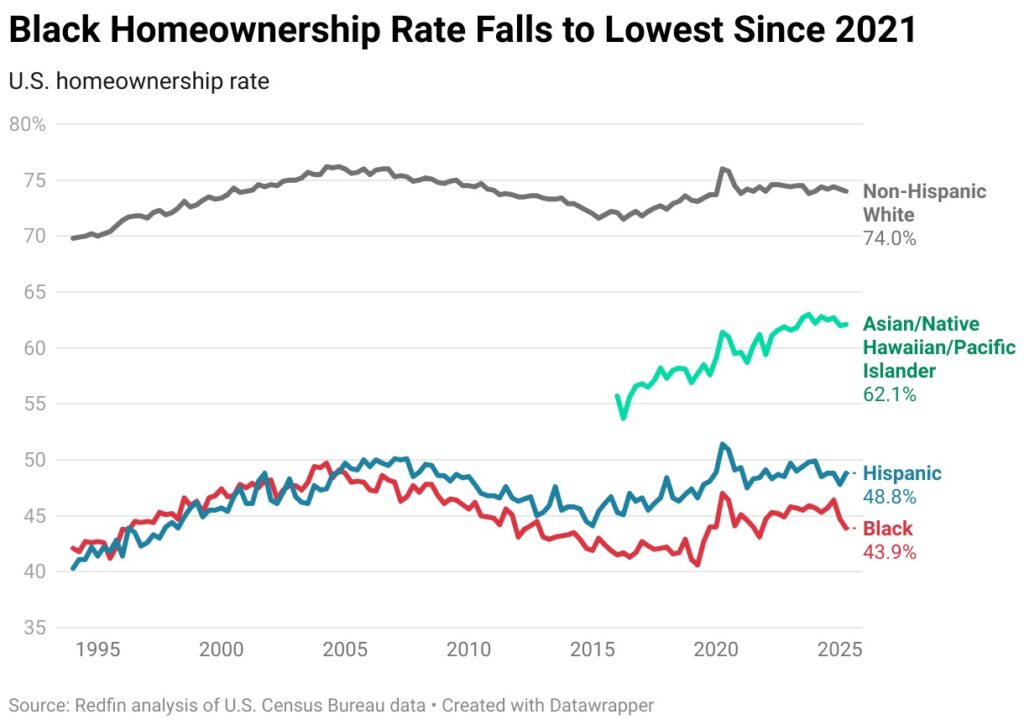

According to the latest data from Redfin, the Black homeownership rate dropped to 43.9% in Q2, the lowest level since Q4 of 2021. That was the biggest year-over-year drop since the third quarter of 2021, down from 45.3% a year earlier.

In contrast, the Hispanic homeownership rate increased marginally (from 48.5% to 48.8%) and the non-Hispanic white homeownership rate decreased slightly (from 74.4% to 74.4%) and the Asian/Native Hawaiian/Pacific Islander homeownership rate decreased (from 62.8% to 62.1%).

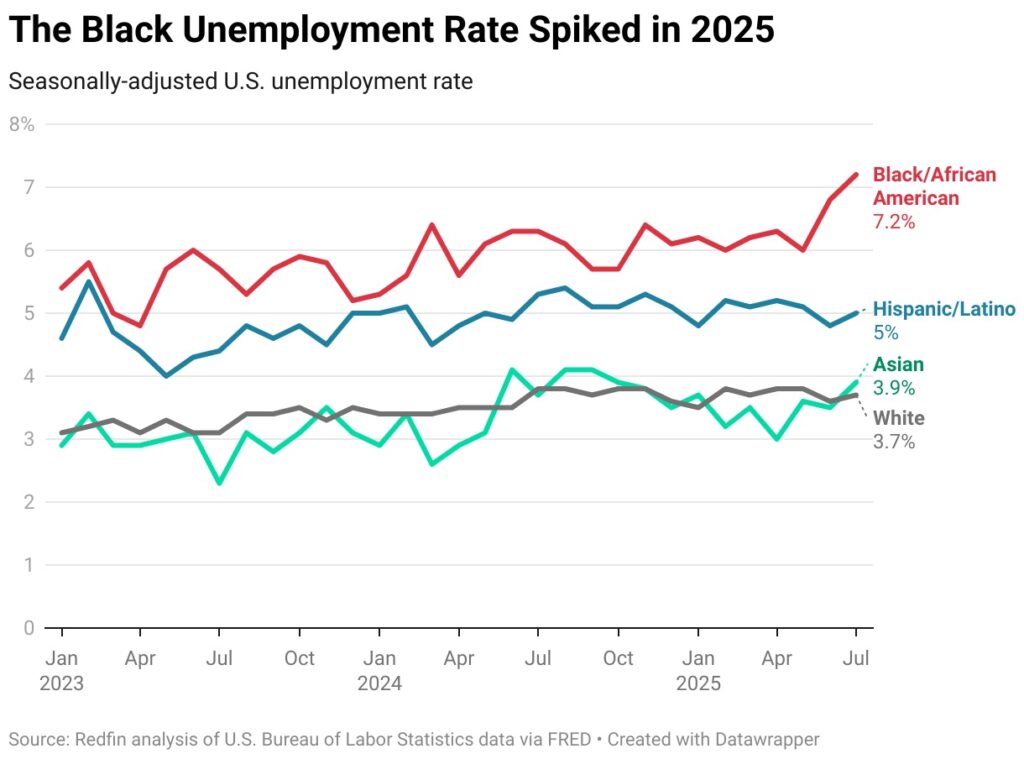

“Rising unemployment is one likely reason the homeownership rate for Black families has dropped recently,” said Redfin Chief Economist Daryl Fairweather. “The recent wave of federal layoffs hit Black households badly because government jobs have historically been an avenue of upward mobility for Black workers. DEI programs have also been dismantled in workplaces across the private and public sectors, which may have resulted in fewer Black employees being hired or promoted.”

While racial disparities continue to exist in the U.S. housing market, the Black community is facing a lot of them.

Unemployment Affecting the Black Community & Home Purchases

As of July, the Black/African American unemployment rate was 7.2%, the highest since October 2021 and up from 6.3% the previous year. While unemployment rates for other groups remained relatively stable, the Asian unemployment rate increased from 3.7% to 3.9%, the white unemployment rate decreased from 3.8% to 3.7%, and the Hispanic/Latino unemployment rate decreased from 5.3% to 5%.

The unemployment rate for Black/African American women has increased significantly, going from 5.5% in July to 6.3% in July. Although it was greater, the unemployment rate for Black/African American men increased less sharply, from 6.6% to 7% in the previous year.

According to a 2024 National Association of Realtors survey, women made up 33% of Black and African American homebuyers, far more than single men, who made up 12% of the market.

Many Americans have found it challenging to become homeowners in recent years due to rising housing prices, high mortgage rates, and economic and job market uncertainties, but these issues are gradually subsiding. After peaking at over 7% at the beginning of the year, the average 30-year-fixed mortgage rate has dropped below 6.5%, seemingly encouraging at least some homeowners to take the plunge.

“Behind the decline in Black homeownership are families who aren’t building stability and wealth through housing,” said Fairweather. “For Black households who feel locked out of the American dream, the good news is that affordability is improving as mortgage rates come down, home prices are growing at less than half the pace they were a year ago, and buyers have been gaining negotiating power.”

Experts advise trying to be eligible for a homebuyer assistance program if you want to buy a house but are unsure of your financial situation. For instance, those who experienced housing discrimination in the early to mid-20th century and their descendants can now receive homebuying aid through new programs.