According to recent Redfin research, the number of home sellers in the U.S. housing market has decreased by roughly 14,000 over the last two months, from a peak of 1.96 million in May to 1.95 million in July. This is the first drop since July 2023, when rising mortgage rates made homeowners reluctant to sell, causing the supply of available homes to drop to almost a historic low.

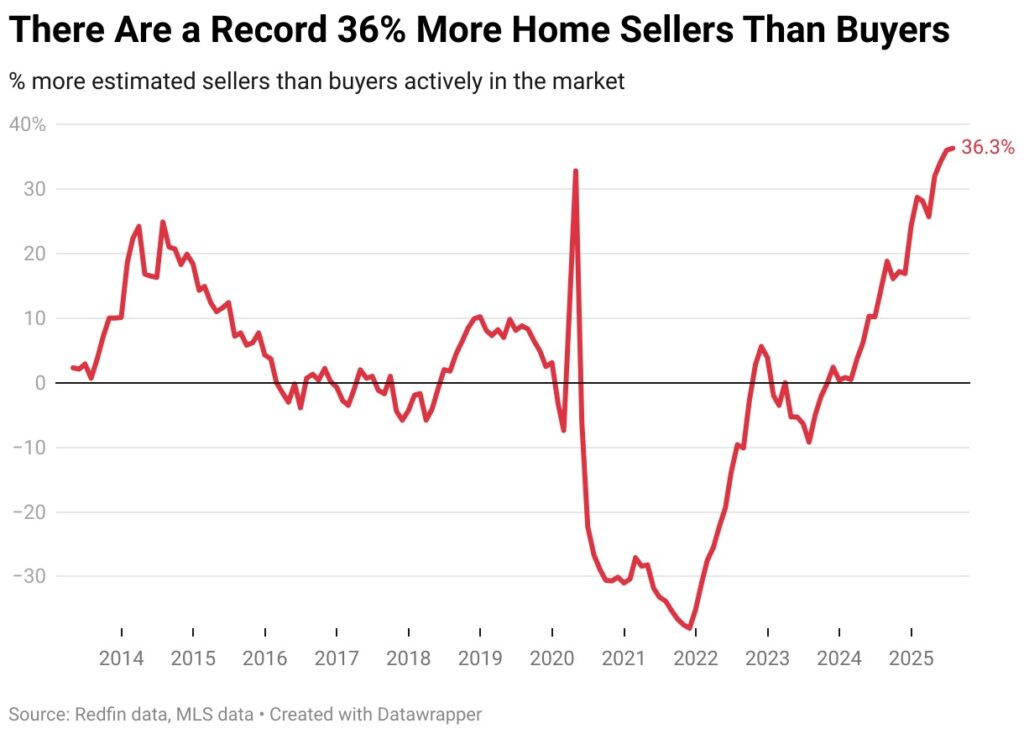

With an estimated 1.43 million purchasers in the property market in July, the lowest number on record aside from the start of the pandemic, when the housing market came to a complete halt, sellers still outnumber buyers by the largest margin in records going back to 2013.

The market had an increasing number of sellers until recently. This is due in part to the slow pace of home sales, which has resulted in an accumulation of stale listings, and in part to the easing of the mortgage-rate lock-in impact. The number of sellers in the market had reached a five-year high, according to a May analysis from Redfin, which also forecast that sellers would begin to shift their strategies once they recognized that the market was a buyer’s market. Per the report, that trend is currently taking place right now.

“Homebuyers are spooked by high home prices, high mortgage rates and economic uncertainty, and now sellers are spooked because buyers are spooked,” said Asad Khan, Senior Economist at Redfin. “Some sellers are delisting their homes or choosing not to list at all after seeing other houses sit on the market for weeks or months, only to fetch less than the asking price.”

Is the Current Market Favoring Buyers or Sellers?

Because home sellers are pulling back, inventory is starting to tick down, which is likely why home prices are now heating up slightly. The median home sale price rose 1.4% year-over-year (YoY) in July to $434,189—the highest July level on record. By comparison, prices rose 1.2% YoY in June and 1.1% YoY in May. This is notable because at the beginning of the year, home-price growth was shrinking.

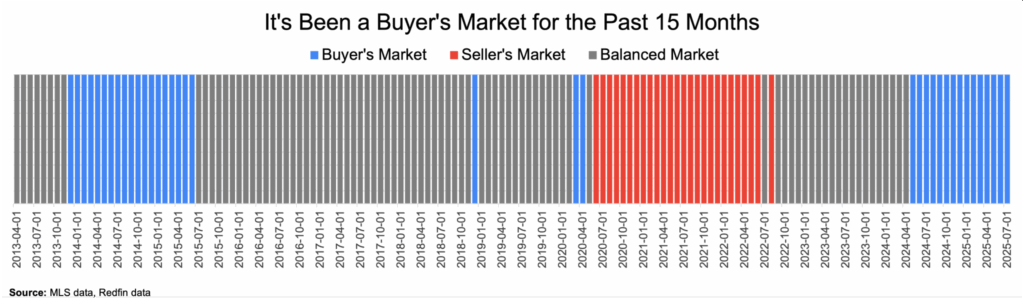

The market has the biggest discrepancy in records since 2013, with 518,801 more selling than buyers, or 36.3% more sellers than buyers. To put it another way, it has been a buyer’s market for the last 15 months, at least nationally.

According to Redfin, a market is considered a buyer’s market if there are more than 10% more sellers than buyers, and a seller’s market if there are more than 10% less sellers than buyers. A market is said to be balanced if the difference is within a range of 10%.

“We’re likely in the most buyer-friendly housing market since the 2008 financial crisis,” Khan said. “Back then, inventory piled up as foreclosures surged, and demand was weak, meaning buyers had negotiating power. We’re not headed for another 2008, though; many of today’s homeowners have built substantial equity thanks to the recent surge in home values, and today’s borrowers must meet stricter lending standards. Plus, there are more options for avoiding foreclosure if a homeowner is at risk of defaulting, such as loan modification.”

Naturally, the market is only favorable to those who can afford to purchase. With home prices at a record high for this time of year and mortgage rates more than double their historical low, many Americans have been priced out of the housing market entirely in recent years. The good news is that mortgage rates have decreased recently, which may encourage some purchasers to make a move.

There are an estimated 8,293 homebuyers and 21,637 house sellers in Miami. This indicates that there are 160.9% more sellers than buyers, which is the biggest disparity among the 50 most populated cities in the U.S. The popular Florida metro is followed by Fort Lauderdale, FL (151.2% more sellers than buyers), Austin, Texas (123.8%), West Palm Beach, FL (123.4%) and San Antonio (113.1%).

Overall, 35 of the 50 most populous metros are buyer’s markets, 10 are balanced markets and five are seller’s markets. The buyer’s markets are concentrated in the Sun Belt and on the West Coast, while balanced markets and seller’s markets skew more toward the Midwest and East Coast.

“It’s a true buyer’s market in San Antonio. Buyers are patient, selective, value conscious, and aware of their increased negotiating power. When they make offers, they ask for the moon,” said local Redfin Premier real estate agent Jesse Landin. “Sellers are struggling to adapt—their expectations are anchored to 2021, when homes were flying off the market for thousands of dollars over the asking price. A growing number are exploring alternatives. Some are entertaining low-ball offers from investors or even foreclosure. Others are considering pulling their home off the market and becoming a landlord if they don’t achieve their desired asking price. The problem is that the rental market is also slow.”

One of Landin’s clients purchased his house in 2020 and has been renting it out ever since. However, due to difficulties finding renters, he recently decided to list it for sale. After four months without a buyer, he is now thinking of delisting the house and attempting to rent it out once more.

Regional Trends Shift as Buyers Continue to Relocate

During the pandemic, the Sun Belt had a sharp increase in population as a large number of homebuyers from more affluent regions of the nation relocated there, pushing up house prices and forcing many residents out of the market. One reason why there are currently far more homes for sale than there are buyers is because homebuilders increased their operations to match the soaring demand. According to Landin, inventory estimates may be overstated because many newly constructed homes in San Antonio are not listed in the MLS.

“Regular sellers are competing with homebuilders for buyers,” Landin said. “If your house was built three years ago and has the same floorplan as a newbuild down the road, you have to list it for less than the newbuild, especially because builders are offering all sorts of powerful incentives to woo buyers. This is putting major pressure on individual sellers—particularly those who bought at the peak of the pandemic market and need to recoup their investment.”

More homes are still being built in Florida and Texas than in any other state. Some homeowners have left Florida as a result of the state’s worsening natural disasters, skyrocketing insurance costs, and growing condo HOA dues.

Home prices are declining in several areas of Florida and Texas as the power is still solidly in favor of buyers. With the exception of Oakland, California, which is also a buyer’s market, West Palm Beach saw the largest loss in the nation in July, with the median sale price down 3.5% YoY. With an estimated 3.3% drop, Austin finished in third place. Home prices in the 35 buyer’s markets were, on average, about unchanged (+0.5%) from a year ago, while prices in the five seller’s markets increased by 5.1%.

With an expected 5,591 sellers and 11,654 buyers, or 52% fewer sellers than buyers, Newark, New Jersey, has the best seller’s market. The other four seller’s markets are Nassau County, NY (40.5% fewer sellers than buyers), Montgomery County, PA (36.1% fewer), New Brunswick, NJ (22.2% fewer) and Minneapolis (12.5% fewer).

Because new building affects nationwide supply and demand, it can have a big impact on whether buyers or sellers have more negotiation power. Building permits are most frequently issued in the South, then in the West, Midwest, and Northeast. While all of the seller’s markets are in the Northeast or Midwest, several of the country’s buyer’s markets are in the South.

Since Redfin last performed this analysis in April, San Antonio’s seller-to-buyer ratio has increased from 89.4% to 113.1%. The biggest increase among the 50 most populated metro areas is 23.7 percentage points. Next comes Virginia Beach, VA (+19.2 ppts to 21.5%), Pittsburgh (+18.5 ppts to 32%), Denver (+16.1 ppts to 61.2%) and Charlotte, NC (+14.7 ppts to 80%).

To read the full report, click here.