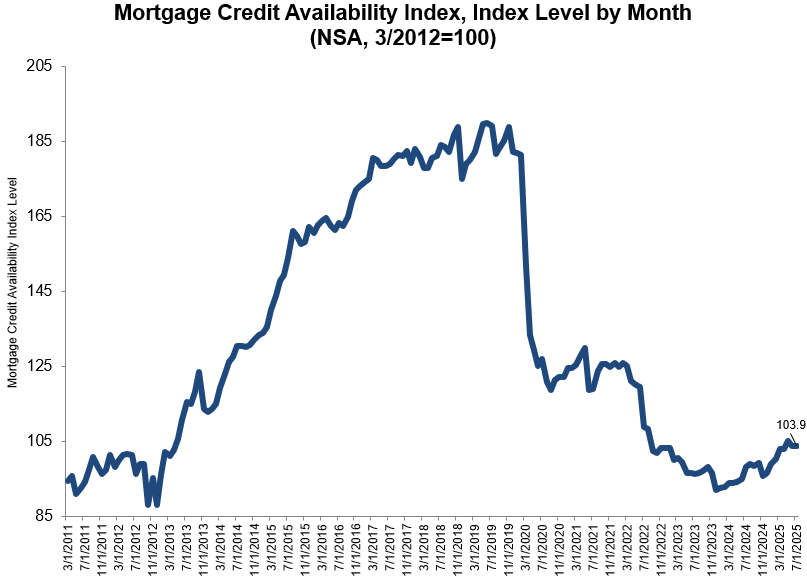

The Mortgage Credit Availability Index (MCAI), a survey from the Mortgage Bankers Association (MBA) that examines data from ICE Mortgage Technology, indicates that mortgage credit availability rose in July. This is according to a recent report that revealed the share of increases shown and whether credit is loosening or tightening for potential homebuyers.

In July, the MCAI increased by 0.2% to 103.9. While an increase in the index signifies loosening credit, a decrease in the MCAI suggests tighter lending rules. In March 2012, the index was benchmarked at 100. While the Government MCAI fell by 0.2%, the Conventional MCAI rose by 0.5%. The Conforming MCAI decreased by 0.5%, while the Jumbo MCAI rose by 0.9% among the Conventional MCAI’s component indices.

“Credit availability edged slightly higher in July, driven by increased availability of ARM loans,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “This development was consistent with a steeper yield curve and the jumbo-conforming spread back in negative territory. The average jumbo rate was around 8 basis points lower than the average conforming rate in July. Additionally, data from a separate survey showed that ARMs loan applications have picked up in recent months, although activity is still muted compared to historical averages. Credit availability of conforming loans declined slightly over the month, mostly due to a pullback in renovation loans.”

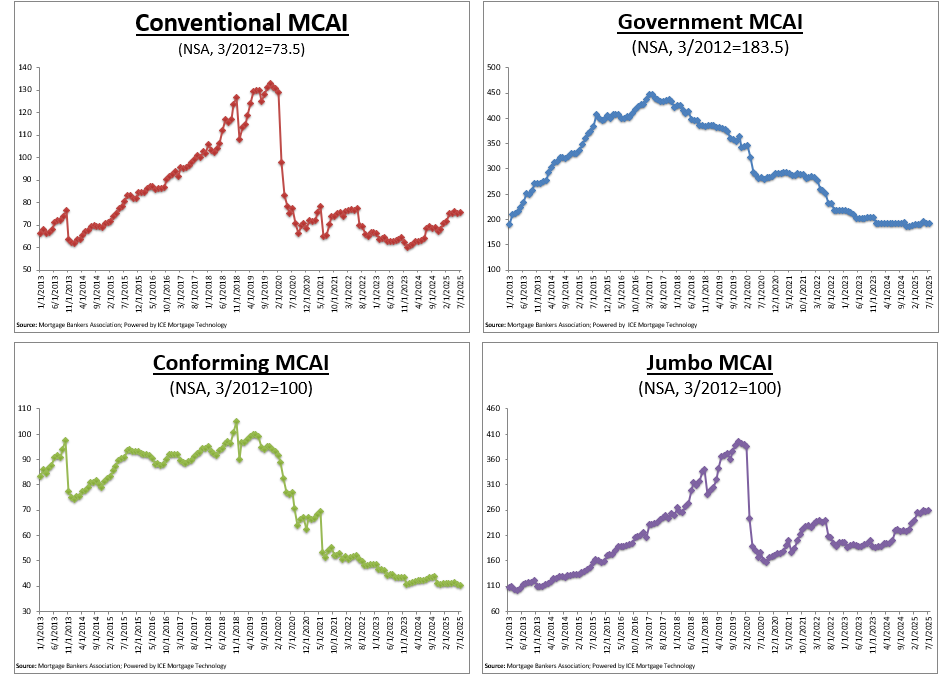

Conventional, Government, Conforming, & Jumbo MCAIs

In July, the MCAI increased by 0.2% to 103.9. While the Government MCAI fell by 0.2%, the Conventional MCAI rose by 0.5%. The Conforming MCAI decreased by 0.5%, while the Jumbo MCAI rose by 0.9% among the Conventional MCAI’s component indices.

Using the same technique as the Total MCAI, the Conventional, Government, Conforming, and Jumbo MCAIs are created to demonstrate the relative credit risk and availability for their respective indices. The population of loan programs that are examined is the main distinction between the Component Indices and the entire MCAI. While the Conventional MCAI looks at non-government loan programs, the Government MCAI looks at FHA, VA, and USDA loan programs.

FHA, VA, and USDA loan offerings are not included in the Jumbo and Conforming MCAIs, which are a subset of the standard MCAI. Conventional lending programs that come inside conforming loan limitations are examined by the Conforming MCAI, whereas conventional programs outside of conforming loan limits are examined by the Jumbo MCAI.

Note: The Conventional and Government indices have modified “base levels” in March 2012, however the Conforming and Jumbo indices have the same “base levels” as the Total MCAI (March 2012=100). To more accurately depict where each index might be in March 2012 (the “base period”) in relation to the Total=100 benchmark, MBA calibrated the Conventional and Government indices. Data prior to 3/31/2011 was generated using less frequent and less complete data measured at 6-month intervals interpolated in the months between for charting purposes.

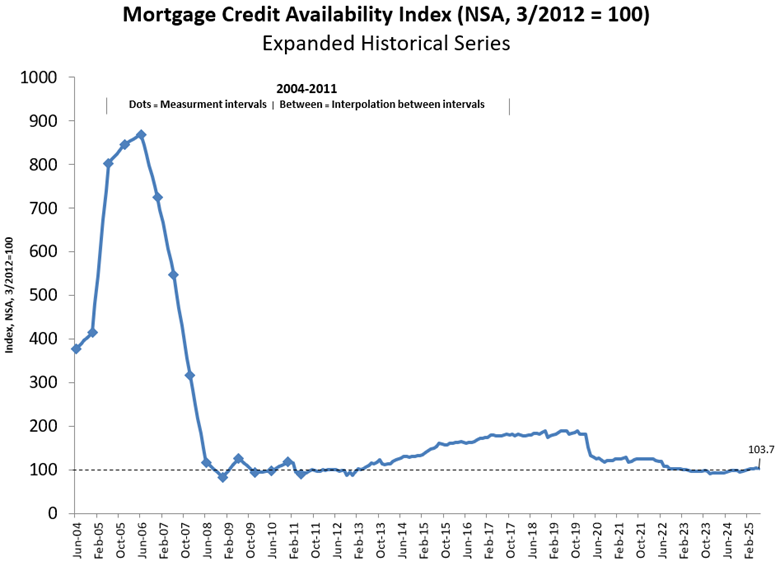

Expanded Historical Series Overview

Conventional, Government, Conforming, and Jumbo MCAI are not included in the enlarged historical series of the Total MCAI, which provides perspective on credit availability spanning around ten years. The purpose of the expanded historical series, which runs from 2004 to 2010, is to give the current series historical perspective by illustrating how credit availability has changed over the past ten years, including the housing crisis and the recession that followed.

Less frequent and incomplete data were measured at 6-month intervals and interpolated for charting purposes in the months previous to March 31, 2011. Further, there has been no update to the methodology for the expanded historical series from 2004 to 2010.

To read more, click here.