flipped sold for a median price of $325,000 nationwide, yielding a 25% return on investment and a gross profit of $65,000 above the median acquisition price of $250,000. In ATTOM’s investigation, profit margins decreased quarterly in 45.7% (79) of the 173 metro regions and annually in 63% (109) of the markets.

To read more, click here.