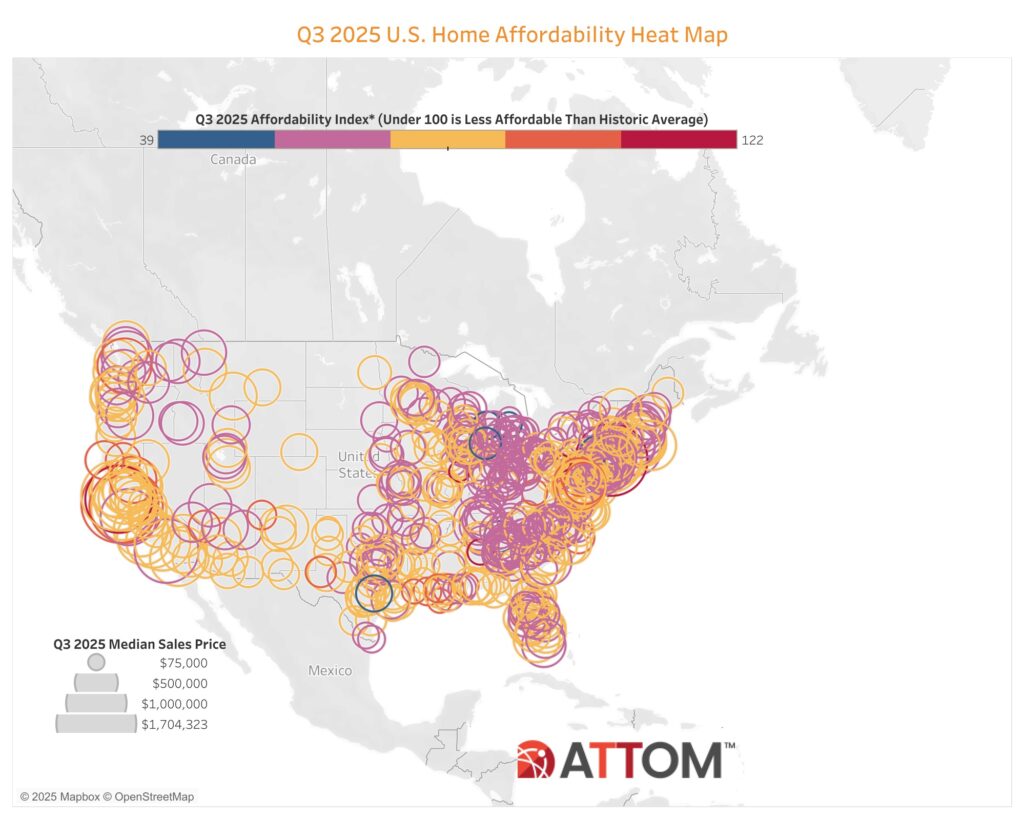

In an estimated 99% of counties with enough data to evaluate for Q3 of 2025, median-priced single-family homes and condominiums were less affordable than historical norms, according to ATTOM’s most recent U.S. Home Affordability Report.

That high rate persisted from the previous quarter. But the country’s affordability problems worsened in many areas as the typical home price touched a new record high of $375,000 in Q3 of 2025. In the third quarter, 44.7% (259) of the 580 counties in ATTOM’s analysis had lower affordability index ratings than in Q2.

“The drop in mortgage rates will help some buyers keep pace with the rising cost of homes,” said Rob Barber, CEO of ATTOM. “But the more favorable loan rates could also enable prices to keep rising and further extend this two-and-a-half-year streak we’re in of homes being less affordable to the typical resident of an area than they historically have been.”

However, there has been some positive news for those who are considering purchasing a property. The average interest rate on a 30-year fixed rate loan decreased from 6.75% in mid-July to 6.26% in mid-September, reflecting a decline in mortgage rates throughout Q3.

While average wages have increased by 28% since the start of 2020, the median home value has increased by 58% nationwide. The first quarter of 2025 was when the most recent wage data was available.

Note: By estimating the monthly income required to cover the major costs of home ownership, such as mortgage payments, mortgage insurance, property taxes, and homeowner’s insurance, on a median-priced single-family home and condo, assuming a 20% down payment and a maximum “front-end” debt-to-income ratio of 28%, ATTOM calculates affordability for average wage earners. The BLS’s annualized average weekly wage data is used to calculate the necessary income.

Regional & Statewide Trends Vary Across the Board

Homeownership costs exceeded roughly 28% of the average resident’s income in 79% (460) of the 580 counties in ATTOM’s analysis, rendering home ownership unaffordable by conventional standards. These were counties that comprised some of the biggest cities in the country, including Brooklyn and Queens in New York City, NY; Los Angeles; and Chicago.

The most populous counties where home expenses accounted for less than 28% of a typical resident’s wages were:

- Harris County, Texas (expenses for a median home required 23.3% of typical annual wages)

- Cuyahoga County, Ohio (23.1% of wages)

- Allegheny County, PA (22.4% of wages)

- Philadelphia County, PA (20.1% of wages)

- Wayne County, MI (17.1% of wages)

The third quarter of 2025 saw a nationwide median home price of $375,000, which was 2.0 percent higher than the previous quarter and approximately 4.8% more than the same period the year before.

In 438 of the 580 counties in ATTOM’s analysis, or 75.5%, median home prices increased year-over-year (YoY). The counties having sufficient data in the third quarter of 2025, a population of at least 100,000, and at least 50 single-family home and condo sales are included in the report.

Among the 47 counties in the report with populations over 1 million, the biggest annual increase in median home prices were in:

- Cuyahoga County, Ohio (up +13%)

- Fulton County, GA (+11%)

- Honolulu County, Hawaii (+11%)

- Suffolk County, NY (+7%)

- Allegheny County, PA (+7%)

Of those large counties, the largest annual drops in median home prices were in:

- New York County, NY (down -3%)

- Sacramento County, CA (-3%)

- Contra Costa County, CA (-3%)

- Hillsborough County, FL (-2%)

- Harris County, Texas (-1%)

In some 49.8% (289) of the 580 counties in the research, the median price of a home increased more quickly than the average resident’s salary. This was an increase from the previous quarter, when only 34.9% of counties saw home prices surpass wage increases.

The largest counties where home values outpaced wage growth in Q3 of 2025 were:

- Cook County, IL

- Kings County, NY

- Bexar County, Texas

- Wayne County, M

- Middlesex County, MA

The largest counties where wages grew more than home prices were:

- Los Angeles County, CA

- Harris County, Texas

- Maricopa County, AZ

- San Diego County, CA

- Orange County, CA

Measuring Housing Costs, American Wages & Income

In tQ3 of 2025, the average monthly cost of property taxes, homeowners insurance, and mortgage payments nationwide was $2,123. Although it was up 6% over the same period last year, it was virtually the same as the prior quarter.

Those expenses on the median single-family home and condos would have taken 33.3% of the typical American’s salary in Q3 of 2025. Compared to 32.2% at the same period last year and 33.2% in the previous quarter, that was a slight increase.

Home expenses on a median-priced home exceeded 43% of usual salaries, a criterion deemed seriously unaffordable, in 34.3% (199) of the 580 counties.

In terms of unaffordability, California and New York counties were notably at the top of the country—as usual. Twelve of the top 25 counties in Q3 where owning a home required the most percentage of a typical resident’s income were in California, and five were in New York.

The counties where home expenses accounted for the largest share of income were:

- Kings County, NY (113% of the typical resident’s wages)

- Santa Cruz County, CA (111.8% of typical wages)

- Marin County, CA (101.3% of typical wages)

- Monterey County, CA (96.8% of typical wages)

- Maui County, Hawaii (94% of typical wages)

Besides Kings County, NY, the counties with populations over 1 million where home expenses accounted for the largest share of income were:

- Orange County, CA (93.1% of typical wages)

- Queens County, NY (79% of typical wages)

- Nassau County, NY (78.3% of typical wages)

- Alameda County, CA (72.7% of typical wages)

A buyer would have needed to earn an annualized income of $90,989 in Q3 of 2025 in order to afford the $375,000 national median-priced single-family home and condo and maintain ownership costs below 28% of their pay.

Overall, in 99% of the counties examined, median-priced single-family homes and condominiums were less affordable than historical norms, according to ATTOM’s third-quarter 2025 U.S. Home Affordability Report. This is because the median home price nationwide increased to a record $375,000. Home prices outpaced salary growth in half of the 580 counties analyzed, and affordability declined in nearly half of them from the previous quarter.

With monthly housing prices above 33% of the average earnings, homeownership remained out of reach for many, even if mortgage rates decreased during the quarter. According to the survey, while some parts of Pennsylvania and the Midwest are still reasonably priced, high-cost places like California and New York are seeing increasing affordability issues.

To read more, click here.