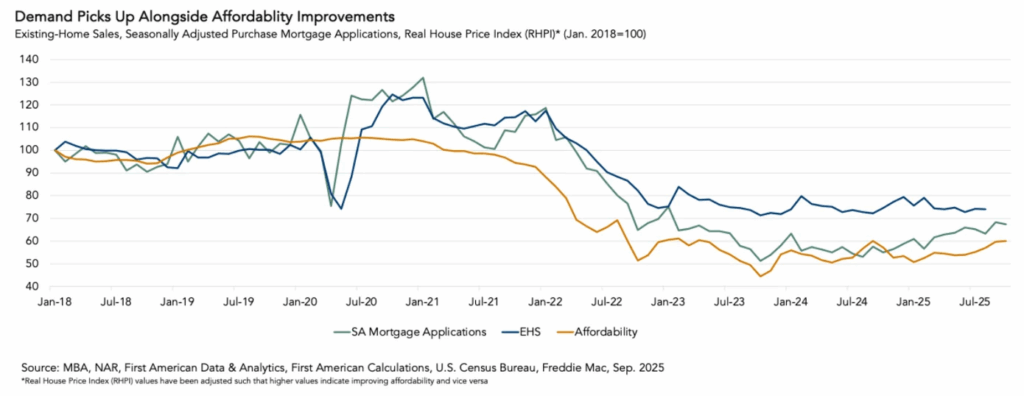

According to new First American data, the existing housing market is beginning to revive after a protracted downturn. While some early indicators, such as an increase in mortgage applications and improved affordability, indicate that demand is starting to stir, the Existing-Home Sales Outlook model predicts a moderate increase in September sales compared to August’s pace and to a year ago. Although the trend is positive, the recovery’s scope is still constrained.

Prior to the pandemic, existing-home sales typically accounted for 4.1% of all households in the U.S. When that long-term rate is applied to the entire number of households in the world today, it suggests a yearly pace of nearly 5.4 million annualized sales, which is roughly 35% greater than the present rate of 4 million. Rather than a lack of possible movers, this disparity is a result of decreased market activity.

Increased market participation was spurred by modest improvements in affordability and lower mortgage rates. Even a little gain symbolizes significant progress after years of stagnation. Data from mortgage applications reveals a similar pattern. As affordability improves, more potential buyers may be experimenting, as evidenced by the September average of weekly purchase applications, which increased by nearly 8% from the previous month and by 19% from a year earlier.

Key Findings:

- September’s existing-home sales are predicted to rise 3.2% over the pace of sales a year ago and 0.6% over the pace of sales last month.

- A robust economy (+0.3%), increased purchasing power (+0.3 %), a weaker rate lock-in effect (as indicated by the lagged spread between the average rate for all outstanding mortgages and the prevailing market mortgage rate +0.2%), and increased credit availability (+0.04%) are the main drivers of the anticipated monthly increase in existing-home sales.

- As mortgage rates decline and affordability increases, sales activity has somewhat increased.

- Though not enough to return the market to “normal” levels, mortgage applications suggest an increase in demand.

- The rebound is being held back by hesitant potential sellers who are also probably purchasers.

Expectations & Affordability Remain an Obstacle for Many Americans

September had the highest level of house-buying power since early 2022. This is the amount of a home that one can afford based on the median family income and the current 30-year fixed mortgage rate. Driven by moderately lower rates, growing wages, and modest price rise, affordability—as determined by our Real House Price Index, which modifies nominal prices for changes in house-buying power—also improved to its best level since September 2024. Some on-the-margin buyers and sellers might decide to reenter the market if prices drop.

However, years of strong housing price growth and high borrowing rates have not been entirely countered by these recent affordability gains. Affordability is still over 65% lower than the five-year pre-pandemic average. Psychology continues to be a significant barrier on the seller’s end. While some homeowners are still stuck with the extremely low mortgage rates they were able to obtain during the epidemic, many homeowners are still waiting for higher values and are reluctant to offer their houses at the current lower assessments. As a result, seller withdrawal rates are abnormally high, which limits inventory levels and mutes sales activity.

September had the highest level of homebuying power since early 2022. This is the amount of a home that one can afford based on the median family income and the current 30-year fixed mortgage rate. Driven by moderately lower rates, growing wages, and modest price rise, affordability—as determined by the Real House Price Index, which modifies nominal prices for changes in house-buying power—also improved to its best level since September 2024. Some on-the-margin buyers and sellers might decide to reenter the market if prices drop.

“Housing turnover still happens because life still happens,” said Odeta Kushi, Deputy Chief Economist at First American. “Life events, such as marriage, expanding families, job changes and divorce, always has and always will drive sales activity.”

The outlook for the housing market is still clouded by the larger economic environment, notwithstanding modest progress on affordability and a slow reduction of mortgage rates. Consumer confidence is low, inflation is still tenacious, and job growth has slowed. Both buyers and sellers continue to exercise caution in this setting.

Overall, “life happens” to many Americans. Sales activity has traditionally been driven by life events like marriage, growing families, changing jobs, and divorce. Experts suggest it will take time for there to be a widespread return to “normal,” and as affordability gradually improves, the rate lock-in effect lessens, and economic uncertainty subsides, the housing market is starting to improve—but it will take time.

To read more, click here.