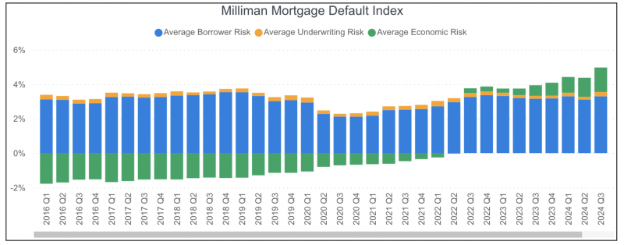

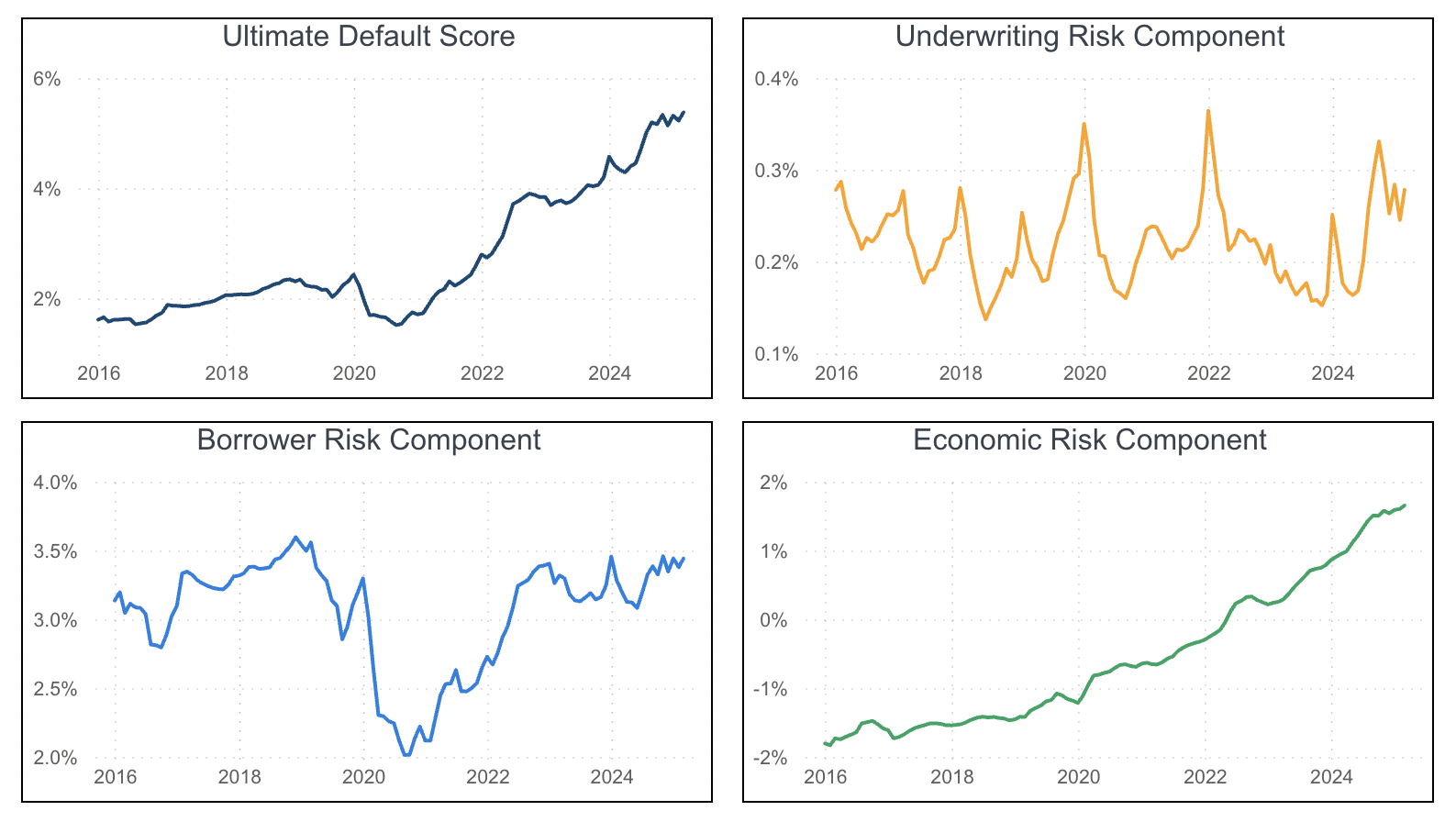

According to the Q1 2025 results of the Milliman Mortgage Default Index (MMDI), recently released by Milliman, Inc., the lifetime significant delinquency rate (for residences that are 180 days or more past due for U.S.-backed mortgages has slightly increased. The MMDI increased to 2.13% in Q1 2025 from 2.05% in Q4 2024.

Both an increase in borrower risk (1.40% to 1.43%) and economic risk (from 0.64% to 0.68%) contributed to the slight increase in default risk for GSE loans during Q1 2025. Borrower risk, as defined by the MMDI, is the chance that a loan will become significantly past owing to factors such as the borrower’s credit quality, initial equity position, and debt-to-income (DTI) ratio.

Key Findings form the MMDI — National

- For loans obtained in Q1 of 2025, the MMDI value for government-sponsored enterprise (GSE) acquisitions increased somewhat to 2.13% from 2.05% for loans obtained in Q4 of 2024.

- The increase was primarily caused by slightly lower average FICO scores, slightly higher average loan-to-value (LTV) and debt-to-income (DTI) ratios, and somewhat higher economic risk.

- The main cause of the quarterly variation in the index value was borrower risk.

Note: Home values, both past and projected, are used to gauge economic risk.

“In early 2025, GSE acquisitions had slightly higher DTI and loan-to-value (LTV) ratios compared to the prior quarter, and a slightly lower average FICO score, meaning borrowers were taking on more debt compared to prior quarters,” said Jonathan Glowacki, a Principal at Milliman and Co-Author of the MMDI. “While the quality of purchase loans continues to be strong, we’ll be monitoring how economic turbulence may impact borrower risk for government-sponsored loans.”

Underwriting Risk Remains Low in Q1

Additional risk adjustments for loan and property attributes, including loan term, paperwork type, occupancy status, amortization type, and other changes, are represented by underwriting risk. Purchase mortgages, which are often fully amortized, well documented loans, have a negative underwriting risk and remain low. The statistics for refinance loans are divided into two categories: rate/term refinance loans and cash-out refinance loans.

Rate/term and cashout refinance loan volumes in 2025 Q1 were roughly $18 billion and $16 billion, respectively, for a total of $34 billion. Rate/term refinance mortgages are less risky than purchase loans, but cashout refinance mortgages are riskier than purchase loans. In 2025 Q1, the weighted-average underwriting risk for refinance loans was 0.30%, up from 0.24% in 2024 Q4.

Additionally, economic risk for GSE loans rose little from 2024 Q4 to 2025 Q1, rising from 0.64% to 0.68%. Forecasts for home prices are unchanged; for the coming year, appreciation is expected to decrease to low single digits nationwide.

Note that Q4 2024 MMDI numbers have been updated to reflect higher-than-expected home price appreciation when examining Q1 2025 data. The MMDI is based on a baseline estimate of future home prices, and its values are updated in later releases to reflect changes in projections and actual circumstances.

To read the full report, click here.