Mark Paoletta, former General Counsel of the Office of Management and Budget (OMB) under the Trump administration and current Chief Legal Officer at the Consumer Financial Protection Bureau (CFPB), has offered his opinions on the Government Accountability Office’s (GAO) recent statements—and the longtime U.S. attorney doesn’t seem too pleased.

A new Banking Dive report revealed that Paoletta defended Acting Director of the OMB Russ Vought’s proposal on February 8 that the bureau get $0 from the Federal Reserve for the fiscal quarter between April and June in a letter to the GAO last week—saying “the move did not constitute an illegal withholding.”

In the report, Paoletta claims that the letter is a reaction to a June correspondence from the GAO in which the congressional watchdog “weaponiz[ed]” the Impoundment Control Act of 1974 “for political purposes.”

Due to many attempts to terminate the great majority of the CFPB’s employees, Senate Democrats have requested that the GAO look into the agency.

Vought, Paoletta & CFPB Go At It in Back & Forth Letters

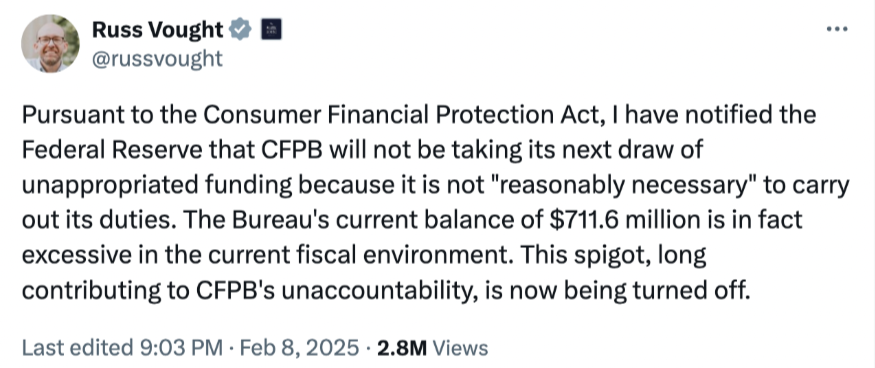

Vought requested Federal Reserve Chair Jerome Powell to refuse any more “unappropriated” funds on his first full day in command of the bureau. He also shared the letter on social media.

“CFPB will not be taking its next draw … because it is not ‘reasonably necessary’ to carry out its duties,” Vought wrote in an X post. “The Bureau’s current balance of $711.6 million is in fact excessive in the current fiscal environment. This spigot, long contributing to CFPB’s unaccountability, is now being turned off.”

In contrast to Vought’s letter to Powell, Paoletta this week accused the GAO of adopting the social media post as their “sole predicate.”

Paoletta stated that neither the post nor the CFPB’s actions after it “could conceivably be construed as an illegal withholding of funds under the ICA.” A different conclusion would “create an artificial funding floor where only a statutory ceiling exists, in addition to eviscerating the CFPB Director’s discretionary authority to determine the amounts needed during the fiscal year to carry out Bureau operations.”

The Fed provides funding to the CFPB, a practice that gave rise to a well followed court dispute. The funding arrangement was affirmed as constitutional by the Supreme Court last year. That strengthens Paoletta’s case, but in his letter to the GAO, the CFPB’s legal head called the congressionally created mechanism “reckless and irresponsible.”

Examining correspondence between the CFPB and GAO in the context of time is crucial, according to the report. Two weeks after the city of Baltimore voluntarily dropped its lawsuit against the CFPB, the GAO sent out its letter in June. There is no ability to “transfer away money from, or otherwise relinquish control” over funds in the CFPB’s reserve fund, according to statements submitted by agency representatives in court.

Recent Approval of Bill Restricts CFPB Funding

However, the “One Big, Beautiful Bill,” which was passed by Congress between June and the present, limits the CFPB’s funding at 6.5% of the Fed’s operating budget, down from 12%.

“Congress expressly affirmed the Acting Director’s determination that the Bureau’s funding level was ‘excessive’ when it reduced the cap on the Director’s discretionary request authority by nearly half,” Paoletta wrote to the GAO. “Your boss—Congress—has thus enshrined its agreement with the Acting Director’s efforts to right-size the Bureau into law.”

Paoletta also claimed that the GAO’s claim that the CFPB is breaking the ICA “undermine[s] both President [Donald] Trump and Congress,” copying Senate Majority Leader John Thune, R-SD, and House Speaker Mike Johnson, R-LA, on last week’s letter.

The GAO’s June letter is “not only in opposition to Congress’s attempt to scale down an out-of-control agency, but also in opposition to Acting Director Vought’s commendable attempts to implement President Trump’s historic reform efforts,” Paoletta wrote last week.

The financing for the CFPB does not run out at the end of a fiscal year, Paoletta pointed out. Instead, he stated that any money that is not spent “remains available to CFPB for obligation in future fiscal years.”

According to Paoletta, Vought “acted well within his legal authorities in declining to request further funds from the Federal Reserve System,” pointing out that the CFPB acting director currently has “sole discretion” over how much funding the bureau requires to operate.

“To read this unambiguous grant of discretion as a requirement that the Director request the full amount of funds available from the Federal Reserve is untenable and part of a politicized campaign against President Trump’s historic efforts to restore fiscal sanity and efficiency to the Federal Government,” Paoletta wrote. “The conclusion GAO apparently seeks — that the Acting Director’s decision to decline to draw down unneeded funds constituted an illegal impoundment under the ICA—is diametrically opposed to the purpose of the ICA itself.”

To read the full letter, click here.