In 2025, the economy has shown resilience, which has helped to lay the groundwork for housing activity, according to the Realtor.com’s latest Housing Forecast. The labor market has somewhat steadied after easing considerably in 2023 and 2024, with the unemployment rate even creeping down to 4.1%, according to the June report.

The Consumer Price Index, which measures headline inflation, has been in the 2%–3% range for 13 months. The Fed’s preferred metric, the Personal Consumption Expenditures Index, has also been in this range for at least 20 months.

The Fed’s two main responsibilities, sometimes known as its “dual mandate,” are monitored in part by unemployment and inflation. After lowering its policy rate by a full percentage point in Q4 of 2024, the Fed has maintained it at a steady level throughout 2025, demonstrating that both sides of its dual mandate are in a strong position.

This stance allows the Fed to respond as necessary as it weighs the possibility of tariff-induced price adjustments that could lead to a new wave of inflation against a view that predicts somewhat slower economic growth and a cooled labor market.

Highlights from the Realtor.com 2025 Forecast — National

- Just behind 2024, 4 million homes are anticipated to be sold in 2025.

- Although home values are rising, growth is predicted to decelerate further (+2.5%).

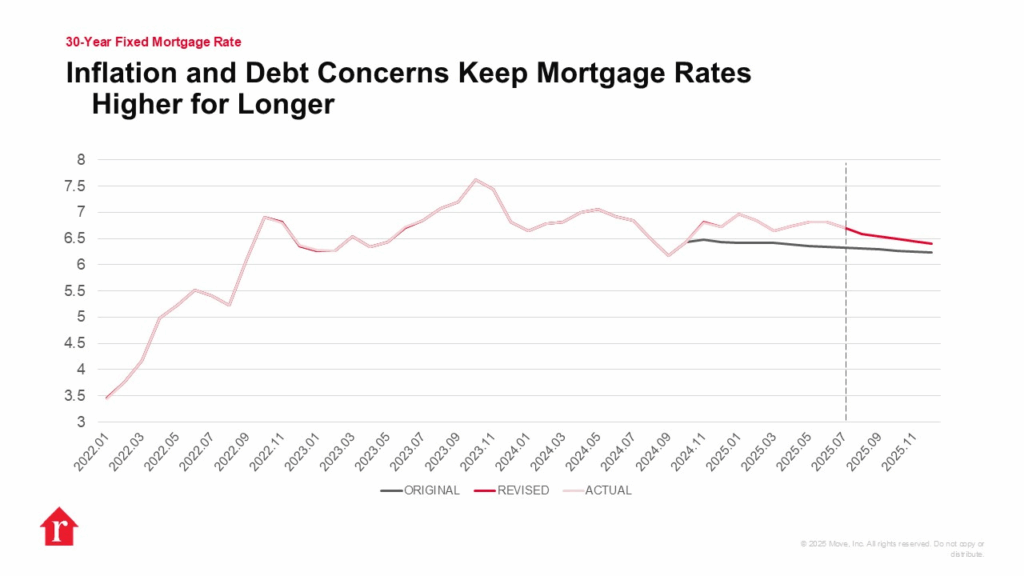

- Despite a decline to 6.4% by the end of the year, average mortgage rates are still comparable to those of the previous year.

- In the medium term, renting remains a desirable alternative for households trying to keep costs down.

Mortgage rates skyrocketed following the 2024 election as investors expected a combination of increased inflation, higher economic growth, and larger deficits. The trend in mortgage rates has been tempered by the expectation that growth will decline even if the economy is still stable. However, a relatively high floor under interest rates has been set for the time being due to the ongoing threat of tariff-induced inflation and the United States’ mounting fiscal debt, which is expected to increase as a result of the Big Beautiful Bill Act.

Analyzing Rate Expectations, Growth & Inflationary Conditions

In the latter half of 2025, Realtor.com experts such as Danielle Hale, Sabrina Speianu, Jiayi Xu, Hannah Jones, Anthony Smith, Jake Krimmel, and Joel Berner predict that moderate growth and comparatively limited inflation pressures would prevail and assist in bringing down mortgage rates. The annual average mortgage rate is expected to be comparable to what experts observed in 2024 (6.7%) despite the rate moving just into the lower-6s (6.4%) by the end of 2025 due to the prolonged decline from a higher starting point.

Relative to the space mortgage rates have covered in recent years, a decline of little over a quarter of a percentage point may seem insignificant, but it is. However, prospective homebuyers would actually save money as a result of this decrease. A drop from 6.7% to 6.4% on a $350,000 loan, which is almost 80% of the current median-priced property listing of $440,950, translates into monthly payment savings of around $70, or about $830 annually.

In terms of home sales, original projections for 2025 were not particularly optimistic. In addition to 2024, which saw the lowest annual total for existing sales since 1995 at just an estimated 4.06 million, experts only projected a modest improvement for the calendar year.

Measuring Downshifts in Price Increases & Affordability Concerns

Home prices have stayed persistently high despite a paucity of housing supply that has afflicted the U.S. for more than ten years, even while affordability indicators indicate that the lack of affordability continues to hover at or near long-term highs.

Since this structural imbalance—the unabated housing supply shortage—continued to prevail, it was initially anticipated that home price growth would only slightly decelerate in 2025.

Although listing price trends are uneven, the growth of home sales prices has moderated as 2025 has progressed. Several metro regions have seen a fall in listing prices, especially in the South and West where inventory has fully recovered.

However, “seller-friendly markets” are those with less than four months’ supply, when a high number of prospective buyers and a small number of available properties maintain strong competition, high prices, and fast sales. On the other hand, a supply range of four to six months is usually a sign of more equitable terms between buyers and sellers, where both sides must approach the deal amicably and be prepared to compromise. Price reductions, concessions, and contingencies are indicative of a buyers’ market, where sellers strive to attract potential buyers, while bidders are often few in any market with six months’ supply.

As expected, this trend toward a more balanced housing market is still going strong, with months’ supply already reaching a post-2016 milestone across the country. Buyers may have more or less bargaining power, depending on the price point and regional area, but the buyer-friendly move is opening doors for individuals who have been waiting. In fact, Realtor.com’s Hottest Markets report‘s trends on market competitiveness have revealed that the Northeast and Midwest markets, where inventory recovery has been slower, have continuously scored hotter. This means that buyers can anticipate faster house sales in these regions.

Renter Activity Heightens as Sellers Adapt

The forecast for the rental market has remained unchanged as conditions have been changing extremely slowly. It is difficult to purchase a property, yet rentals have decreased by 2.1% in the past year. The median asking rent fell 2.7% from its August 2022 peak in June, marking the 23rd consecutive month that rents have been falling. Renters who are prepared to keep waiting for their chance at the American dream can save about a few dollars a month as a result.

Households across the U.S. are weighing the monthly cost comparison, which is heavily skewed toward renting, against their ambition to become homeowners. As of June 2025, the only metro area where purchasing a starter house is more cost-effective than renting is Pittsburgh.

According to the most recent June Housing Trends report from Realtor.com, sellers are taking notice of the trend and responding to it. As inventory increased by almost 30% and time on market decreased during the month, more than one out of five listings had a price reduction, which helped to stabilize the expectation that the median price of a home sale would follow.

However, not every seller has made the decision to align with the market. Instead, an increasing percentage of homeowners chose to “delist,” or remove their listing from the market without a sale. In the 12 months that ended in May, these delistings increased by 47%, increasing their frequency among listed homes and demonstrating that some sellers would rather wait than compete with the market. Delistings can eventually affect the supply and demand balance because they depress supply and, if they exceed new listings, diminish the number of homes for sale.

The recent buyer-friendly momentum may stall if the increasing delistings trend persists or picks up speed. When making offers, buyers should consider this context. Overall, a homeowner turned seller who is willing to negotiate is more likely to have a property that has been on the market for a longer amount of time, but this is not certain.

Overall, the cost of housing remains too high for many people to believe they have a reasonable chance of becoming homeowners. According to the paper, experts are beginning to notice this in declining homeownership numbers, which they predict will decline to 65.3%. The drop is more pronounced when examining homeownership rates for younger households. Those people’s lack of access will probably influence their and their families’ financial prospects for many years to come.

Forecasting 2025 & Beyond — U.S.

Realtor.com’s estimate has so far been reasonable, trailing by only 2% the sales pace it has seen this year. Put another way, the early-year boost from mortgage rates falling to just over 6% in September fueled a robust start to 2025, and home sales have thus far this year been marginally better than first projected.

That outperformance has diminished, though, as home sales have declined and are currently only marginally higher than the pace of the previous year. Actual data has lagged somewhat behind the first projection during the pivotal spring selling season.

According to experts, sales in the second half of 2025 will resemble the more subdued spring season, varying from month to month by a little above and below the pace from the previous year. Given that home sales are approaching the 4 million level, the 2025 annual total for home sales would be 1.5% lower than the pace from the previous year.

Recent increases in buyer interest from both internal and external trend sources indicate the potential for a “late-summer rally,” according to the report. A stronger-than-anticipated second half could be supported if this momentum continues. To evaluate the market impact, keeping an eye on buyer traffic, listing activity, and changes in mortgage rates would benefit consumers for what’s to come.

To read the full report, click here.