Homeowners made an estimated 49.9% profit on average single-family home and condo sales in Q3 of 2025, according to ATTOM’s third quarter 2025 U.S. Home Sales Report. That was still less than the 55.4% average profit sellers saw in the third quarter of 2024, but it was a tiny increase over the 49.3% profit margin reported in the previous quarter.

Profit margins for home sellers were over 30% before 2020. Profits soared to over 60% in mid-2022 as the Covid-19 outbreak prompted people to buy homes and flee cities in pursuit of more space. Since that peak, the average seller’s return has been gradually declining, although it has remained slightly below 50% for the past three quarters.

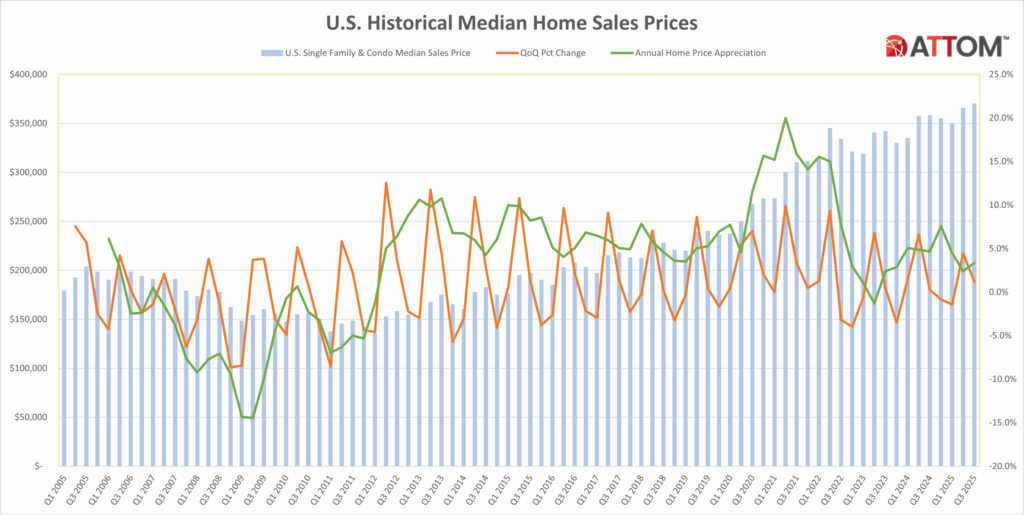

In the meantime, the cost of homes has kept going up. In Q3 of 2025, the median national sales price was $370,000, up 3.4% from the same period the year before and 1.2%t from the preceding quarter.

As a reminder that the market is still a little below its recent peak, the average home sales generated a raw profit of $123,100, which was up 1.9% from the previous quarter but down 3.5% from the third quarter of 2024.

“Profit margins remained steady and high throughout the traditionally busier summer selling season,” said Rob Barber CEO of ATTOM. “While continuously rising prices could have chased away buyers and slackened demand, the recent dip in mortgage rates may be helping to keep more people in the market.”

Most Metro Areas See Declining Profit Margins

Of the 157 main metro regions in ATTOM’s survey, 58.6% (92) saw a decline in profit margins from quarter to quarter, and 84.1% (132) saw a decline from year to year. The percentage difference between the median purchase price and the median selling price of homes in a particular location is known as the profit margin. If a metro area had enough data to analyze and at least 1,000 home sales in the third quarter of 2025, it was included.

The metro areas with the biggest annual drops in profit margins were:

- Ocala, FL (down from 103.9% to 55.1%)

- Punta Gorda, FL (down from 88.3% to 58%)

- Vallejo, CA (down from 66.4% to 43%)

- North Port-Sarasota, FL (down from 61.1 to 38.8%)

- Port St. Lucie, FL (down from 77.8% to 56.1%)

The largest annual increases in home sale profit margins were in:

- St. George, UT (up from 26.3% in Q3 of 2024 to 37.2% in Q3 of 2025)

- Gulfport, MS (up from 26.2% to 35.7%)

- Augusta, SC (up from 37.8% to 43.7%)

- Lexington, KY (up from 42.9% to 48.6%)

- Dayton, Ohio (up from 55.1% to 60.7%)

In Q3 of 2025, the average home sale nationwide made a raw profit of $123,100, although there were significant differences, with sales in the top big cities making 18 times as much as those at the other end of the scale.

Further, for the second consecutive quarter, the national median house sales price surpassed $370,000, a record high and a 3% increase over the same period previous year. Of the 159 metro regions with enough data to evaluate, some 76.7% (122) saw an increase in median sales prices year over year, while 55.3% saw an increase in prices from quarter to quarter.

Compared to 8.13 years for homes sold in the previous quarter, owners owned homes sold in Q3 of 2025 for an average of 8.39 years before selling them, the longest average homeownership tenure in at least 25 years.

Additionally, in Q3 of 2025, homes sold by banks or other lenders made up 1.2% of all sales countrywide, which was somewhat less than the 1.3% share reported in the quarter before and in Q3 of 2025.

To read more, click here.