This article originally appeared in the August 2025 edition of MortgagePoint magazine, online now.

The number of vacant properties available for bank-owned auction rose to a more than four-year high in the first quarter of 2025, according to Auction.com data. That’s good news for prospective auction buyers who are less experienced and more risk-averse—including owner-occupants.

It’s also good news for community revitalization and local housing market health. Vacant properties contribute to neighborhood blight the longer they sit vacant but often represent affordable housing inventory once renovated and returned to the retail market by auction buyers.

“I don’t understand when a property is vacant for a year or two years, why they keep postponing the sale,” said Landon Cunningham, VP of Client Relations at Tenet Capital, a Spokane, Washington-based lender that provides financing for buyers at auction. “Those houses are going to become more and more dilapidated. More crime, more people squatting in that house.”

Cunningham noted that when vacant foreclosures are renovated, it’s a win-win-win for the neighborhood, local economy, and new homeowners.

“The neighbors are happy, you are providing jobs to the contractors, and somebody has a nice house they can move into,” he said.

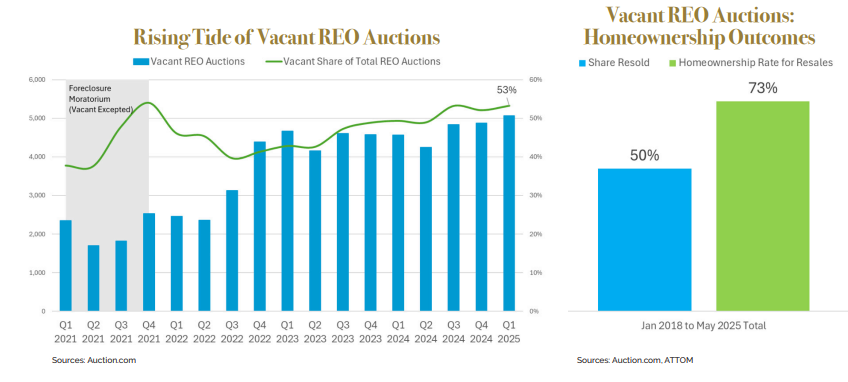

More than 5,000 vacant REO auctions occurred on the Auction.com platform in the first quarter, up 4% from the previous quarter and up 11% from a year ago to the highest level since the third quarter of 2020—soon after the onset of the COVID-19 pandemic.

Vacant properties represented 53% of all REO auctions in the first quarter, the highest level since Q4 2021, when the nationwide foreclosure moratorium on government-backed mortgages expired. Vacant properties were exempted from the moratorium, so they represented a bigger share of a smaller REO auction pie in 2020 and 2021, when the moratorium was in effect.

From Vacant to Owner-Occupied

Until they’re sold, vacant REOs represent risk for the surrounding neighborhood as deferred maintenance issues pile up and the property becomes a magnet for vandalism. On the flip side, these properties also represent latent opportunity for the local housing market. Once sold to a local community developer at auction, they can be transformed into quality, affordable housing.

“It had been vacant for quite a while … probably a year, so it was not very well taken care of,” said Auction.com buyer Francois Delille about a Houston-area property he purchased at auction in 2022. Following renovations, he returned the property to the retail market as a rental. “The house being vacant, that’s such a waste. … If that house had been to auction six months earlier, it would have been rented six months earlier. “

Auction.com buyers like Delille have purchased more than 45,000 vacant REOs over the last seven years. More than half of those are now owner-occupied (23,456), with 73% of the resales of those vacant REOs (when buyers like Delille resell) going to owner-occupants.

Affordable Housing Supply

Among the vacant REOs renovated and resold, the average sale price was a relatively affordable $301,156, requiring 31.1% of the local family income to buy on average—including mortgage, property taxes, and insurance. That’s according to an Auction.com analysis of public record data.

Those not resold typically represent quality, affordable rentals. The average estimated rent for vacant REO purchases not resold was $1,591, representing 24.1% of the local family income, on average.

These quality, affordable rentals go to tenants like Dana Morgan, who now rents a home that Delille, previously purchased as a vacant REO.

“(We had looked at) 300 to 400 properties, and none of them had a bedroom downstairs that fit the lifestyle that we needed for my family,” said Morgan, describing his search for a rental property in an Auction.com video. “So, this property was perfect.”

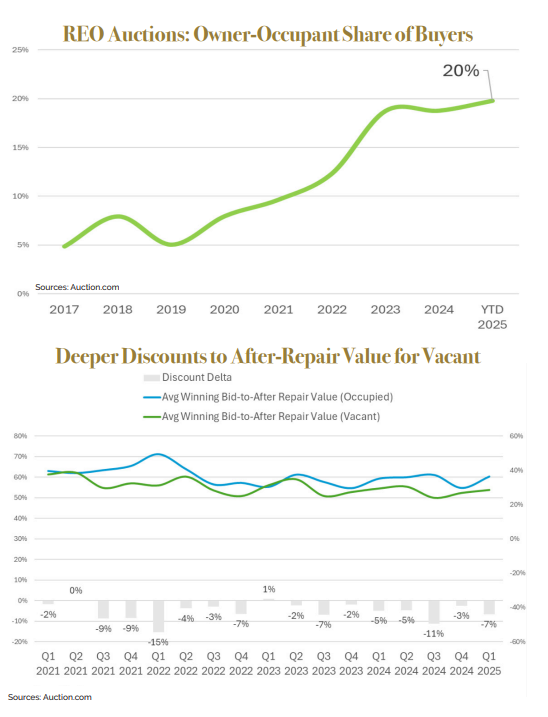

More Owner-Occupant Buyers

Experienced local community developers like Delille and Cunningham aren’t the only buyers interested in vacant REOs, which are often more accessible and appealing to a broader pool of less-experienced auction buyers—including owner-occupants. Auction.com data shows 20% of REO auction sales so far in 2025 going to owner-occupant buyers, up from 19% in 2024 to a new high as far back as data is available, 2017.

Vacant REO auctions are attractive to owner-occupants and other less-experienced auction buyers for a couple reasons. First, they typically come with an interior inspection and appraisal, making their valuation more certain and lessening the risk that a buyer will pick up a money pit property with myriad unexpected repairs. Because there is no current occupant, buyers don’t have to factor in the additional time and money costs that come with a possible eviction.

More Precise Pricing

The higher valuation certainty also means that vacant REOs can be priced more precisely by sellers, and that translates into bigger discounts—relative to after-repair value—for buyers.

The average winning bid-to-after-repair value ratio for vacant REOs purchased on the Auction.com platform in the first quarter of 2025 was 54%, 6 percentage points below the ratio of 60% for occupied REOs. That 6-point delta is consistent with the long-term average going back to 2017.

Conversely, the average winning bid-to-appraisal value ratio for vacant REOs purchased on the Auction.com platform in the first quarter was 83%, 7 percentage points above the ratio of 76% for occupied REOs. Because the appraisal for vacant REOs can be based on an interior inspection of the property—not possible with occupied REOs—the appraisal value is a more accurate reflection of the true “as-is” value for vacant properties than it is for occupied properties.

Clearing Out Older Inventory

The rise in vacant REO auctions over the past three years has helped to clear out the inventory of properties that have been sitting vacant for some time, weighing down surrounding property values and undermining neighborhood stabilization.

Vacant REO properties brought to auction in the first quarter of 2025 had been bank-owned an average of 345 days, down from an average of 744 days a year ago and down from an average of 1,323 days in the first quarter of 2022, immediately after the foreclosure moratorium was lifted.

Despite the decrease, vacant REOs have been in foreclosure longer than occupied REOs. Occupied REOs brought to auction on Auction.com in the first quarter of 2025 had been bank-owned an average of 268 days, down from 633 days a year ago and down from 1,306 days in Q1 2022.

Rural Concentration

Vacant REOs available for auction are heavily concentrated in more rural areas, with 72% of the Q1 2025 volume in an area designated as rural by the Census Bureau. But that doesn’t mean the properties are far from civilization. Only 8% were in areas designated as Rural-Remote (25 miles or more away from an urbanized area), while 30% were within five miles of an urbanized area.

Among major metro areas, the biggest annual increases in vacant REO properties brought to auction in the first quarter of 2025 were found in Seattle; Wichita Falls, Texas; Phoenix; Colorado Springs; and Los Angeles.

Among major metro areas, those with an above-average share of vacant REO auctions in the first quarter of 2025 included Houston; Phoenix; Los Angeles; Riverside, California; and Baltimore.