The Home Purchase Sentiment Index (HPSI), a gauge of consumer sentiment about housing, is one of the findings from Fannie Mae’s September 2025 National Housing Survey (NHS). At 71.4, the HPSI did not fluctuate from month-over-month. The HPSI is also down 2.5 points from the previous year.

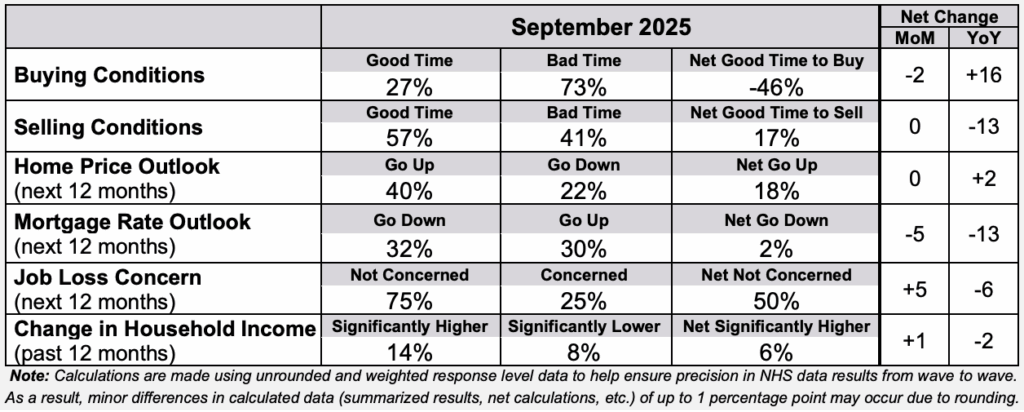

This month, the Buying Conditions and Mortgage Rate Outlook components—two of the six HPSI components—saw declines. Increases in Job Loss Concern and Change in Household Income offset these declines. Every month, the outlook for home prices and selling conditions remained unchanged.

Key Findings from the HPSI:

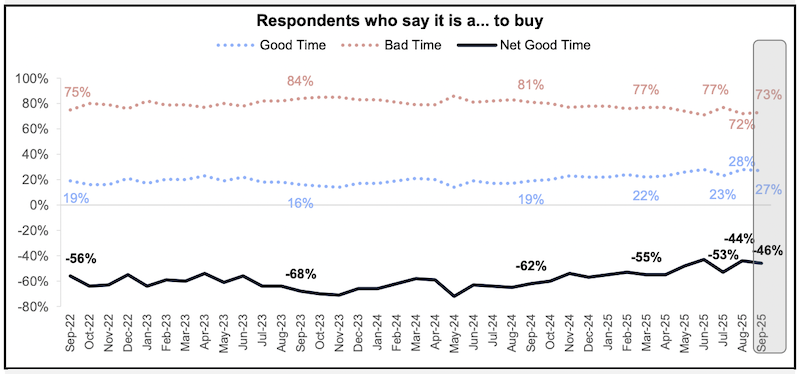

- Since last month, the net proportion of consumers (-46%) who believe that now is a good time to buy a home has dropped by two percentage points. While the percentage of respondents who believe now is a terrible time to buy (73%) climbed by one percentage point, the percentage of respondents who believe now is a good time to buy fell by one percentage point (27%).

- Consumers who believe that now is a favorable time to sell still make up the same percentage (17%). The majority of customers (57%) believe that now is a good time to sell, while 41% disagree.

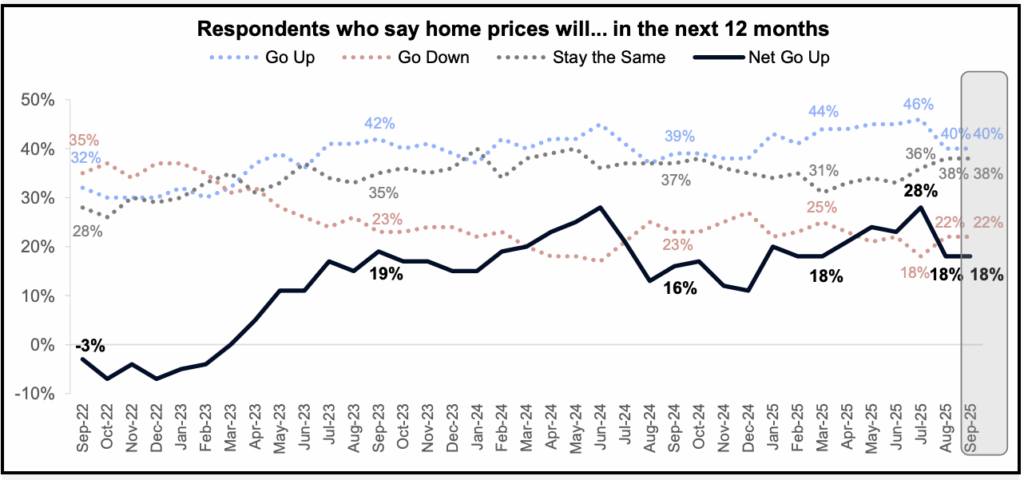

- The net percentage of consumers who believe that home prices would increase (18%) did not change from the previous month. Additionally, the percentage of consumers who anticipate rising home prices (40%) and those who anticipate falling prices (22%), respectively, did not change.

- In September, the net percentage of consumers who believe that mortgage rates will drop over the next 12 months fell by five percentage points to 2%.

- Five percentage points were added to the net share of employed consumers who say they are not worried about losing their jobs, reaching 50%.

- One percentage point, or 6%, more people now report that their household income is much higher than it was a year ago. The majority of consumers think their household income is roughly the same as it was a year ago (77%, a new survey high). Just 14% of consumers claim to have more money now than they did a year ago.

Consumers Weigh In On the Future

Over the next year, consumers anticipate that home prices will rise 1.8% on average (a 0.4 percentage-point increase MoM) and rental prices will rise 6% on average (a 1.1 percentage-point increase MoM).

The number of consumers who anticipate rising house rental costs (64%) rose by 1 percentage point from the previous month, while the percentage who anticipate falling rental prices fell by four percentage points to 8%. Two percentage points higher than in August, a quarter of households (26%) anticipate that home rental prices would remain unchanged.

MoM, the percentage of consumers who say they would purchase a home if they were moving down (67%) fell by 1%. MoM, the percentage of respondents who say they would rent if they were moving rose by 1% to 33%.

What the Survey Entails & What’s to Come

This month, the percentage of consumers who believe that obtaining a mortgage would be difficult rose by two percentage points to 57%, while the percentage who believe that it would be easy fell by two percentage points to 43%.

While the number of consumers who anticipate their personal financial condition to worsen rose by one percentage point to 23%, the percentage of consumers who anticipate it to improve fell by one percentage point to 32%. At 45%, the percentage of those who anticipate their own financial circumstances remaining unchanged remained constant.

The number of consumers who believe the economy is headed in the right direction fell by 3 percentage points to 32%, while the proportion who believe it is headed in the wrong direction rose by 3 percentage points to 67%.

Note: Fannie Mae’s National Housing Survey (NHS) data on customers’ sentiments regarding home purchases is condensed into a single figure by the Home Purchase Sentiment Index (HPSI). In order to support analysis and decision-making linked to housing, the HPSI supplements current data sources and represents consumers’ present opinions and expectations regarding the state of the housing market.

To read more, click here.