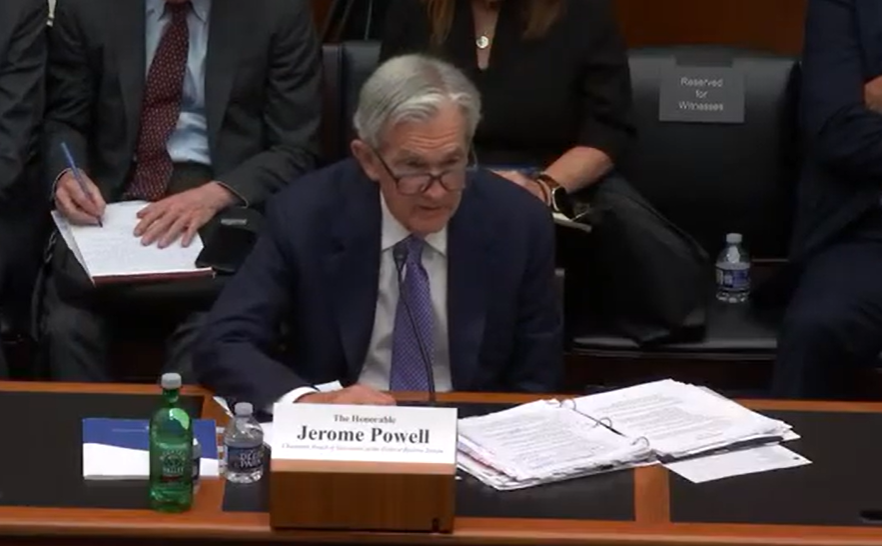

Federal Reserve Chair Jerome Powell told National Association for Business Economics conference in Philadelphia, that the Fed is getting closer to reducing the more than $6 trillion of securities it holds balance sheet.

“Our long-stated plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve condition,” Powell said. ‘We may approach that point in coming months, and we are closely monitoring a wide range of indicators to inform this decision.’

Shifting Market Conditions?

Some signs have begun to emerge that liquidity conditions are gradually tightening, including a general firming of repo rates along with more noticeable but temporary pressures on selected dates, Powell added. “The Committee’s plans lay out a deliberately cautious approach to avoid the kind of money market strains experienced in September 2019. Moreover, the tools of our implementation framework, including the standing repo facility and the discount window, will help contain funding pressures and keep the federal funds rate within our target range through this transition to lower reserve levels.”

However, normalizing the size of the balance sheet doesn’t mean the Fed will be looking to returning to pre-pandemic levels, according to Powell.

“In the longer run, the size of our balance sheet is determined by the public’s demand for our liabilities rather than our pandemic-related asset purchases. Non-reserve liabilities currently stand about $1.1 trillion higher than just prior to the pandemic, thus requiring that our securities holdings be equally higher. Demand for reserves has risen as well, in part reflecting the growth of the banking system and the overall economy.”

Powell was mum on the issue of interest rates.

The next U.S. Federal Reserve interest rate meeting will be held on October 28–29. The CME FedWatch Tool predicts rate will be cut 25 basis points at the meeting, with another, similar, cut expected in December.