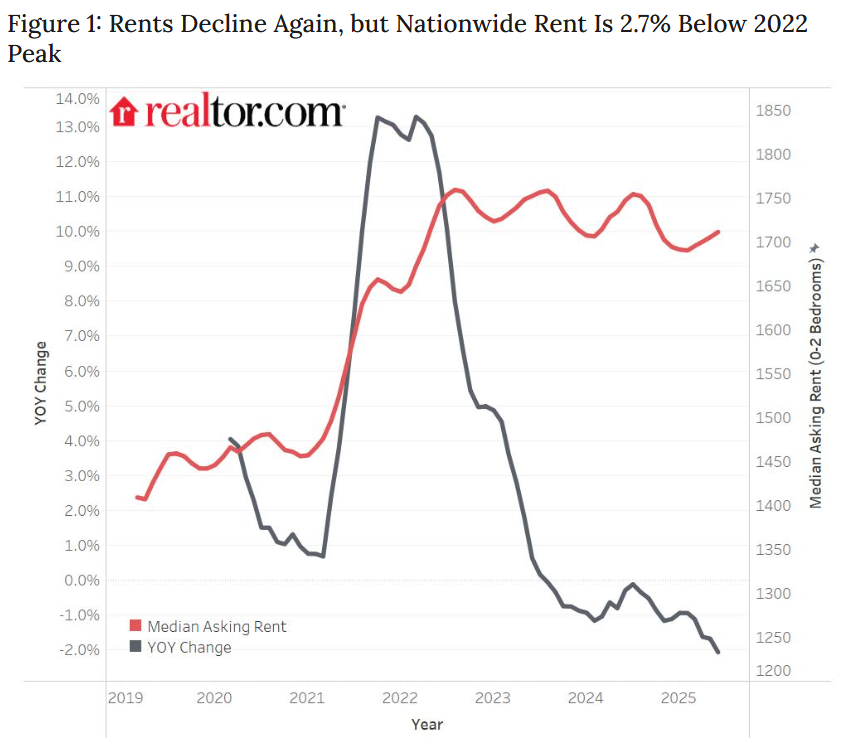

Rent prices declined for the 24th consecutive month in July 2025, marking a full two years of easing rental pressure in the U.S. rental market, according to the July Realtor.com Monthly Rent Report. Despite the consistent drop in rents, growing pullback in multifamily development fueled by increasing construction costs and new tariffs on building materials like lumber, aluminum, and steel, is signaling potential trouble ahead for future rental supply.

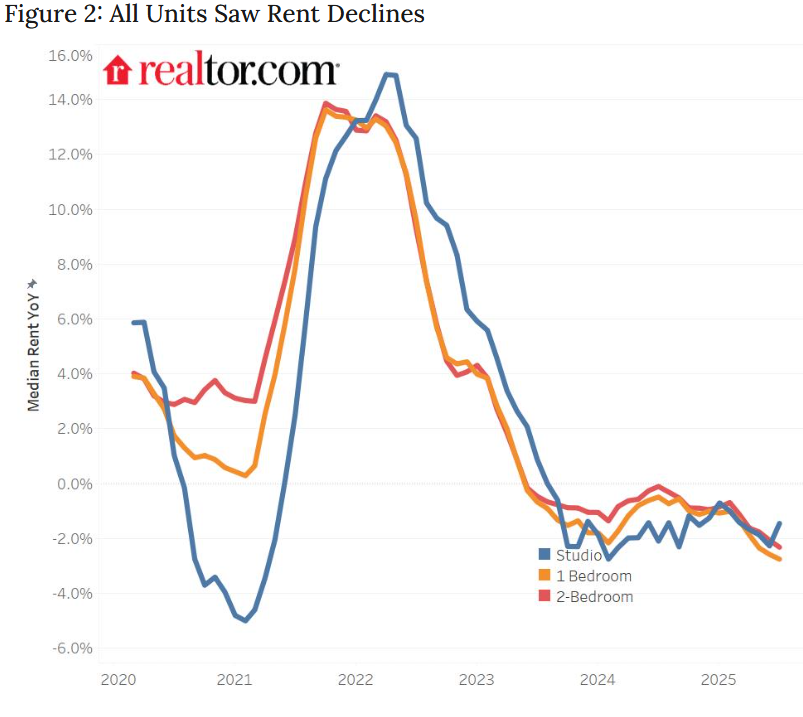

The study found that the median asking rent for zero- to two-bedroom properties in the 50 largest metros fell to $1,712 in July, a $43 (-2.5%) decline year-over-year. While monthly rent growth continues to follow a typical seasonal pattern, it has consistently lagged behind last year’s pace, indicating a persistently cooler rental market. Rent prices remain $254 (17.4%) higher than their pre-pandemic levels, but are now $47 (-2.7%) below the peak level reached in August 2022.

“Rents have now declined for two full years, giving renters more leverage and financial breathing room than they’ve had in some time,” said Danielle Hale, Chief Economist at Realtor.com. “But there are early signs that relief may not last forever. Developers are pulling back in key markets, and construction headwinds—especially tariffs on steel, lumber, and aluminum—could create a shortfall in new rental supply down the line.”

The National Association of Home Builders (NAHB) estimates that $204 billion worth of goods were used in the construction of both new multifamily and single-family housing in 2024—$14 billion of those goods were imported from outside the U.S., meaning approximately 7% of all goods used in new residential construction originate from a foreign nation.

Multifamily Development on the Decline

In June 2025, multifamily completions for buildings with two or more units fell 38.1% year-over-year, dropping from a seasonally adjusted annual rate of 656,000 units in June 2024 to just 406,000. This significant decline reflects the growing challenges facing developers, including elevated construction costs, shrinking profit margins due to lower rents, and newly expanded tariffs on imported building materials. The impact is being felt unevenly across the country, as the Midwest saw the steepest annual drop in completions (–55.7%), followed by the South (–33.5%), Northeast (–33.0%), and West (–28.9%).

Owners of multifamily units have resorted to offering renter concessions to attract or retain tenants, thus reducing the cost of renting a property for a specific period, including free rent for a month, reduced rent, waived fees (like application or pet fees), or even free amenities, for example.

Recent data from Apartments.com examined the tactics landlords are using to attract renters in today’s marketplace. With affordability still top of mind for many, incentives like a free month of rent are emerging as leverage for property owners seeking to house tenants. The study found that 36% of renters said a free first month or rent would be the strongest factor to signing a lease when choosing between comparable apartments.

With the strength of concessions as a driver for landlords, the Apartments.com survey found that 88% of renters said they would consider overlooking minor flaws in an apartment for a good rent concession, while nearly a third of renters value a rent concession that provides ongoing value throughout the term of their lease, and 95% of renters said a concession mentioned in a listing would make them more likely or potentially more likely to inquire about the property.

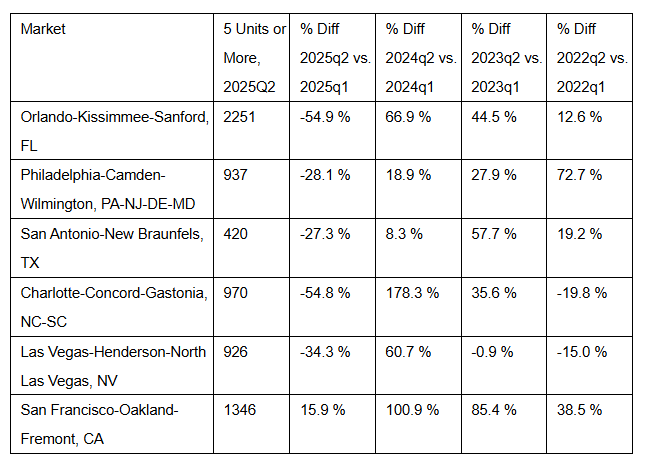

Local Permitting Trends Vary

Permitting trends across large metro areas show that some markets are already feeling the effects from higher construction costs and compressed profits:

- Orlando, Florida: Permits for multifamily units dropped -54.9% from Q1 to Q2 2025—the first Q2 decline since 2022.

- Philadelphia, Pennsylvania and San Antonio, Texas also saw their first Q2 permitting dips in three years.

- Charlotte, North Carolina and Las Vegas, Nevada experienced their largest quarterly permitting declines in Q2 since 2022.

- San Francisco, California, which saw a modest increase, posted its slowest Q2 growth in permitting in three years.

These local slowdowns suggest that developers are responding to worsening conditions by reducing plans for new projects—an early warning sign that the supply of new rental units could tighten over time. Looking ahead, the doubled tariffs on imported steel and aluminum announced in June could make this condition worse.

Recent data from the NAHB found that in Q2, confidence in the market for new multifamily housing increased year-over-year in the second quarter. NAHB’s Q2 Multifamily Production Index (MPI) had a reading of 46, up two points year-over-year, while the Multifamily Occupancy Index (MOI) had a reading of 82, up one point year-over-year.

”Multifamily developer confidence and sentiment are showing slight signs of improvement when compared to this time last year,” said Debra Guerrero, SVP of Strategic Partnerships and Government Affairs at The NRP Group in San Antonio and Chair of NAHB’s Multifamily Council. “High interest rates, rising construction costs, limited land availability and restrictive local regulations are still significant issues in certain parts of the country. But confidence in subsidized affordable housing has shown considerable improvement in this survey, due in part to optimism surrounding the expansion of federal affordable housing resources flowing from the recent congressional reconciliation bill.”

Tracking Trends by Unit Size

While rent prices historically rise during the spring and summer months, this year’s seasonal lift has been softer than usual. As of July, rents were up just 1.2% year-to-date, compared to 2.8% growth over the same period in 2024.

Despite near-term affordability gains for renters, the sharp drop in multifamily completions and early signs of weakening permitting activity may shift market dynamics later this year or in 2026.

For the study, Realtor.com examined rental data as of July 2025 for studio, one-bedroom, or two-bedroom units. Rental units include apartments, as well as private rentals (condos, townhomes, single-family homes).

Click here for more on Realtor.com’s examination of July 2025 trends in the rental market.