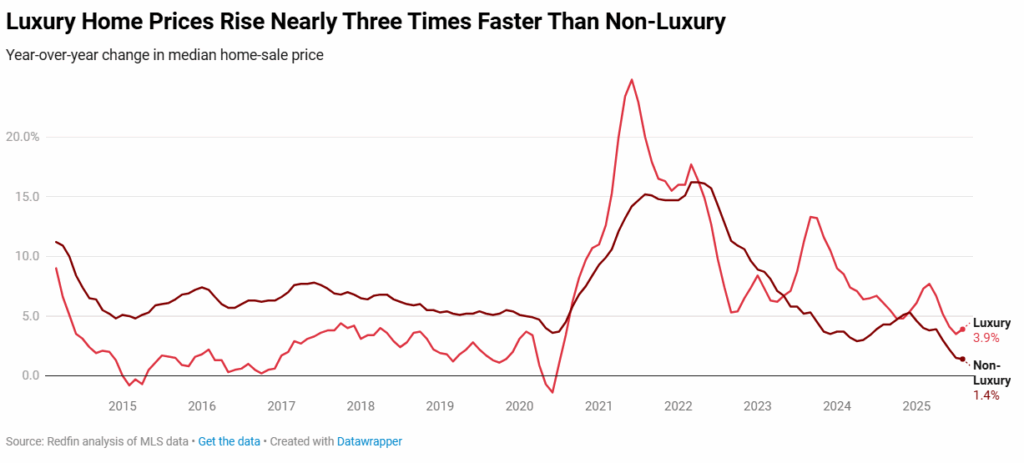

A new report from Redfin reveals that luxury home sale prices in August rose 3.9% year-over-year to a median $1.25 million, a record high for the month of August, but down from the all-time high of $1.35 million in March, a month when prices are typically higher.

The report found that luxury home prices grew nearly three times faster than non-luxury home prices, which increased 1.4% to a median of $370,000.

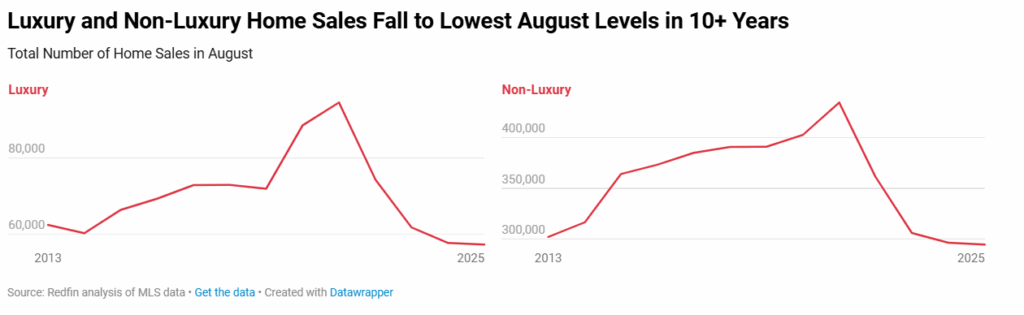

Luxury home sales fell 0.7% year-over-year to the lowest August level since at least 2013 (as far back as Redfin’s data goes). It was a virtually identical story for sales of non-luxury homes, which dropped 0.6%—also to the lowest August level on record. Pending sales of luxury homes (+0.1% year over year) and non-luxury homes (-0.1%) were virtually flat in August from a year earlier.

“Sales have slowed across all price tiers, and luxury homes are no exception,” said Redfin Senior Economist Sheharyar Bokhari. “Last year was super slow in the luxury market, and this year is even slower. High-end buyers often keep the market moving because they’re less tied to mortgage rates, often buy in cash, and can prioritize lifestyle over affordability. But right now, many of those buyers are waiting on the sidelines, holding out for more certainty around the economy and the housing market.”

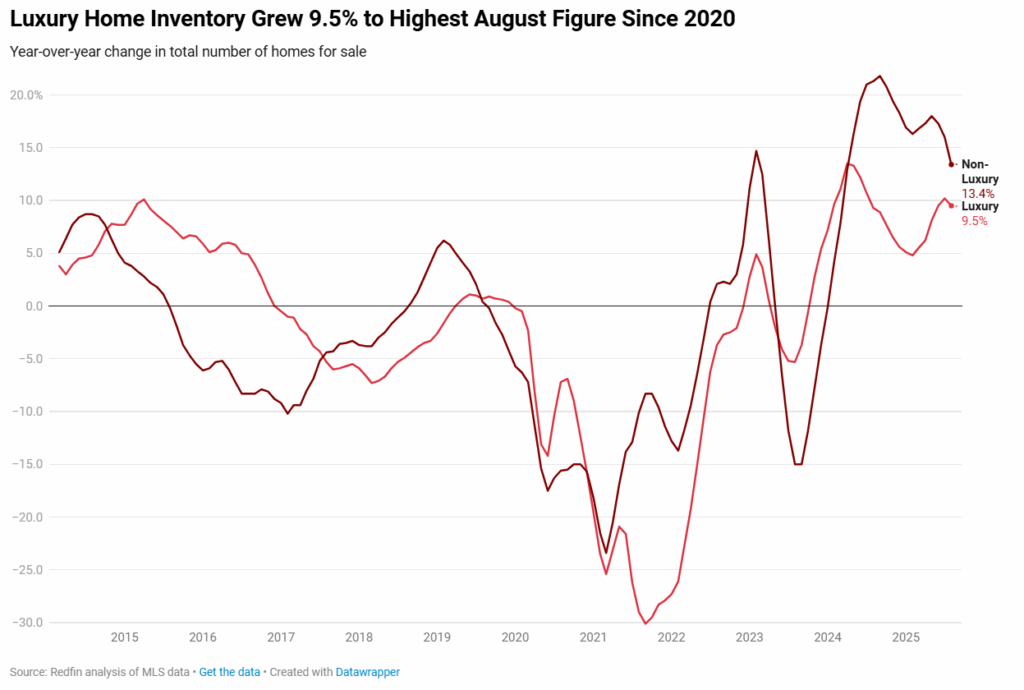

Luxury Home Inventory Climbs to Five-Year High

Redfin found that sales were stagnant even as the number of luxury homes on the market grew 9.5% last month to the highest level for August since 2020. The number of non-luxury homes for sale grew faster (13.4%) to reach the highest August level since 2019.

New listings of luxury homes were basically flat (0.2%), while new non-luxury home listings fell 0.8%—highlighting that sellers are joining buyers in pulling back from the market.

Days on the Market

The typical luxury home sold in 46 days in August, three days slower than a year ago. Only 28.3% of luxury homes went under contract within two weeks in August, down 1.9 ppts year-over-year—the lowest share for August since 2020.

“Luxury buyers are moving like molasses,” said Meme Loggins, a Redfin Premier Real Estate Agent in Portland, Oregon. “They wait for $100,000 price drops and then negotiate over tiny issues, like a leaking sink. The slow market is wearing sellers down too. I had a seller with a gorgeous million-dollar home in a highly desirable area of Portland pull the listing from the market recently because she was exhausted from trying to keep it ready for showings for so long.”

Non-luxury home sales also took considerably longer than a year ago, with the median days on market increasing to 40 from 33. The share that went under contract within two weeks fell 4.2 ppts to 34.4%.

Metro-Level Highlights

- Prices: The median sale price of luxury homes rose most in West Palm Beach, Florida (15% increase to $4,004,687); New York (12.3% increase to $4,138,603); and Newark, New Jersey (11.7% increase to $2,056,664). The median sale price of luxury homes fell in just one metro, Tampa, Florida (-5.5% to $1,442,783).

- Sales: Luxury home sales increased most in Indianapolis, Indiana (19.1%); Fort Worth, Texas (14%); and San Francisco, California (13.9%). Luxury home sales dropped most in West Palm Beach, Florida (-27.8%); San Jose, California (-24.4%); and Miami, Florida (-19.4%).

- Active listings: The total number of luxury homes for sale increased most in Fort Worth, Texas (25.7%); Tampa, Florida (25.4%); and San Antonio, Texas (20.5%). Total luxury inventory fell the most in San Jose, California (-24.3%); Philadelphia, Pennsylvania (-22.5%); and Chicago, Illinois (-18%).

- New listings: New listings of luxury homes increased most in Indianapolis, Indiana (18.6%); Cleveland, Ohio (16.7%); and St. Louis, Missouri (14.9%). New listings fell most in San Jose, California (-27.6%); Anaheim, California (-19.4%); and Jacksonville, Florida (-16.2%).

- Speed of sales: Luxury homes sold fastest in St. Louis, Missouri with a median of 13 days, ahead of Detroit, Michigan (14 days); and San Jose, California (14 days). They sold slowest in Miami, Florida (140 days); West Palm Beach, Florida (124 days); and Fort Lauderdale, Florida (113 days).

Setting the New Bar

Realtor.com’s recent “What Is Luxury?” report reveals that the threshold for what qualifies as a luxury home has risen from $796,922 in 2016, to approximately $1.3 million today. While a $1 million home was comfortably above the luxury bar in 2016, buyers now need to spend closer to $1.6 million to reach that same level of luxury status.

“While a million-dollar home still represents an important benchmark, it’s not the luxury marker that it once was nationwide and in many markets,” said Danielle Hale, Chief Economist at Realtor.com. “With or without a seven-figure price tag, luxury is often about exclusivity and relative standing in a local market. In many areas a high-end home can rise many multiples above the area’s typical home price. Further, with a dramatic rise in home prices, Realtor.com data shows just how dramatically the definition of luxury has shifted over the past decade.”

Nationally, a $1 million listing used to sit just below the top 5% of homes in 2016, and was still among the top 10% before the pandemic.

Click here for more on Redfin’s analysis of the August 2025 luxury home sales market.