While the bad news continues, with mortgage rates close to 7%, there is some good news afoot: after several weeks of declines, mortgage applications have finally risen. That said, per a new Realtor.com analysis, homebuyers will pay more in closing costs in some states.

“Both buyers and sellers incur closing costs in a real estate transaction,” says Jiayi Xu, Economist at Realtor.com. “For sellers, potential costs may include transfer taxes, title insurance, escrow fees, and other related expenses. Buyers, on the other hand, may be responsible for costs such as appraisal and inspection fees, title and escrow fees, attorney fees, lender charges, and more.”

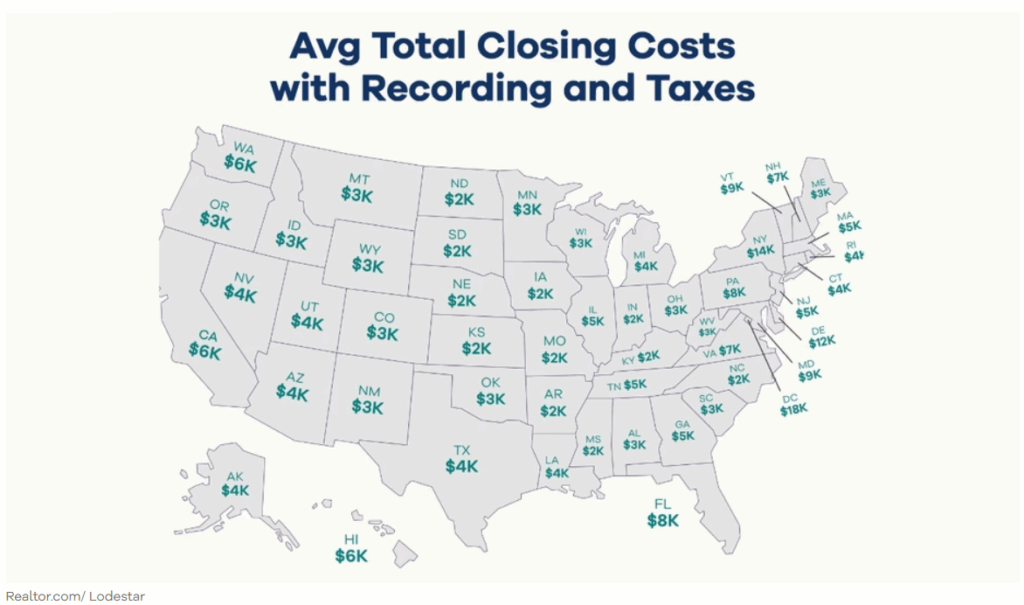

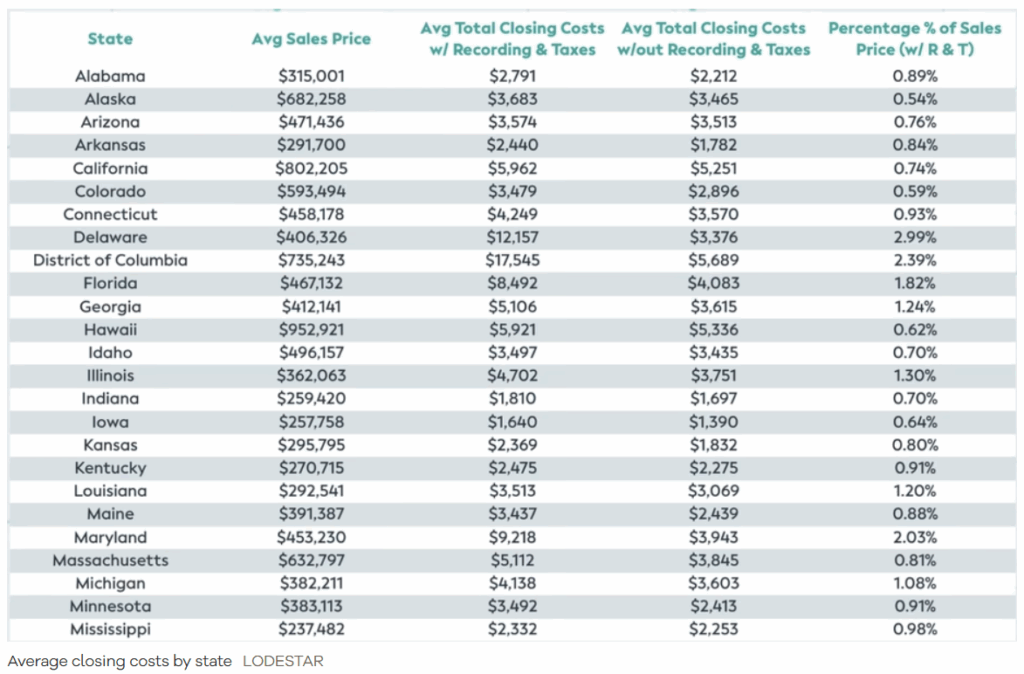

Delaware has the highest closing costs at 2.99% based on sale price, ending up costing homebuyers an average of $12,157. That’s per a new study by LodeStar Software Solutions, a provider of mortgage closing cost data (note that closing costs include recording and taxes).

But while Delaware’s percentage of costs is high, the actual dollar amount pales in comparison to Washington, D.C. There, higher housing costs ($735,243 average sales) more than offset the lower percentage (2.39%) of the sales price, meaning homebuyers can expect to pay the highest average closing costs in the US, around $17,545.

States with the highest closing costs as a percentage of sales price tend to be locations where transfer taxes make up a bulk of the pricing, whereas states with minimal or no transfer taxes have lower total closing costs.

And remember that real estate transfer taxes are part of closing costs. Due at the closing, transfer taxes are imposed on the “transfer” of the property deed from the seller to the buyer. The amount you’ll pay for this one-time fee varies, depending on where you live. Usually, the seller pays the transfer tax. Recording fees are one-time charges from a county or local government to file the documents related to the closing.

The top markets with the most expensive average closing costs, including recording and taxes, are:

- Washington, D.C. ($17,545)

- New York ($13,738)

- Delaware ($12,157)

- Maryland ($9,218)

- Vermont ($8,597)

“High closing costs in D.C. are likely driven by both elevated home prices and steep transfer tax rates—1.1% of the sale price for residential properties under $400,000, and 1.45% on the full amount for transfers above $400,000,” explains Xu. “In addition, legal requirements and dense urban regulations add complexity and administrative expenses, further pushing up closing costs in the city.”

Meanwhile, South Dakota ($1,551), Iowa ($1,640), and Missouri ($1,740) lead the states with the lowest closing costs.

Home Prices Remain High

The price of a home plays a big part in closing costs. In April, the national median list price for a home was $431,250.

“Some might find it surprising how little the difference there is between median and average sales prices and closing costs,” said Ron Carvalho, Director of Data Operations at LodeStar. “It goes to show that there’s not much skewing of the average for high or low transaction prices. Our data seems to suggest that there’s a fairly tight price range in a given market—maybe a narrower price range than one might expect.”

Buyers need to do their homework so as not to come up short on cash when it’s time to close. Their real estate agent should provide a list of all the fees to be paid, so buyers come to closing with the correct payment amount.

Click here for more on Realtor.com’s analysis of U.S. trends in closing costs.