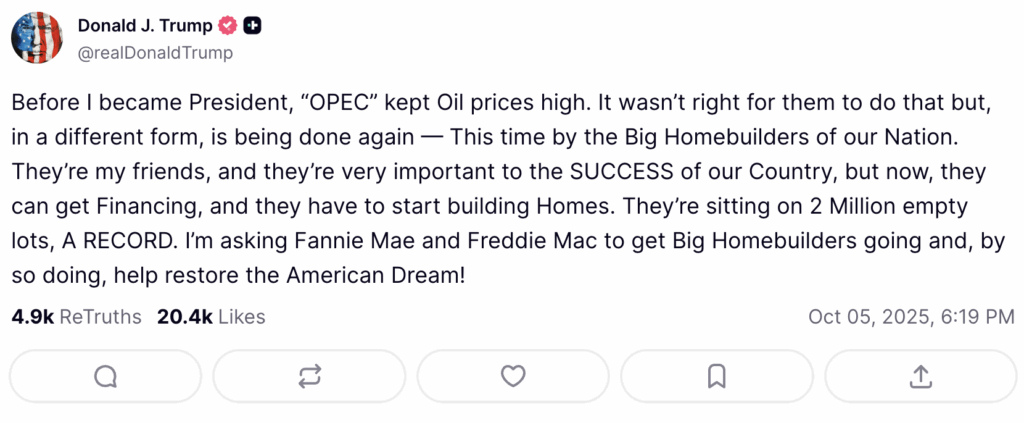

President Donald Trump has pledged to collaborate with builders to start building new homes as part of his effort to “restore the American dream.” In a Sunday Truth Social post, the President called on government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac to “get Big Homebuilders going.”

“Before I became President, ‘OPEC’ kept oil prices high. It wasn’t right for them to do that but, in a different form, is being done again—This time by the Big Homebuilders of our Nation,” he wrote.

Trump Social Post Stirs the Pot

According to Trump, although “it wasn’t right,” he pointed out that the Organization of the Petroleum Exporting Countries (OPEC) had “kept oil prices high” before he took office, and that the housing market is currently experiencing the same issue.

The individuals Trump was criticizing “are my friends, and they’re very important to the SUCCESS of our Country,” he said.

He then promised to make sure they could secure the capital required to rekindle the sector.

“Now, they can get Financing and they have to start building Homes,’ he warned. ‘They’re sitting on 2 Million empty lots, A RECORD,” he said. “I’m asking Fannie Mae and Freddie Mac to get Big Homebuilders going and, by so doing, help restore the American Dream!”

Top U.S. bank executives allegedly met with Trump in August to discuss his administration’s plans to privatize the two GSEs, which have been under federal conservatorship since the 2008 financial crisis and guarantee more than half of the country’s mortgages.

The businesses have since restored their capital reserves, paid back their Treasury loans, and resumed steady profitability.

Amid rumors of preparations for privatization, shares of both companies, which are currently traded on over-the-counter markets, have risen sharply. Over half of all mortgages in the country are guaranteed by the two.

What GSE Changes Would Mean for Hopeful U.S. Homebuyers

A comprehensive government backup that was meant to provide a short-term respite would disappear if the companies went public, but if the corporations providing the guarantees completely revert to the private sector, mortgages may become more expensive and more difficult to obtain.

While Trump has been prepared to risk economic disruption with his expansive trade agenda, analysts pointed out that there might be greater sensitivity to drama in mortgage rates, which are both visible and well-known to many customers.

“Tariffs may have impacted the stock market, but they did not result in immediate price hikes at Walmart or Dollar General,” TD Cowen analyst Jaret Seiberg wrote in May. “By contrast, the price of mortgages will respond to each recap and release development. That makes the political cost more immediate. It is why we expect a slower and more deliberative process.”

According to a source who spoke to Reuters, Citi CEO Jane Fraser met with Trump at the White House. According to a second source, Trump also had meetings with BofA CEO Brian Moynihan and his staff.

To read more, click here.