August had the first month-over-month decline since March 2025 and the 25th consecutive month that rent prices declined year-over-year, indicating the anticipated seasonal slowdown that will continue into the fall. In the meanwhile, many renters are planning to move in order to free up space, save money, or discover a new neighborhood as a result of more than two years of falling rentals.

Asking monthly rents fell $38 (-2.2%) in August compared to the previous year. According to the Realtor.com August Monthly Rent Report, the median asking monthly rent for 0–2 bedroom apartments in the 50 largest metros decreased $46 (-2.6%) to $1,713 as compared to the August 2022 peak, although it was still $249 (17.0%) more than pre-pandemic levels.

“Rental declines across the majority of markets in various-sized homes are providing new options for renters, who have been squeezed by significant increases since the pandemic,” said Danielle Hale, chief economist at Realtor.com. “As rents remain significantly higher than pre-pandemic levels, our Site Visitor Survey shows that the search for a more affordable home remains one of the top reasons to move across all age groups. This is likely a reason why we’re starting to see a modest uptick in renter mobility.”

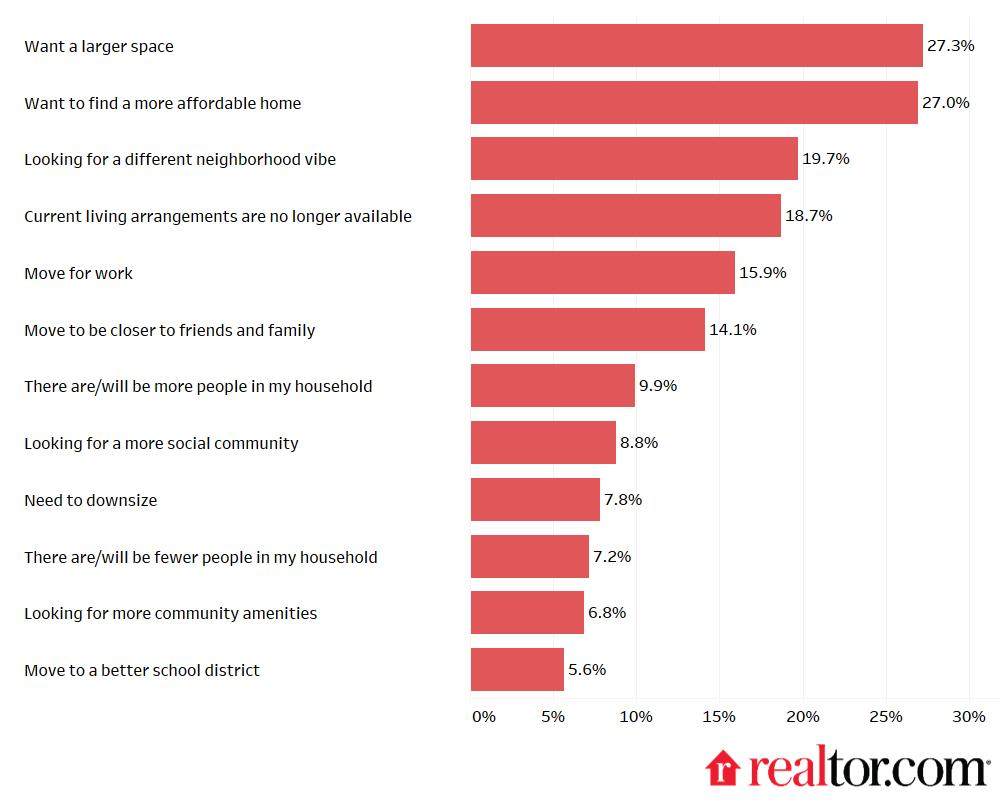

When asked why renters are moving into a new rental home, they responded:

Renters Can Look Forward to Easing Rent Prices

In every size category that Realtor.com looked at, the median rent decreased. At $1,430 a month, studio rents fell $25 (-1.7%) year-over-year (YoY); one-bedroom rents fell $35 (-2.1%) YoY to $1,593; and two-bedrooms, which grew at the fastest rate over the previous six years, saw the biggest drops, falling $42 (-2.2%) YoY to $1,897.

| Unit size | Median rent | Rent YoY | Consecutive months of decline | Total decline from peak | Rent change – 6 years |

| Overall | $1,713 | -2.2 % | 25 | -2.6 % | 17.0 % |

| Studio | $1,430 | -1.7 % | 24 | -3.4 % | 13.3 % |

| 1-Bedroom | $1,593 | -2.1 % | 27 | -4.0 % | 14.9 % |

| 2-Bedroom | $1,897 | -2.2 % | 27 | -3.1 % | 18.6 % |

Even with steady annual decreases, median rents are still 17.0% more than they were prior to the pandemic. In comparison, over the six years ending August 2025, the median price-per-square foot of for-sale home listings increased by 51.3%, while overall consumer prices increased by 26%.

More renters are considering a move while rents are decreasing. About 80% of tenants remained in their current rental property when rents increased in 2021–2022, with mobility at about 20.8%. According to census data, renter mobility increased somewhat in 2023 (21.5%) and further increased in 2024 (21.6%).

Renters are most frequently thinking about moving to get more space, discover a more inexpensive house, or check out a new neighborhood, according to data from the Realtor.com Site Visitor Survey. Renters wishing to move are finding pockets of opportunity in markets where rental prices have dropped the most from their peaks, such as Las Vegas (-13.6%), Atlanta (-13.6%), and Austin, Texas (-13.4%).

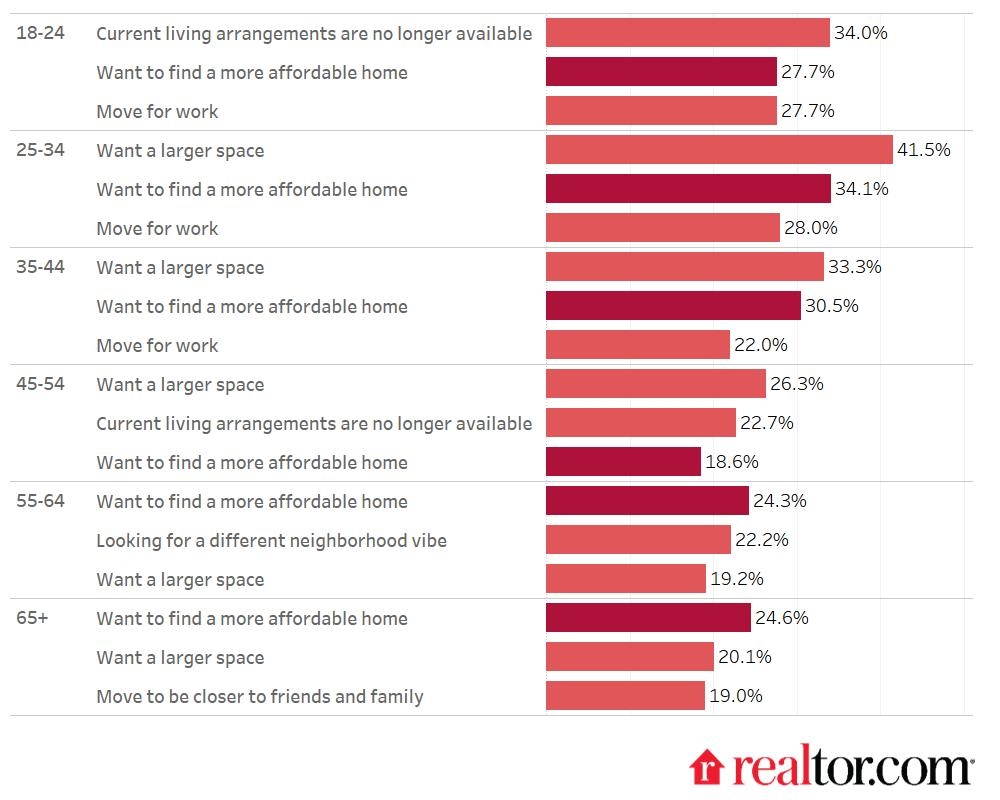

While middle-aged renters may be seeking additional space to accommodate a growing family, younger and older tenants are more likely to move for financial reasons.

“Renters focused on affordability are often willing to make compromises, like choosing a longer commute, fewer amenities or fewer on-site services,” said Jiayi Xu, Economist at Realtor.com. “It shows that many households are carefully weighing costs against lifestyle, making tradeoffs to find a home that better fits their budget.”

When asked what would motivate them to move, renters said looking for affordability is one of the top reasons for all age groups:

Renters are Optimistic, but Still Hindered by Home Affordability

There is a lot of hope for homeownership, despite the fact that the average age of home buyers hit a record high of 38 in 2024 and that many tenants are still too expensive to purchase. More than half of the nearly 60% of renters who responded to the study said they intend to purchase a home within the next year or two. However, obstacles including down payment savings, a shortage of reasonably priced housing, and credit limitations continue to be the main causes of rental behavior.

The trade-offs that tenants who prioritize affordability are most willing to tolerate are fewer amenities, longer commutes, and reduced on-site services. This implies that in order to find more cheap homes, budget-conscious renters are striking a balance between monetary concerns and lifestyle concessions.

Overall, finding a more inexpensive home, however, continues to be one of the key motivations for moving across all age groups.