Fixer-uppers are becoming a unique chance to enter the market at a cheaper cost, and the data indicates that demand is rapidly increasing, as rising home prices and mortgage rates continue to pose a problem to purchasers around the country.

By definition, fixer-uppers are cheap. As of July 2025, the typical listing price of all single-family homes countrywide is $436,250, however the median listing price of homes classified as fixer-uppers is $200,000; hence, fixer-uppers provide a 54.2% discount. With a median square footage of 1,628 vs 2,000 for all single-family homes, fixer-uppers are also often smaller. The average fixer-upper was constructed in 1958 and has three bedrooms and two bathrooms.

Fixer-upper homes get 52% more page views per property than comparable older, inexpensive homes, according to a recent Realtor.com analysis. In July 2025, the number of searches for the term “fixer-upper” on Realtor.com more than tripled compared to four years prior, indicating an increasing demand for affordable homes that purchasers may customize. Instead of investing the time and resources to present their home as move-in ready, sellers who are prepared to advertise a lower price and market it as a fixer-upper may find greater success with online homebuyers.

Top Five Best Fixer-Upper Markets for Value & Inventory:

- St. Louis

- Detroit

- Jackson, MS

- Toledo, Ohio

- Dayton, Ohio

The median list price of fixer-upper homes nationwide is only $200,000, which is a startling 54% reduction from the median price of $436,250 for all single-family homes. According to Realtor.com, St. Louis, Detroit, Jackson, MS, Toledo, Ohio, and Dayton, Ohio are the top five cities for buyers looking for fixer-uppers and these possible bargains.

The prices of these “Fixer-Upper Five” are frequently less than half of those of comparable move-in-ready houses, making them an excellent option for both first-time buyers and investors. Waco, Texas—home of HGTV’s popular Fixer Upper series—offers a fixer-upper discount of more than 53.4%, and these homes make up 10.0% of local listings, making it another affordable target with plenty of opportunities, despite being left out of the analysis because it is outside the top 100 metros.

“Fixer-uppers give buyers a way to break into the housing market at a time when affordability is still stretched thin,” said Danielle Hale, Chief Economist at Realtor.com. “For those with the vision and a toolbox, fixer-uppers provide both a starting point in the market and the chance to create a home that’s truly their own. For sellers, listing their home as a fixer-upper at a lower price may generate more interest online than if they spend extra money on upgrades to make it move-in-ready.”

Top 10 Metros with the Highest Share of Fixer-Uppers:

| Metro | Fixer-Upper Share |

| Syracuse, NY | 11.5% |

| Toledo, Ohio | 10.3% |

| New Orleans-Metairie, LA | 10.2% |

| Jackson, MS | 10.0% |

| St. Louis, MO-IL | 9.9% |

| Albany-Schenectady-Troy, NY | 9.8% |

| New Haven, CT | 9.6% |

| Detroit-Warren-Dearborn, MI | 9.6% |

| Dayton-Kettering-Beavercreek, Ohio | 9.5% |

| Buffalo-Cheektowaga, NY | 9.5% |

More U.S. Homebuyers Are Eyeing Fixer-Uppers

The average fixer-upper was constructed in 1958 and had three bedrooms and two bathrooms. With a median square footage of 1,628 square feet compared to 2,000 for all single-family houses, these homes are often smaller and older, but they provide a valuable resource: a more cost-effective route to home ownership for buyers prepared to put in sweat equity.

There were 79,175 fixer-uppers listed in July 2025, up an estimated 18.8% from July 2021 (66,619 listings). However, their percentage of listings has decreased, from 6.1% in July 2021 to 5.2% in July 2025, making them somewhat less common than they were four years previously.

Although it still takes a little longer for fixer-uppers to sell—53 days on average compared to 50.5 days for comparable homes—the difference has decreased dramatically since 2021. Buyer behavior has changed due to rising mortgage rates and property prices, which makes the strategy of purchasing cheaper properties and building sweat equity even more alluring.

For fixer-upper prospects, a few metro areas stand out due to their abundance of listings and substantial discounts. The Midwest and Northeast often have the highest concentration of fixer-uppers, whereas the Midwest and South typically have the best deals on these properties.

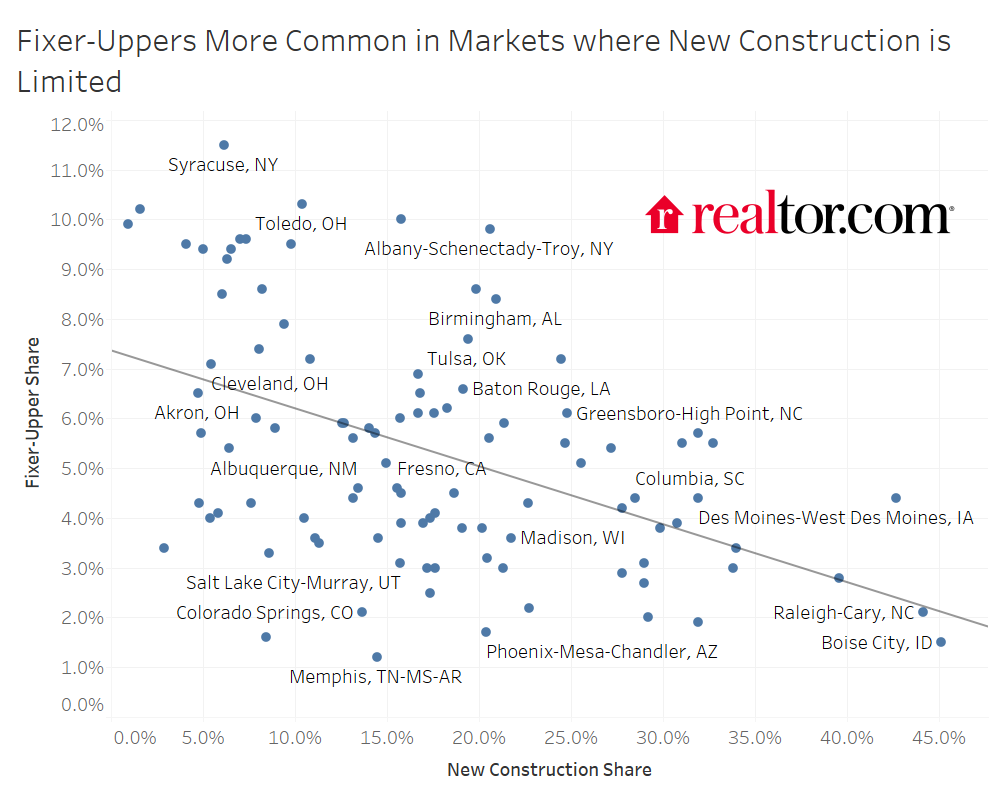

Curiously, new construction is typically the least common in markets with the highest concentration of fixer-uppers. The supply of housing cannot keep up with demand in areas where land is limited or construction is subject to regulatory obstacles. Because of this, older, less expensive properties are excellent options for remodeling and for buyers who are ready to take on a project.

Top 10 Metros with the Largest Fixer-Upper Discounts:

| Metro | Fixer-Upper Median Listing Price | Overall SFH Median Listing Price | Fixer-Upper Discount |

| Jackson, MS | $66,750 | $299,000 | 77.7 % |

| St. Louis, MO-IL | $99,900 | $315,000 | 68.3 % |

| Birmingham, AL | $100,000 | $310,000 | 67.7 % |

| Pittsburgh, PA | $79,900 | $246,075 | 67.5 % |

| Toledo, Ohio | $79,975 | $234,650 | 65.9 % |

| Detroit-Warren-Dearborn, MI | $100,000 | $285,000 | 64.9 % |

| Dayton-Kettering-Beavercreek, Ohio | $97,500 | $259,900 | 62.5 % |

| Little Rock-North Little Rock-Conway, AR | $113,825 | $282,500 | 59.7 % |

| Wichita, KS | $120,000 | $284,950 | 57.9 % |

| Kansas City, MO-KS | $180,000 | $412,500 | 56.4 % |

With a few more Northeastern metros included in the fixer-upper availability group and a few more Southern ones in the fixer-upper discount set, the Midwest is well-represented in both lists. It makes logical that there are more fixer-uppers in the Northeast because homes there are often older. It makes logical that older residences in the South are giving more of a discount because homes there are typically newer. New Orleans acts differently from the rest of the South since it is an older metropolis than even many in the Northeast.

Curiously, the median listing prices for single-family houses are already lower than the national median in all of the markets with the biggest fixer-upper discount. This implies that rather than being a percentage of property value, the fixer-upper discount—that is, the price to get a fixer-upper down to the median—is more fixed. The markets with the lowest fixer-upper discounts, such as Honolulu and San Jose, CA, have very high median listing prices, mostly because of the higher land prices.

The proportion of freshly constructed homes on the market is strongly inversely correlated with the proportion of fixer-uppers. The best markets for fixer-upper activity are those with a high demand for homes but a limited supply. In certain metro areas, new construction is frequently prohibited by legislation or by the scarcity of reasonably priced land. These metro areas’ older, less costly residences are therefore excellent prospects for remodeling.

Note: Experts from Realtor.com concentrated on single-family houses with a listing price per square foot below the median for their ZIP code and that are at least 20 years old for this analysis. Properties that might need renovations or repairs are represented by age and relative cost. To ascertain whether the home is being marketed as needing work, Realtor.com takes this group of candidates and applies a big language model to scan the listing details. The listing statistics for the properties the AI tool recognized as fixer-uppers are then compiled by Realtor.com, which compares them to the other prospects that aren’t promoted as fixer-uppers and to the total number of properties in their market to determine how well they do.

To read more, click here.