Last month, three indicators of competition in the U.S. housing market fell to their lowest September levels in six years, according to a recent Redfin study.

- Share of homes selling above list price: Additionally, the percentage of homes that sold for more than their final list price was 25.3%, which is lower than the estimated 28.5% that was reported a year before.

- Average ratio of sale price to list price: This measure dropped from 99.1% a year ago to 98.6%. Compared to last September, when it sold for 0.9% less, the average home sold for 1.4% less than its final list price.

- Share of homes selling in two weeks: Some 32.8% of homes that were under contract sold within two weeks after being listed, which is a decrease from 34.9% a year ago.

According to a fourth statistic, time on market, the housing market is expanding at the slowest rate in over ten years for this time of year. It was the slowest September pace since 2016, with the average home that went under contract in September sitting on the market for 50 days.

“Homebuyers have extremely high expectations. Some of them remember being preapproved for a 3% mortgage rate during the pandemic, which meant they could afford a $450,000 house. Now that rates, insurance costs and property taxes have gone up, they can only afford a $325,000 house, but still have $450,000 expectations,” said Roze Swartz, a Redfin Premier agent in Houston. “Sellers can’t be picky on price—if they don’t have the lowest price on the market, they’re not even going to get showings. That’s a tough pill to swallow, but it’s better to price low from the start than price high and make a drastic cut after your home has been sitting on the market for months without any offers.”

September 2025 Metro-Level Highlights

- Prices: Median sale prices rose most from a year earlier in the Midwest: Milwaukee (9.1%), Detroit (7.9%) and Cleveland (7.4%) saw the biggest increases. The biggest declines were in Texas: Dallas (-2.7%), Austin, Texas (-2.3%), and Houston (-1.5%).

- Pending home sales: Pending sales rose most in San Francisco (17.1%), Riverside, CA (11.6%) and West Palm Beach, FL (11%). They fell most in Houston (-11.7%), Denver (-8.4%) and San Antonio (-6.3%).

- Closed home sales: Home sales rose most in Providence, RI (17.1%), San Francisco (15.6%) and West Palm Beach (14.6%). They fell most in Detroit (-8.6%), Orlando, FL (-6.5%) and Nassau County, NY (-2.6%).

- New listings: New listings rose most in Detroit (11.6%), Boston (9.2%) and Pittsburgh (7.8%). They fell most in Anaheim, CA (-10.6%), San Antonio (-10.2%) and Orlando (-9.9%).

- Active listings: Active listings rose most in Washington, D.C. (21.1%), Las Vegas (20.7%) and Seattle (16.6%). They fell in just two metros: San Francisco (-7.7%) and San Jose, CA (-6%).

- Sold above list price: In San Francisco, the average sale-to-list-price ratio was 104.2%, meaning the typical home sold for 4.2% above its final list price—the biggest premium of any metro. Next came Newark, NJ (103.1%) and San Jose (102.2%). The metros with the lowest ratios are in Florida: West Palm Beach (94.8%), Miami (95.2%) and Fort Lauderdale (95.4%).

- Days on market: In Fort Lauderdale, the typical home that went under contract did so in 97 days, up 26 days from a year earlier—the biggest increase among the metros Redfin analyzed. Next came Miami (+23 days) and Las Vegas (+19 days). Three metros saw decreases in days on market: Kansas City, MO (-3 days), San Francisco (-2 days) and Chicago (-1 day).

Sluggish Market Affecting Homebuying Activity

Due to high prices and economic uncertainties, fewer individuals are purchasing homes, which is why the housing market is sluggish. Additionally, inventory has increased, giving purchasers additional alternatives and allowing many of them to take their time. The ratio of home sellers to purchasers is 36.7%, which is close to a record. The good news for buyers is that this frequently gives them the chance to bargain and request reductions.

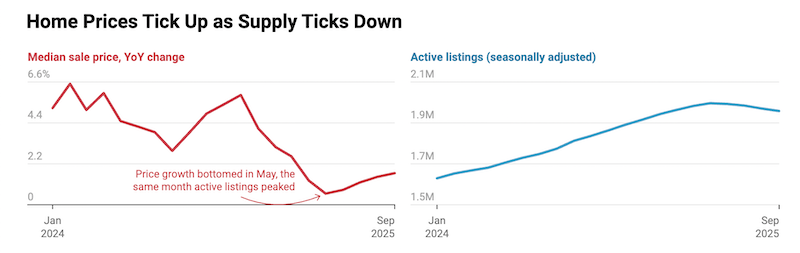

September had the largest increase in six months and the highest September level on record, with the median house sale price up 1.7% year over year to $435,545. Due to an increase in inventory, which gave purchasers additional options, home price rise slowed in the first half of the year.

Listings have begun to decline in recent months, which has raised sale prices even though buyers still have a lot more options than they did a few years ago. Still, as indicated above, sellers in many markets are accepting bids for less than their list prices since buyers continue to have negotiation power.

Additionally, on a seasonally adjusted basis, active listings decreased 0.6% month-over-month (MoM) to 1.96 million in September, the lowest since February, but they were still up 8% year-over-year (YoY). Due to weak homebuyer demand, sellers have retreated in recent months. If they don’t get the price they desire, some sellers are taking their houses off the market and choosing to rent them out instead, according to Redfin brokers.

In September, existing-home sales increased 4.5% year over year and 0.4% MoM to reach a seasonally adjusted annual pace of 4.25 million. It’s the biggest YoY increase since December and the highest level since January. Seasonally adjusted, total home sales increased 0.7% MoM and 3.4% YoY, reaching their highest level since October 2022.

The report also revealed that a decrease in mortgage rates is probably the reason for the little increase in home sales. For the majority of 2025, rates have been gradually declining; in September, they averaged 6.35%, the lowest level in a year.

Experts suggest it’s worth noting that both total sales and existing home sales are backward-looking indicators that reflect agreements reached in previous months. Pending home sales, which decreased 2.4% YoY in September—representing the worst annual reduction since February—and an estimated 1% MoM on a seasonally adjusted basis, provide a more recent indicator of homebuyer desire. Although some buyers have stepped off the sidelines as a result of the rate decline, many are holding out in the hopes that rates would drop much more, according to Redfin brokers in various cities.

To read more, click here.