Although the U.S. housing market appears to be improving, many Americans believe that the market has stagnated. The most recent report from Realtor.com, Cruel Summer: Why the U.S. Housing Market is Stuck, buyers, sellers, and builders all face unique difficulties, they are all bound together by a shared frustration.

“The housing market is caught in a collective slowdown, touching everyone from buyers to sellers to builders,” said Jake Krimmel, Senior Economist at Realtor.com. “Despite facing different pressures, each group is reacting the same way, with hesitation and retreat. The result is a market that can’t gain meaningful traction. That being said, a more balanced market is emerging, creating opportunities for those with the patience and flexibility to adapt.”

Despite approximately 21 straight months of increased inventory, home sales are still close to multi-decade lows. This summer alone (May 2025–July 2025), inventory has increased by an estimated 28%, surpassing one million homes for three consecutive months and hitting its highest levels since November 2019. In many areas, prices have leveled out, but high mortgage rates and economic uncertainty are deterring buyers and sellers. According to the survey, all parties involved are retreating, which is causing the housing market to be characterized more by a collective stop than by a housing crisis.

Home Costs, Mortgage Rates Hindering Buyers Nationwide

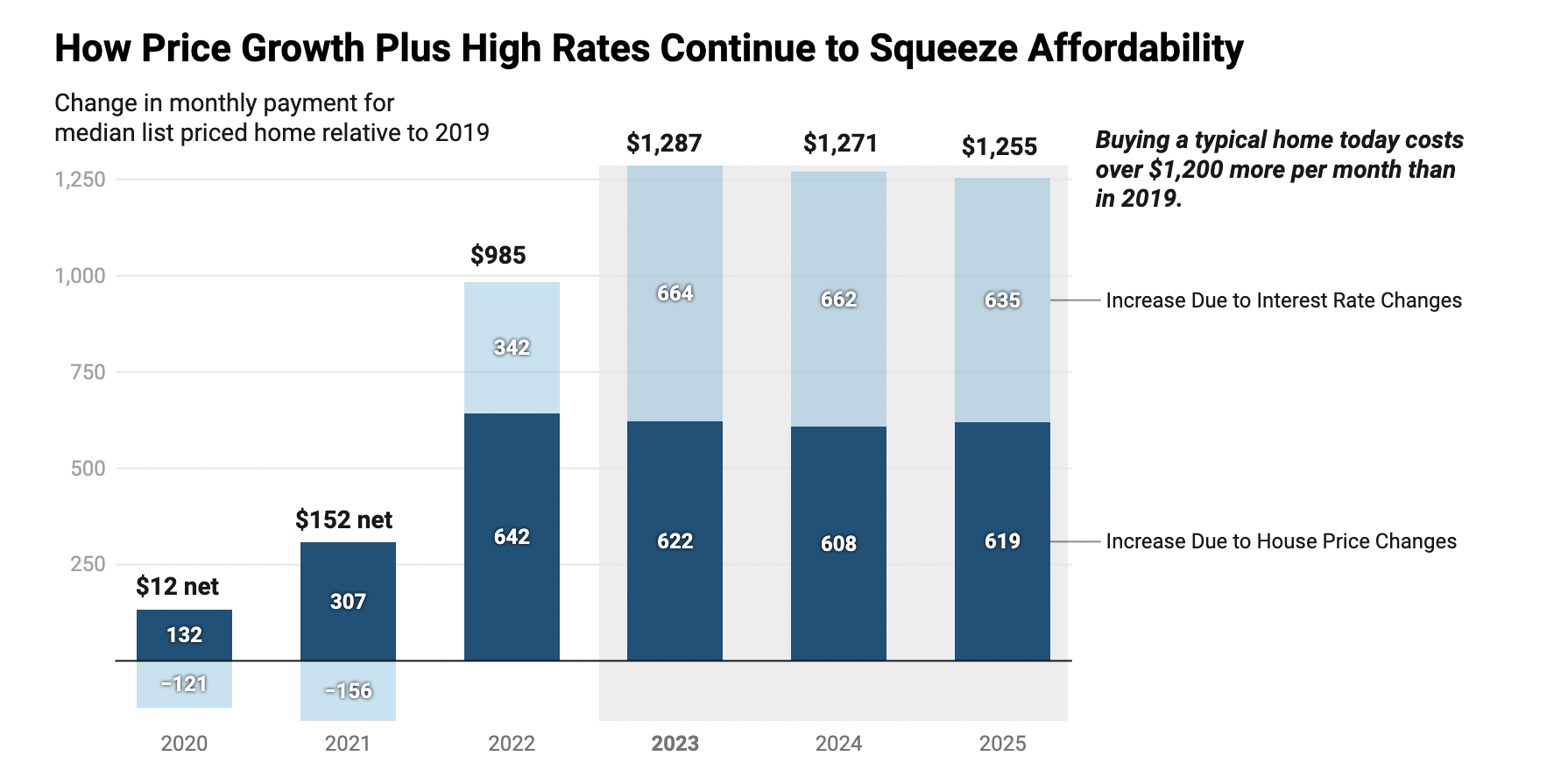

Affordability remains a significant barrier for home purchasers. Although mortgage rates have increased, resulting in noticeably higher monthly payments, the national median list price is still close to $440,000, essentially unchanged from 2022. Today’s purchasers are paying more than $1,200 more a month for the median-priced home than they did in 2019, as a result of increased interest rates and price growth.

Incomes have climbed, but they haven’t kept up with the rising cost of home ownership. The “double whammy” of high rates and residual price appreciation has kept buying power low and excluded many potential buyers, even in places where prices have dropped. Only 28.0% of properties on the market were priced within the means of the average household, which makes an estimated $78,770 per year, according to Realtor.com’s most recent Buying Power Report.

Additionally, sellers are negotiating in a challenging environment. Many homeowners are still hesitant to cut rates, even when demand has decreased. Rather than compromise on the price they have in mind, many are opting to completely delist their homes. In June 2025, the delisting-to-new listing ratio increased from 0.13 in May to 0.21, meaning that 21 new listings were withdrawn without a sale for every 100. The ratio was considerably greater in some metro areas, like Miami, where there were 59 delistings for every 100 new listings.

The pace of inventory expansion is being slowed by this dynamic as well as a recent decline in new listings. The reluctance of sellers to modify their prices is causing transactions to stall and maintaining high prices, which exacerbates affordability problems.

The pressure is also being felt by home builders. Permits are declining, the pipeline of new building is getting smaller, and single-family home construction is declining. Permits increased by 0.2% month over month in June 2025, although they were 4.4% less than in June of the previous year. Despite a 4.6% increase from May 2025, starts were still less than those in June 2024 (-0.5%).

Housing developers have been more cautious due to factors like high financing prices, low customer demand, and new building material tariffs. The nation still lacks an estimated four million dwellings at the time of this reversal. Although builders are still necessary to bridge the long-term supply gap, the present climate is making it more difficult to defend new projects.

Home Sales & Prices Remain a Financial Hurdle for Americans

The report showed that a sharp regional difference also complicates the situation. Slower sales and price reductions have resulted from supply exceeding demand in the South and West. With over 50% of both new and existing home listings as of July 2025, the South surpassed its 39.4% share of American households in terms of housing supply. On the other hand, the Midwest and Northeast continue to be competitive markets with strong demand and little supply.

This geographical fragmentation highlights the significance of localized strategies for buyers, sellers, and governments alike, and makes it more difficult to assess national patterns.

The housing market is not experiencing a crisis in spite of these difficulties. The majority of homeowners have a sizable equity balance. Low interest rates are locked in for many. Further, even if activity has slowed, the foundations have not changed. Conditions for a healthier, more balanced market may progressively materialize as interest rates start to decline and market players modify their expectations.

Additionally, mortgage rates in 2019 ranged from 3.5% to 4.5%, with a downward tendency as the year went on. Although they weren’t the lowest rates ever recorded during the COVID-19 pandemic years that followed, they were significantly lower than what we currently observe. Rates have really been persistently high in 2025, spending the majority of the year in the 6.5% to 7% area.

Consider a $400,000 house to see how that impacts monthly budgets: With a 20% down payment and a 4% interest rate, the monthly principal and interest payment would be around $1,500. That loan costs $2,100 a month at a 6.75% interest rate, which is close to what experts have seen lately. The difference in monthly financing costs is $600, or $7,200 annually.

| Metro | 2019 Max Target Home Price | Share of Homes for Sale < Target (July 2019) | 2025 Max Target Home Price | Share of Homes for Sale < Target (July 2025) | Difference in Max Target Price (2025 vs. 2019) | Change in Buying Power (%) |

| Milwaukee-Waukesha, WI | $314,000 | 58.2% | $281,000 | 28.3% | -$33,000 | -10.5% |

| Houston-Pasadena-The Woodlands, Texas | $330,000 | 59.2% | $299,000 | 32.4% | -$31,000 | -9.4% |

| Baltimore-Columbia-Towson, MD | $397,000 | 63.1% | $360,000 | 42.7% | -$37,000 | -9.3% |

| New York-Newark-Jersey City, NY-NJ | $397,000 | 28.2% | $360,000 | 13.1% | -$37,000 | -9.3% |

| Kansas City, MO-KS | $335,000 | 63.5% | $304,000 | 34.2% | -$31,000 | -9.3% |

Milwaukee, Houston, Baltimore, New York City, and Kansas City have had the biggest declines in purchasing power over the last six years. Less notable salary growth has been observed in the markets, which has only made the problems with house affordability worse. In 2019, a Milwaukee household with a typical income could purchase a home for $314,000. A median-earning household could now afford a $281,000 home, a 10.5% decrease.

The homeownership rate is under pressure to decline, particularly for younger households, as buyers are compelled by declining purchasing power to choose smaller homes, longer commutes, or to put off home purchases entirely. Due to a shortage of reasonably priced inventory and deteriorating affordability conditions, buyers are deterred from entering the market and postpone their plans to purchase a property. As a result of this change in buyer demand, sellers increase prices to attract more activity and homes remain on the market longer.

To read more, click here.