For many older Hispanic homeowners, a house represents not just a place to live but their most valuable financial asset. Yet turning that asset into a financial legacy is far from guaranteed. A new analysis from the Harvard Joint Center for Housing Studies highlights the barriers that keep many Hispanic families from preserving and transferring their housing wealth to the next generation.

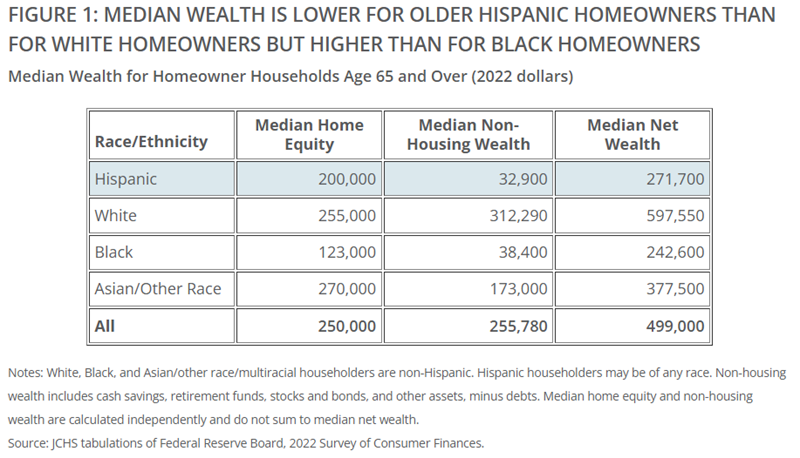

In 2022, Hispanic homeowners age 65 and older held significantly less wealth outside their homes than white homeowners. Median non-housing wealth for Hispanic owners was just $32,900, compared to $312,290 for white owners. Limited income also plays a role. The median income for older Hispanic households was $41,000, well below the $55,590 reported for white households.

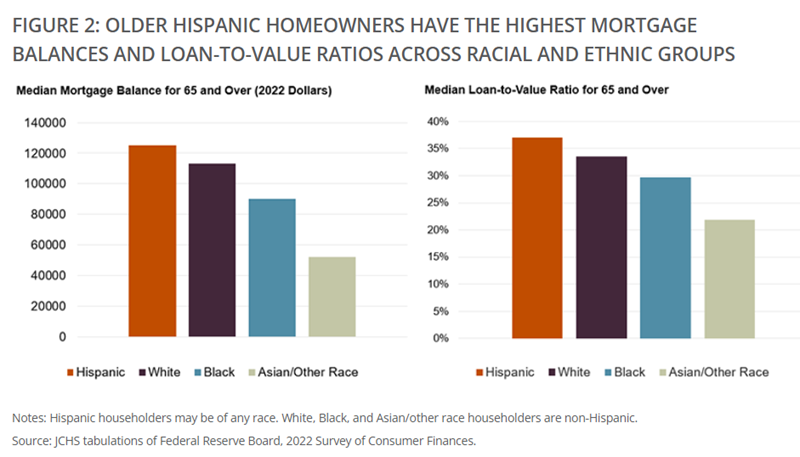

At the same time, housing costs remain a significant burden. Older Hispanic homeowners who still carry a mortgage had median monthly payments of $911, higher than the $773 average for their white peers. Many Hispanic households also live in high-cost areas, which can eat into home equity gains.

One major issue is limited cash reserves. Hispanic owners aged 65–74 had a median of only $3,000 in cash savings, which is a fraction of the $31,400 that white homeowners had. This makes it difficult to cover needed home repairs or make accessibility upgrades. According to the report, “New pressures may also arise in later life, including increased healthcare expenses, more functional limitations, and new caregiving responsibilities.”

Carrying housing debt into retirement compounds the challenge. Nearly 40% of Hispanic homeowners over thew age of 65 still had a mortgage in 2022, compared to about 33% of white owners. Those Hispanics with mortgage debt often had higher balances and owed more relative to their home’s value, according to the report.

This results in many older Hispanic households now being left with fewer resources to support children or grandchildren. Just 7.2% of Hispanic households reported receiving an inheritance or financial gift, compared to nearly 30% of white households.

“Homeownership alone does not ensure long-term financial security or generational wealth for all households,” the report concludes. “Without broader support, such as lower housing costs, better caregiving assistance, and help with accessibility needs, the gap is unlikely to close.”

Click here for more on the Harvard Joint Center for Housing Studies report on Hispanic generational wealth.