Despite the current relatively high levels of short-term borrowing costs, a new paper jointly published by the Federal Reserve banks of New York and San Francisco stated that the possibility of the Federal Reserve once again setting its short-term interest rate target at near zero levels at some point in the upcoming years remains real.

“The medium- to long-term risk that the central bank’s interest rate target will return to super low levels “is currently at the lower end of the range observed over the past fifteen years,” said a paper that counted New York Fed President John Williams as a Co-Author. It was published on Monday. But the researchers added the chance of a return to near-zero rates “remains significant over the medium to long term…due to recent elevated uncertainty.”

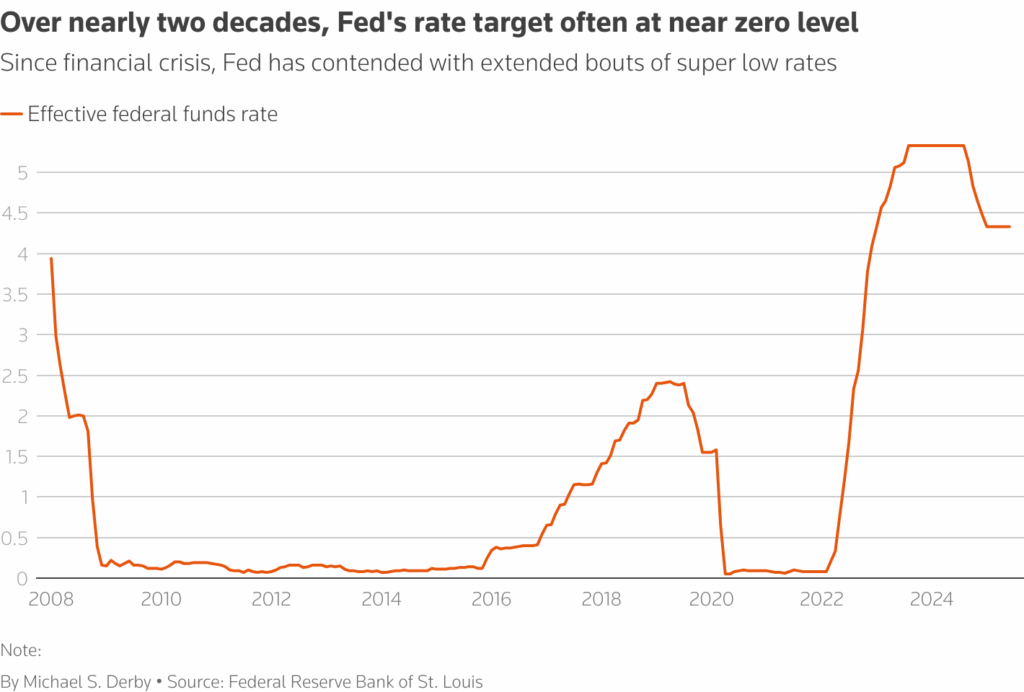

Troubled economic times and their aftermath are linked to a federal funds rate goal that is close to zero. From 2008 and the start of the financial crisis until late 2015, the Fed set its short-term interest rate target at these levels. The COVID-19 pandemic put it back at these levels in March 2020, but the Fed then began raising interest rates aggressively in the spring of 2022 to fight the worst inflation readings in decades.

Central bankers have significant difficulties when the Fed’s interest rate target, which it needs to fulfill its employment and job mandates, is set close to zero. Officials have been forced to use contentious asset purchase programs designed to lower long-term rates in order to give stimulus beyond what a super low goal can offer. This has resulted in a significant expansion of the Fed’s balance sheet. Additionally, the Fed had to use communication tactics, which policymakers thought would increase the stimulus effect of low interest rates.

During a multi-decade trend of lowering rates within a long-running trend of declining inflation pressures, the recent episodes of hitting near-zero rates occurred. A new environment for the central bank has emerged as a result of the past few years’ experience. Inflation caused by the epidemic has significantly decreased. However, the Fed remains at a level that is comparatively high in comparison to recent years’ experience, with its current target rate hovering between 4.25% and 4.5%. Additionally, trade policy creates a great deal of ambiguity about the future.

Fed officials anticipated in June that they would begin the process of reducing their target to 3.4% by 2027. President Donald Trump is also on the central bank to implement substantial easings.

Officials have also been updating their prediction of the neutral rate in relation to the state of the economy. That estimate, along with the June projections, indicates that, compared to previous years, the Fed may have more leeway to lower rates without reaching zero.

To read more, click here.