According to a recent Redfin report, the average buyer’s agent commission in the United States for properties sold in the second quarter was 2.43%, up from 2.38% in the same period last year. Following the implementation of new National Association of Realtors (NAR) commission regulations in August 2024, commissions increased somewhat for the third consecutive quarter.

In Q1 of 2024, when NAR first announced a settlement prescribing new commission standards in response to a class action lawsuit brought by house sellers, commissions are now back to where they were prior to NAR’s rule implementation. Commissions fell as soon as the settlement was made public, reaching a low of 2.36% in Q3 of 2024. In part, the settlement revealed that sellers could bargain for lower commissions, which is why they fell at that time.

Buyer’s agent commissions have gradually but steadily returned to their pre-settlement levels during the past 12 months. This is due to the fact that purchasers have the capacity to negotiate better pay for their brokers and, in many parts of the country, they have negotiating power over sellers. NAR agreed to develop new guidelines regarding the communication of commissions offered to buyer’s agents as part of the settlement announcement in early 2024.

NAR explained the new regulations as follows:

“Buyers and their agents will need to reach an agreement regarding how the agent will be compensated for their services and put it in writing prior to touring a home. … Offers of compensation (when a seller or a seller’s agent shares compensation with a buyer’s agent) can no longer be shared on Multiple Listing Services (MLS). … Offers of compensation are still an option but must be communicated off-MLS if a seller chooses to make an offer available.”

Commissions for Homes Below $500K Jump to Highest Level Since 2023

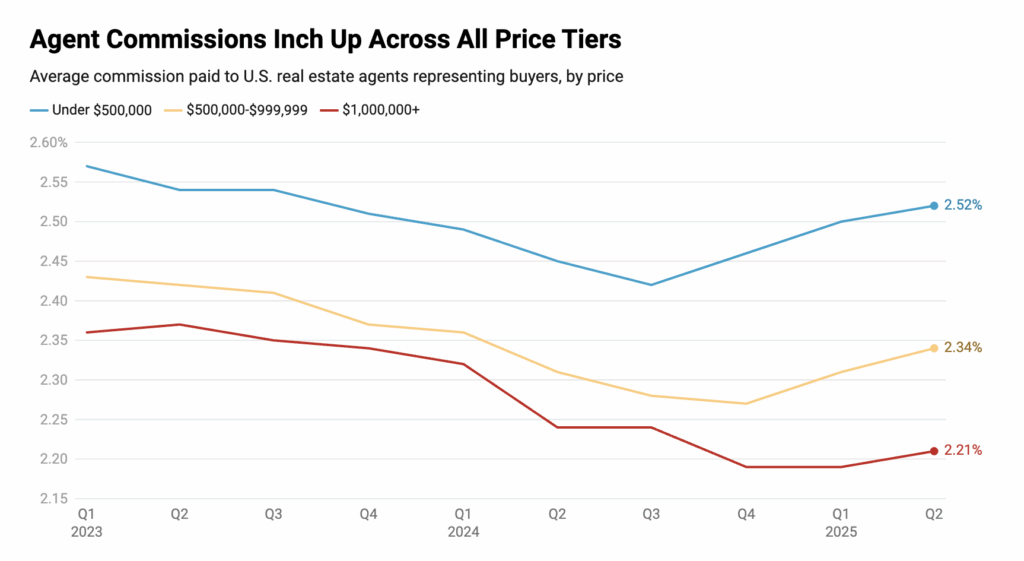

According to the report, all pricing tiers saw a small increase in commissions during Q2.

The average buyer’s agent commission for properties selling for less than $500,000 was 2.52%, which was higher than the previous quarter’s 2.50% and the previous year’s 2.45%. Since the third quarter of 2023, it was the highest average commission for the pricing tier.

The average buyer’s agent commission for properties selling for between $500,000 and $999,999 was 2.34%, which was higher than the previous quarter’s commission of 2.31% and the previous year’s commission of 2.31%.

The average buyer’s agent commission for homes selling for $1 million or more in the first quarter was 2.21%, which was three basis points lower than the 2.24% commission a year earlier but higher than the all-time low of 2.19% the previous quarter.

“At the entry-level price point under $500,000, buyers are struggling to just purchase the house, so it is rare that a commission is negotiated,” said Andrew Vallejo, the a Redfin agent in Austin, Texas. “Builders are mostly paying 3% or more, so if there are any new homes in competition with our listings, we have to cover the buyer agent commission to stay competitive.”

Agents Notice Differing U.S. Market, Commission Trends

As mentioned, buyers now have the upper hand in the home market. In June, the U.S. home market saw more than 500,000 more sellers than buyers, the largest difference since Redfin began monitoring in 2013.

Sellers are more likely to pay a higher commission to clinch a purchase when there are so few bidders in the market. However, the influence that buyers have over sellers differs depending on the market.

The majority of buyer’s agents now ask for a 3% commission, up from 2.5% to 2.75% before the NAR settlement, according to Vallejo.

“Austin’s market is slow, so buyers have a lot more power,” Vallejo said. “Buyers can walk away if the seller does not pay the buyer’s agent commission, and they’ll likely be able to find another home they like with a seller who is willing to pay what the buyer is asking for to offload their home. Since the NAR settlement, there has been a lot more discussion about commissions with clients, and more sellers are trying to counter with a lower commission rate, but in most cases, in today’s market, the buyer can stay firm.”

However, local Redfin Premier agent Jo Chavez claims that many sellers in Kansas City, MO, continue to pay the commission amount that purchasers have requested.

“I’ve had more sellers ask about offering no commission, or a low commission, since the new rules went into effect. But very few have opted to counter below what a buyer’s agent asks for,” she said. “There may be a little more negotiation now, but the end result is still typically the same—a seller paying 3%, or close to 3%, to the buyer’s agent.”

According to agents in Minneapolis, some buyers are open to granting their agents more leeway when it comes to commission requests.

“Most buyers in our market have been coming in with an expectation of a 2.7% commission to their agent,” said local Redfin Premier agent Emily Olson. “That said, I’ve been seeing some flexibility lately, and I’ve had success negotiating it down to 2.5% in a number of cases.”

Note: Redfin’s data on buyer’s agent commissions for closed home sales served as the basis for the study in this report. Using national, aggregated sales data from Redfin agents’ listings, deals that Redfin.com sent to partner agents, and deals where purchasers used Bay Equity Home Loans, the analysis represents nationwide commission rates.

To read more, click here.